Amortization

Another Day, Another Dollar

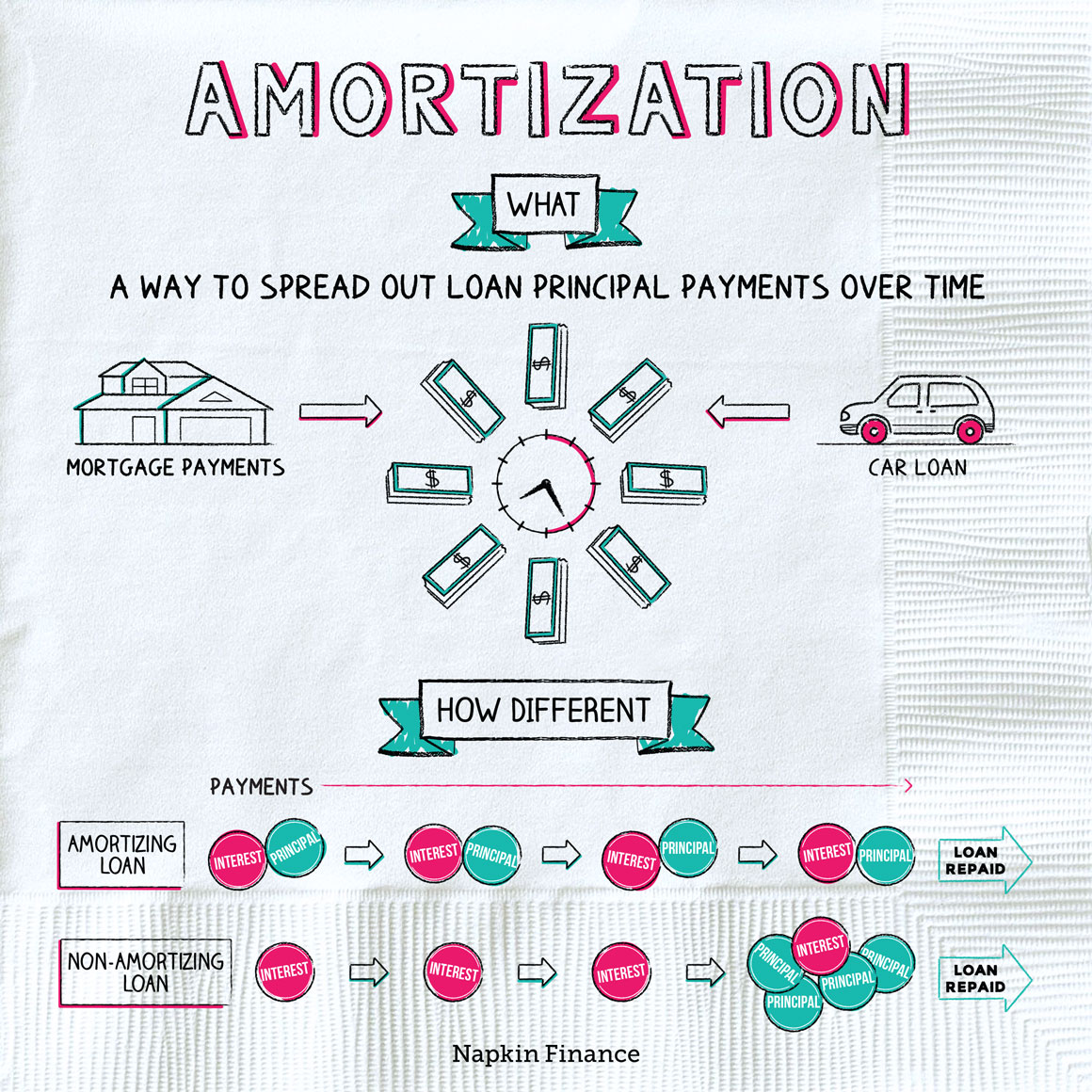

Amortization is a way of paying off a debt by spreading payments over a period of time. Your lender divides payments into equal amounts for the duration of the loan.

So-called “amortizing” loans typically include:

- Mortgages

- Car loans

- Personal loans

When you borrow money with an amortizing loan, you’ll pay the same amount at each agreed upon period (typically monthly) throughout the lifetime of your loan. These payments are also called installments.

Each installment of an amortizing loan is made up of two parts:

- Principal: how much you owe on your loan

- Interest: the extra money your lender charges so that it can earn a profit on the loan

So, for example, if your mortgage payment is $2,000 a month, one chunk of each payment is going to pay off the mortgage balance, while the remainder is covering interest on the loan.

With a loan that amortizes, you (or the borrower) pay back the principal amount you borrowed gradually over time. But not all loans work this way. With some types of loans, the borrower pays interest over time but doesn’t repay the principal amount until the end of the loan, when they pay it back as a lump sum.

Here’s how that distinction breaks down:

| Amortizing loan | Non-amortizing loan | |

| Payment schedule | Make a series of even payments on the loan. | Make small regular payments (of interest only) and then one very large payment at the end of the loan. |

| Loan balance is paid back | Gradually over time. | Only at the end of the loan’s term. |

| Example | Mortgages | Bonds |

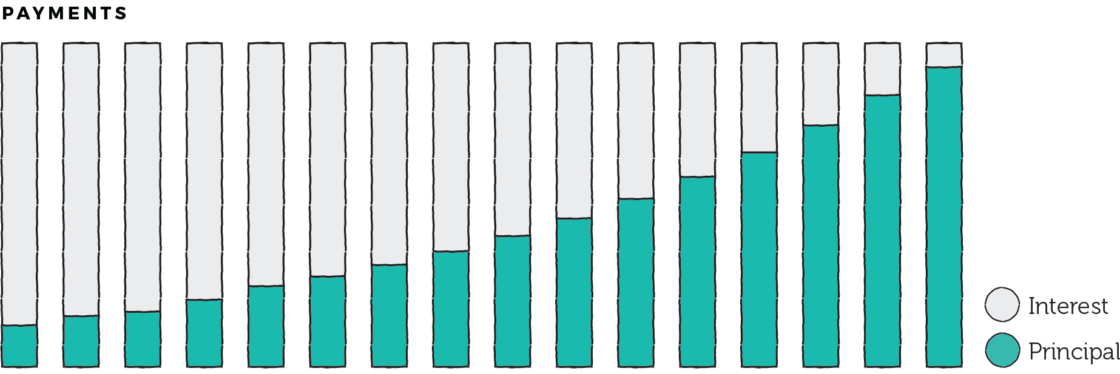

How much of your payment goes toward principal and how much goes toward interest shifts over time. Why? Because your lender calculates the interest you pay based on your principal. As you owe less on your loan, the interest also decreases.

At the start of your repayment period, a lot of your payment will go toward interest. By the end, most goes toward principal.

An amortization table can show you how much of each monthly payment you make goes toward principal and toward interest—and how that mix changes over the life of a loan.

Here’s how a $100,000 loan—that’s paid back over five years at an interest rate of 10%—would amortize. At the start, you pay a lot in interest and don’t make as much progress toward paying down the loan balance. That changes the closer you get to your payoff date.

An amortization table can help you:

- Understand how much you pay in interest over the lifetime of a loan

- Choose between different lenders with varying interest rates

- See the benefit of making extra loan payments or bigger payments

Amortization helps you spread out loan payments over a set period of time. You’ll make equal payments at the time each installment is due. Each payment goes toward both what you owe on the loan and the interest earned by your lender.

- “Negative amortization” is when you don’t pay enough to cover the interest on the loan, so the amount you owe goes up instead of down over time.

- The word “amortization” comes from Middle English “amortisen,” meaning to kill or alienate, and from the Latin words “ad” and “mort,” meaning death.

- Around one-third of homebuyers have no idea what their mortgage interest rate is even though that determines how much they’ll pay over the life of the loan.

- Amortization lets you pay off a loan in periodic, equal installments.

- An amortized payment is divided between the loan principal and interest. Over time, the ratio of interest to principal changes, but the payment amount remains the same.

- An amortization schedule can help you understand how each payment is split between principal and interest along with how much interest you’ll pay over the life of the loan.