Refinancing

Cash in Your Chips

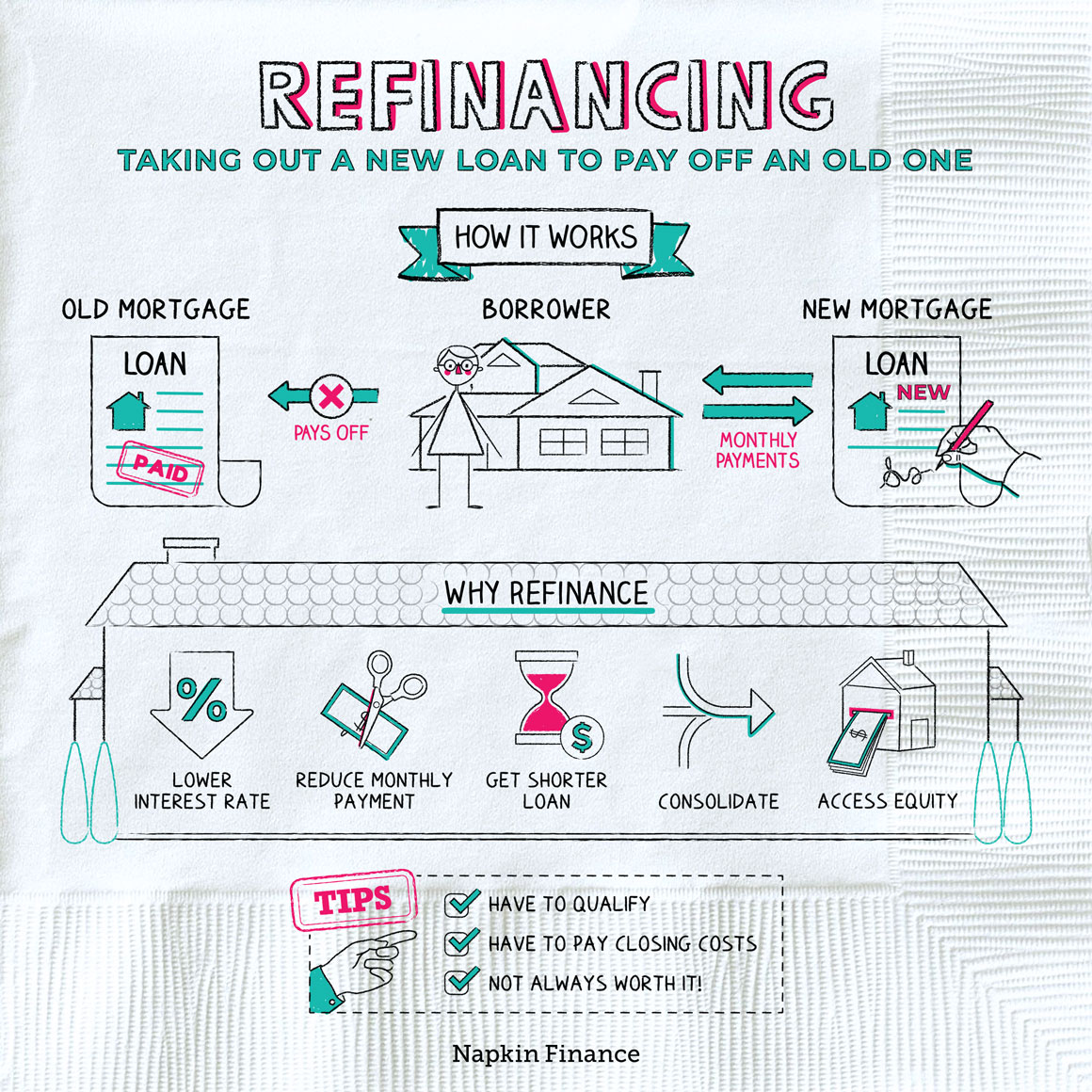

Refinancing is getting a new loan to replace an old one. Borrowers usually refinance in order to get a lower interest rate or better term.

Although refinancing may make you think of mortgages, you can also refinance student loans, car loans, personal loans, and even credit cards.

Although there are different types of refinancing available, they usually work something like this:

Decide to refinance

↓

Shop around and submit an application for a new loan

(with your current lender or another one)

↓

Lender approves your application

and gives you the new loan with new terms

↓

You use the new loan to pay off your old loan

↓

Now the new loan is your only loan, and you have to

make payments until it’s paid off

People refinance for many reasons, but it usually comes down to affordability. Borrowers might decide to refinance to:

- Save money.

- If interest rates have fallen since they took out their original loan, then getting a new loan at a lower rate could reduce their monthly payments and save them money over the total life of the loan.

- Reduce their monthly payment.

- They could do this if the new loan has a lower interest rate.

- Or, they might opt to extend the life of the loan—like by refinancing a mortgage with 15 years left on it into a new 30-year mortgage. Stretching the same repayment amount over a longer period of time will reduce their monthly bill.

- Shave time off the loan.

- While this increases monthly payments, a borrower can save money they’d pay out in interest during the life of the loan.

- Consolidate.

- Some borrowers use a lower interest loan to pay off many high interest loans or other debts or simply to combine multiple debts into a single monthly payment.

- Access equity.

- A borrower could refinance a smaller loan into a larger one—like refinancing a mortgage with $100,000 owed on it into a $150,000 mortgage (if they have enough equity in their home).

- They’ll have higher monthly payments and will pay more interest in total but will also have extra cash on hand for whatever purpose they need it for.

Depending on the loan, a borrower might have access to different refinancing options. Some of the most common include:

| Type | What it means |

| Rate-and-term | Replace the existing loan with a new agreement with a lower interest rate and better terms |

| Cash-out | Cash out some of the asset’s equity in exchange for a higher loan amount |

| Cash-in | Pay down some of the outstanding loan to reduce the total balance |

| Consolidation | Take out a new loan at a lower interest rate to pay off other loans |

Refinancing isn’t for everyone. Before taking the plunge, keep in mind:

- Refinancing can come with high expenses, typically including an application fee and closing costs.

- Not everyone will qualify. You typically need to have at least really good credit and steady income.

- Depending on the new loan’s terms, you might end up paying more over the life of the loan than you would have otherwise.

- If you opt for a fixed-rate loan but interest rates then fall, you may want to refinance again down the line (and pay the associated costs all over again).

- Some loans have prepayment penalties that could make refinancing more expensive than it’s worth.

- Every time you apply for a new loan (including for a refinance) it causes a temporary ding to your credit score.

Refinancing is the process of taking out a new loan so that you can pay off an existing loan (or multiple loans). Borrowers most often use it for mortgages, but it’s also possible to refinance student loans, personal loans, car loans, or credit card debt. Borrowers usually refinance to get a lower interest rate or better loan terms.

- Rumor had it that famed bank robber Charles “Pretty Boy” Floyd was popular with the public because he would destroy mortgage documents at the banks he robbed.

- Refinancing hit record levels during the coronavirus pandemic—likely thanks to a combination of ultra-low interest rates and mortgage borrowers who had lots of free time on their hands, which they could use to spend shopping around for rates.

- Refinancing involves getting a new loan to pay off an existing loan. You can refinance home loans, student loans, car loans, and other personal loans.

- Borrowers typically refinance loans to get a better interest rate or loan terms or to reduce what they owe.

- Common refinance options include rate-and-term, cash-in, cash-out, and consolidation.

- Not everyone qualifies for refinancing, and it comes with high expenses that might outweigh any savings.