Mortgages

Home Sweet Home

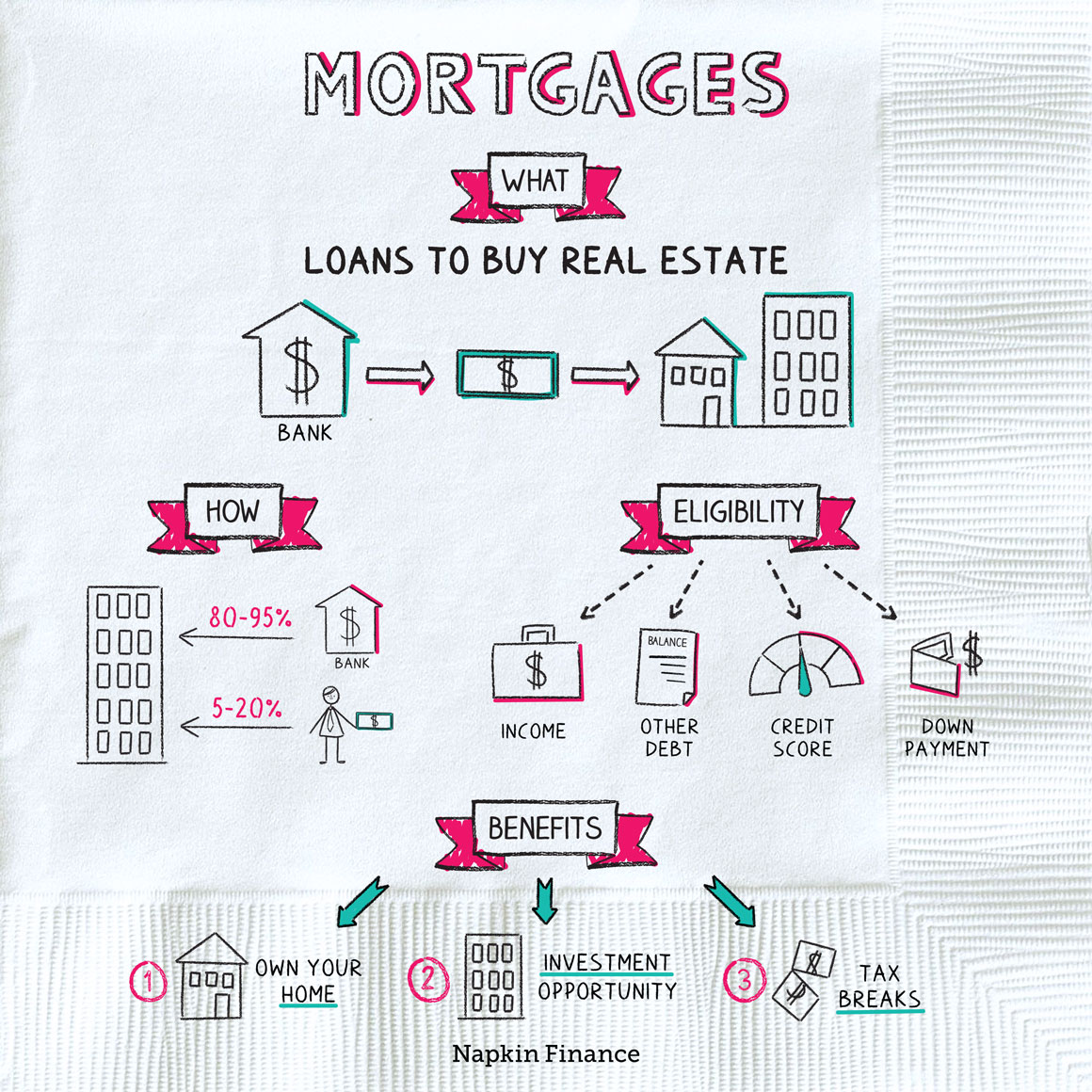

A mortgage is a type of loan that people use to help them buy a house or piece of property.

Not many people can afford a house out of pocket. That’s where mortgages come in. Like other loans, they let you borrow a large sum of money to buy the house and then pay back what you owe in regular installments (usually monthly).

The process generally looks something like this:

Figure out what you can afford

(and get your finances in order)

↓

Get preapproved for a mortgage

(so you know how much you qualify for)

↓

Find the perfect house

and make an offer

↓

Finish the underwriting process

(the lender’s final approval of your loan)

↓

Sign the paperwork and get the keys

↓

Make monthly payments to your lender

A typical mortgage spreads your payments out over 30 years, though 15-year terms are also common. By making equal monthly payments over that period, the borrower gradually pays off the principal amount of the loan.

When you apply for a mortgage, the bank or other lender will take a close look at your finances before approving your application. In particular, they’ll typically look at your:

- Income—including what you earn from a salaried job or any self-employment income you have

- Other debt—such as whether you still have student loans outstanding or any balances you’re carrying on credit cards

- Credit score—the higher your score, the better your chances at getting approved for a loan with favorable terms

- Down payment—the larger your down payment, as a percentage of the home’s total value, the more likely you are to receive approval for your mortgage application

How you stack up on those considerations may affect the size of the loan the lender is willing to make, what interest rate you qualify for, and even whether your application is approved in the first place.

Although you should never take on a mortgage lightly, using a mortgage to buy a home can come with some important advantages, including:

- Ownership—as you pay off your mortgage, you build equity in your home, which can help improve your overall financial security.

- Investment opportunity—if your home rises in value, then the value of your equity in it will rise too.

- Tax breaks—you can generally deduct your mortgage interest on your taxes as long as you itemize your deductions.

Within these (and other) loan types, you’ll come across two main variations:

- Fixed-rate: The interest rate stays the same for the life of the loan.

- Adjustable-rate (ARM): The interest rate on the mortgage (and the size of your required monthly payment) may go up or down over time depending on interest rates in the broader economy.

Fixed-rate mortgages are often best for buyers who expect to stay in the home a long time, who are worried interest rates may rise, or who prefer more certainty over their payments.

Adjustable-rate mortgages are typically offered with lower initial interest rates than fixed-rate mortgages and so may be better for buyers who plan to move before their rate changes or who think rates might go down in the future.

There are many mortgage options out there, each with their own pros and cons and some that are only available to certain borrowers. The most common ones you’ll encounter include:

| Type | Who’s it for? | Down payment | Good to know |

| Conventional | Most homebuyers | 5%–20% | You may need to buy mortgage insurance if your down payment is less than 20% |

| Jumbo | Those borrowing large amounts (such as more than $500,000) | 10%–20% or more | Lenders may want to see a near-perfect credit score |

| FHA | Buyers who can’t qualify for a conventional mortgage | As little as 3.5% | May be able to qualify even with poor credit |

| VA | Current and former military members (and their spouses) | None | Often come with favorable terms, like low interest rates and limited closing costs |

| USDA | People in rural areas who can’t qualify for a conventional mortgage | None | Interest rates can be as low as 1%; your income must fall below a certain limit to qualify |

A house is probably the most expensive thing you’ll ever buy. Before you take the mortgage plunge:

- Check your credit report. Lenders will want to see that you’re good at repaying what you borrow.

- Talk to multiple lenders to see where you can get the best deal and then negotiate. A lender’s first offer might not be its best.

- Ask every lender for a complete cost rundown so that you know exactly what you’re getting into.

- Know what you can actually afford. Just because a lender offers you a $1 million loan doesn’t mean you need (or can afford) it.

A mortgage is a loan that lets you buy a house and pay back the cost in regular installments over time. These loans can come in two variations: fixed, where the interest rate stays the same, or adjustable, where the interest rate can change over time. Before signing on the dotted line, you’ll want to know exactly how much you’re borrowing, at what rate, and when the loan comes due.

- “Liar’s loans,” also known as stated income loans, were popular during the housing bubble from 2001 to 2005. The names refer to mortgages with low (or no) proof of income requirements. In other words, mortgage borrowers could just “state” their income as a given figure in order to obtain a loan—and no one at the bank would actually check before forking over the money.

- Another common variety in the housing bubble was “interest only” loans in which a borrower paid (you guessed it) only the interest on the loan but never built equity.

- The word “mortgage” comes from the combination “gage” meaning “pledge” and “mort” meaning “death.” Your “death pledge” to the lender ends when you don’t make payments or finish all your payments.

- A mortgage is a type of loan that can help you buy a house.

- Before approving you for a mortgage, lenders will typically look at your income, other debts, credit score, and down payment size.

- Mortgages can be fixed-rate or adjustable-rate, which describes whether the interest rate stays the same or changes during the life of the loan.

- In addition to traditional (or “conventional”) mortgages, there are special types of mortgages to help those who can’t afford a large down payment, who have poor credit, who are veterans, or who live in rural areas.

- If you think you’re ready to take on a mortgage, make sure to shop around for a good rate, borrow no more than you can truly afford, and understand all the fine print of the loan before you sign on the dotted line.