Collateral

Give and Take

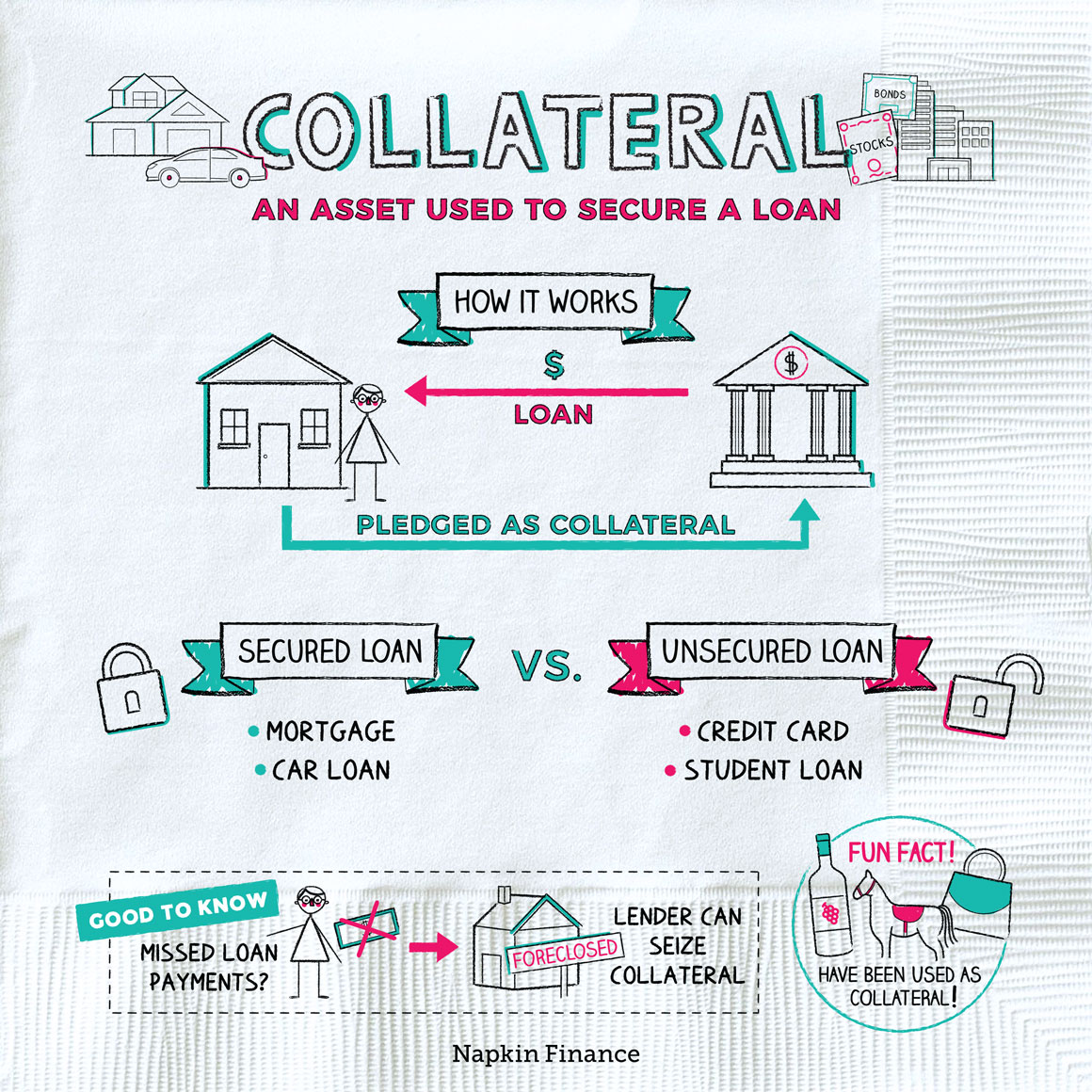

Collateral is something that a borrower pledges to a lender to secure certain types of loans. If the borrower doesn’t repay, the lender gets the collateral.

The purpose of collateral is to reduce the lender’s financial risk. If you can’t make your car loan payments, your lender can repossess your car and sell it. That means that whether or not you make your payments the lender can feel pretty confident it will get its money back.

That’s why loans backed by collateral often:

- Have lower interest rates

- Are for larger amounts

A loan that requires collateral is called a “secured loan.” A loan that doesn’t require collateral is called an “unsecured loan.” Unsecured loans are backed only by your promise to pay—there’s nothing the lender can repossess if you don’t (though they might be able to wreck your credit score or even take you to court).

Here are some examples of each type:

| Secured loans | Unsecured loans |

|

|

An unsecured loan usually has a higher interest rate because it’s riskier for the lender to loan money with no guarantee of repayment.

The loan type usually dictates the collateral required. Secured loans are often made against:

The collateral generally must be worth at least as much as the amount of the loan. The basic rule of thumb is that what you put up must be easy to sell and hold its value for at least the amount of time it will take you to pay back the loan.

Some banks even let you use future paychecks for very short-term loans (like a couple of weeks).

One of the most common types of secured loans is a mortgage. In this case, the collateral is the house itself. Here’s how it works:

Borrower has the house appraised

to determine its fair market value

↓

Lender agrees to provide a loan

equal to or less than the appraised value

↓

Borrower agrees to make on-time loan payments

If the borrower misses too many payments, the lender can begin the foreclosure process, which is the formal way to take control of the collateral (the house).

The borrower might get the chance to catch up on late payments, but if not, the lender will take ownership of the home and sell it to a new buyer in order to recoup what it’s still owed on the original mortgage.

A house isn’t just collateral for a mortgage. You can also use it to secure a home equity loan or home equity line of credit.

- Home equity loan: Like a mortgage, the borrower receives a lump sum in exchange for making equal payments to the lender over a set time period. You can usually borrow up to 85% of your equity in the house (equity is the difference between what you owe on your mortgage and what your home is currently worth).

- Home equity line of credit: This is similar to a credit card and allows the borrower access to credit when they need it up to a certain amount. Again, you can usually borrow up to 85% of your equity.

As with a mortgage, if a borrower doesn’t make timely payments on either a home equity loan or line of credit, the lender can seize the house.

Collateral is an asset used to secure a loan. The asset is like an insurance policy for the lender: If you don’t repay the loan, the lender gets your asset. Home and auto loans usually require collateral, which come in the form of the house and car themselves. Because loans that require collateral are less risky for lenders, they often come with lower interest rates.

- While homes are frequently put up as collateral, some assets used to secure loans are a bit more bizarre: designer handbags, horses, wine, rubber, cheese, and even soccer players have been used.

- During the Renaissance, a suit of armor could be considered valid collateral.

- Collateral is an asset you agree to let a lender take if you don’t pay back a loan.

- The type of collateral required to secure a loan is usually based on the type of loan you need. For mortgages your home is the collateral, while your car is for an auto loan.

- You might be able to use the equity (or ownership) you have in your house to secure a loan or line of credit that you can use for other purposes.