FHA Loans

Helping Hand

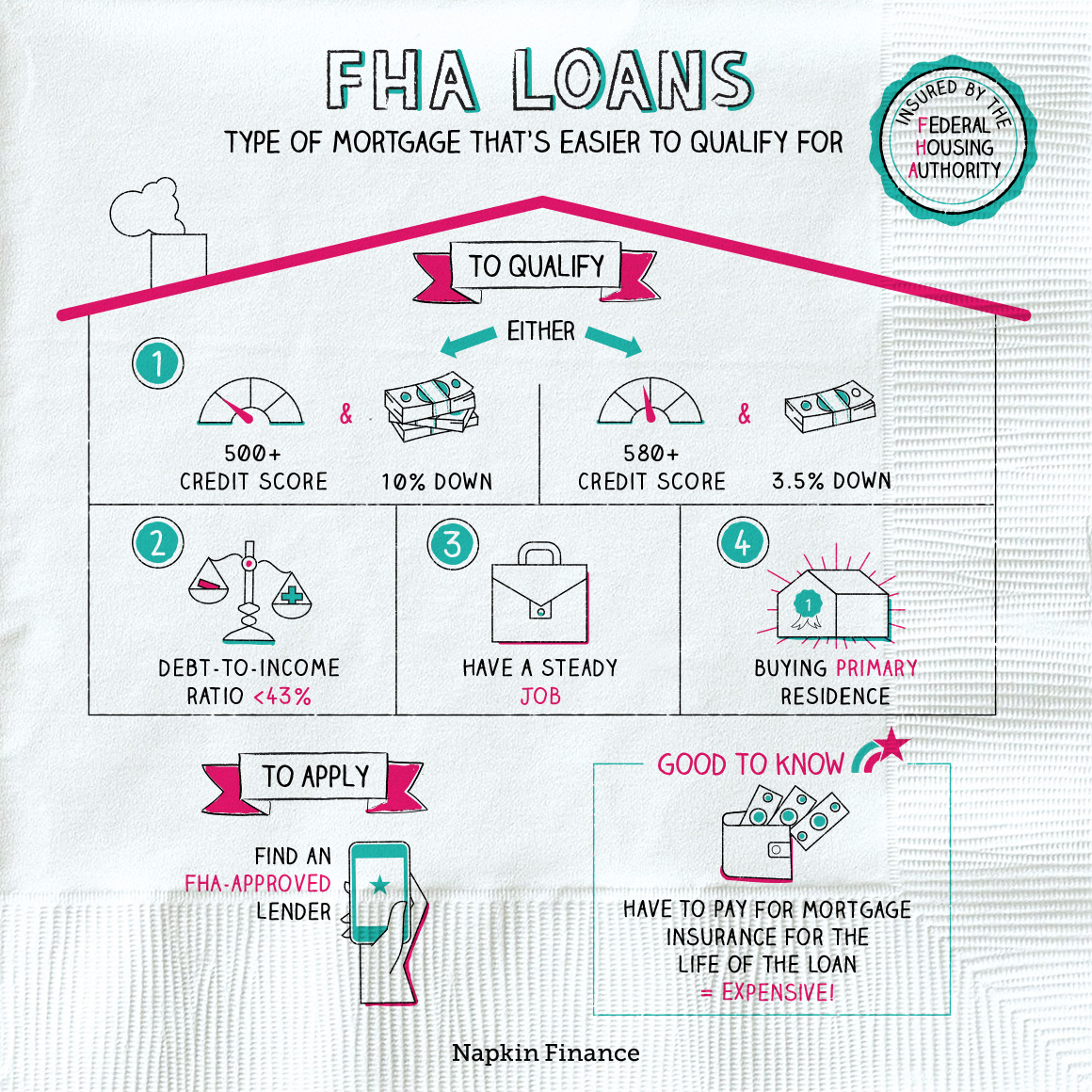

FHA loans are a type of mortgage loan that’s available to people who might not qualify for a traditional mortgage.

In particular, they can be an option for borrowers with worse credit or smaller down payments than what you usually need to get approved for a mortgage. Although the loans are made by private lenders (like banks), they’re insured by the federal government through the Federal Housing Administration (hence the name).

There are some cut-and-dry eligibility requirements you have to meet to potentially qualify for an FHA loan, including on your:

| What | Requirement |

| Credit score |

|

| Down payment |

|

| Debt-to-income ratio |

|

| Other |

|

Keep in mind that specific lenders will generally also apply their own criteria when evaluating FHA applications. Although 500 is the minimum requirement in the FHA guidelines, lenders can choose to set that number higher or use stricter requirements on other criteria.

FHA loans may be used to buy a number of different property types, including:

- Single-family homes

- Multi-family properties with up to four units

- Condos

- Mobile homes

However, because the program limits how large of a loan you can access, mansions and high-end properties will probably be off the table. The exact maximum amount you can borrow varies by area (and is updated every year), but you can check with the FHA or some local mortgage lenders in your area to find out the exact figure.

Applying for an FHA mortgage and buying a home with one isn’t really different from the usual mortgage and homebuying process. The only key is you have to work with a lender that offers FHA loans (because not all do).

And just like applying for a traditional mortgage—you probably want to find a few potential FHA lenders and shop around for the best interest rate. Just make sure you submit all your applications within a week or two so that your credit score only gets dinged for one hard inquiry.

Although easier qualification requirements sound great, FHA mortgages come with some drawbacks. A key consideration is the monthly mortgage insurance payment.

With traditional mortgages, you only have to carry mortgage insurance if you have less than 20% equity in the home, and you can stop carrying (and paying for) the insurance once you reach that point. With an FHA loan, you’re required to carry that insurance for the entire life of the loan (or until you refinance into a traditional mortgage).

Here’s a look at the full trade-offs:

| Pros | Cons |

| Lower credit score requirement | Pay mortgage insurance premiums for the life of the loan |

| Lower down payment requirement | Typically come with higher interest rates than traditional mortgages |

| Higher debt-to-income accepted | How much you can borrow is capped depending on where you live |

There are a few steps you can take before you actually reach the application process to increase your chances of approval:

- Pay down your debts.

- The less debt you carry, the less risky you’ll seem to lenders, since they need to make sure you can afford all of your monthly obligations.

- Build up a history of on-time payments.

- Make sure all your bills are paid on time in the months leading up to applying for a mortgage, and take any other steps you can to improve your credit.

- Save as much as you can.

- Putting down as large a down payment as possible can help you qualify for approval and get a lower interest rate.

- Apply with several lenders.

- When you’re ready to apply, get quotes from several companies so that you can compare their offers and negotiate for the best deal possible.

FHA loans are types of mortgages that borrowers with lower credit scores and smaller down payments might be able to qualify for (even if they can’t get approved for a traditional mortgage). There are strict eligibility requirements for the loans, which are made by private lenders but then insured by the federal government. To apply for one, just find an FHA-approved lender.

- There’s no shame in getting help. The FHA backs more than eight million mortgages on more than $1 trillion in loans in total.

- Although you wouldn’t think a global pandemic is a popular time to take on a massive new financial commitment, 2020 was a bonanza year for homebuyers, with existing home sales reaching 14-year highs. Some 33% of those who closed deals that year were first-time homebuyers.

- Like Social Security benefits and unemployment insurance, FHA loans were created as part of the New Deal in the 1930s.

- FHA mortgages are government-insured loans with less strict borrowing criteria than conventional loans. They can offer a path to homeownership for those who might not otherwise qualify for a mortgage.

- You might be able to qualify for an FHA mortgage with as little as a 3.5% down payment or with a credit score as low as 500.

- Not all lenders offer FHA loans, so you’ll need to research your options before applying.

- The main drawback of the loans is a requirement to pay for mortgage insurance for the life of the loan (or until you refinance into a traditional mortgage).