Term vs. Permanent Life Insurance

Life Sentence

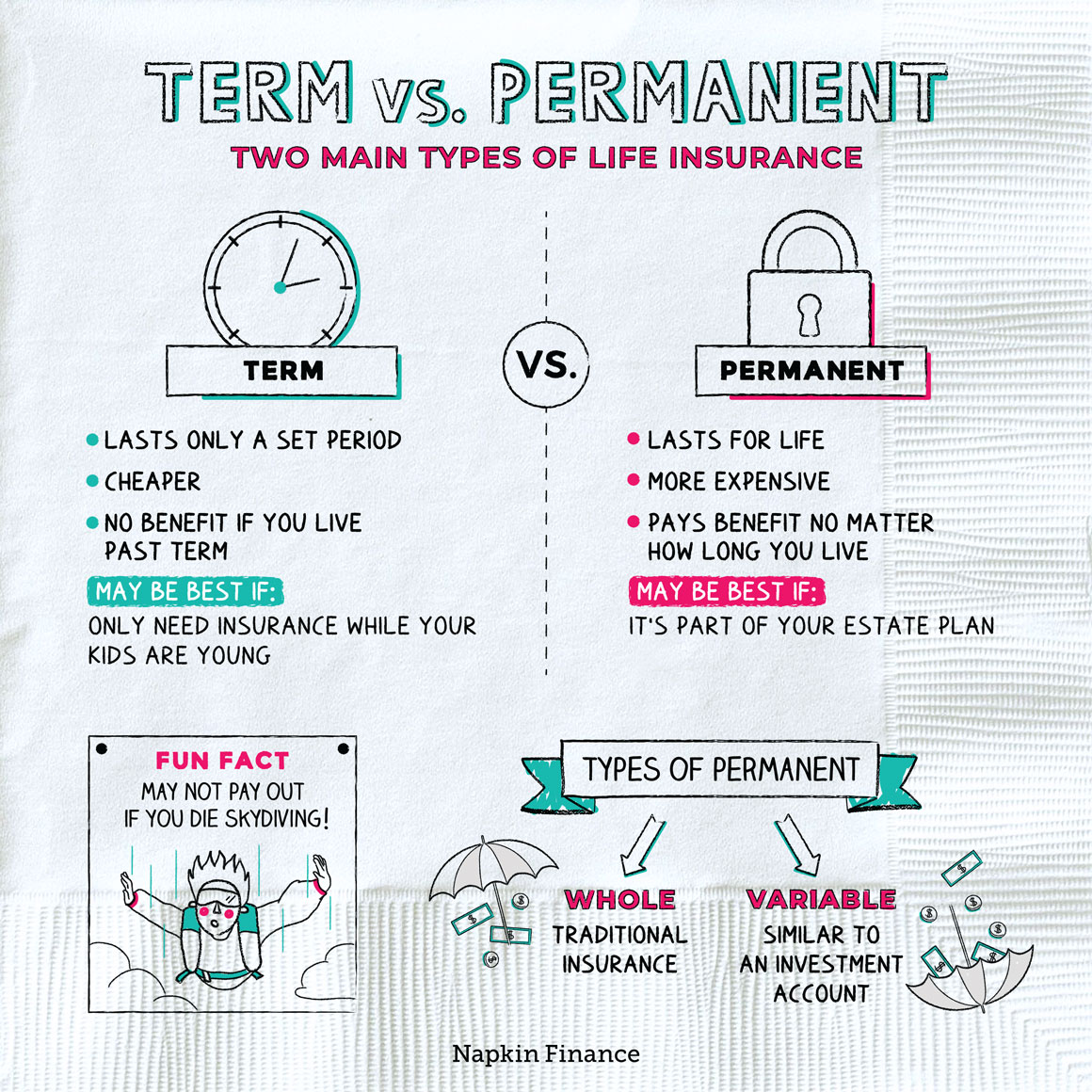

Term and permanent policies are the two main types of life insurance.

With both types of policies, you make ongoing premium payments to an insurance company. In exchange, the insurer may pay a lump sum to your loved ones if or when you die.

But term and permanent policies have important differences in how much they cost and the specifics of if or when they’ll pay out a benefit.

The key distinction between term and permanent life insurance is how long you’re covered for.

- Term: Coverage lasts for a set period of time (like 20 years).

- If you die during the policy’s term, the insurance will pay out to your family.

- If you live past the policy’s term, then it won’t pay anything.

- Most companies offer policies for as little as one to as many as 30 years.

- Permanent: Coverage lasts for your whole life.

- Whether you pass away the year after you buy the policy or live to be 110, the insurance company will pay your beneficiaries (as long as you’ve paid the premiums).

- You might also hear these policies referred to as “whole life.”

As you might guess, because permanent life insurance covers you forever, it’s more expensive than term. In fact, your annual premium can cost anywhere from five to 15 times more than similar term life insurance.

A permanent insurance policy also comes with a savings or an investment account (it may be called the policy’s “cash value”). As you pay premiums over time, the value of this account grows. You may be able to borrow against the account’s cash value or take a withdrawal from it.

| Term | Permanent | |

| Coverage lasts | For a set term only | For life (if you keep paying the premium) |

| Cost | Cheaper | More expensive |

| Is there a cash value? | No | Yes |

| What if I want to cancel my policy? | The premiums you’ve paid are gone forever | May be able to receive the policy’s surrender value to get some money back |

For many people, choosing term or permanent life insurance comes down to cost, but there are other reasons that might make one or the other more appealing.

| Term | Permanent |

| Replace your income only during a certain time (like until your kids reach adulthood) | Want to be certain a dependent will be taken care of no matter what |

| Want the lowest cost option | Don’t like the idea of paying premiums for something you might never use |

| Could face changing financial needs | Comfortable committing to a policy for the long haul |

| Not ready to make an estate plan | Incorporating the insurance into an estate plan |

Permanent insurance can itself come in two main types:

- Whole—the more traditional (and plain vanilla) type.

- Your premium stays the same for the life of the policy.

- The cash value grows slowly at a set interest rate, like a bank account.

- Variable—a more complex (and usually more expensive) type.

- You can choose to increase or decrease your premium payments.

- You can invest the cash value in more aggressive investment options, like stocks.

Usually when people talk about permanent insurance, they’re talking about whole. Variable policies can be seen as almost more akin to investment accounts.

Term and permanent policies are the two main types of life insurance. Term insurance covers you only for a set period of time and is usually the cheaper option. Permanent life insurance pays out a benefit no matter when you die and is typically more expensive. Either type of policy can help you protect your loved ones, but there are important differences to understand.

- Many companies won’t sell you term life insurance if the policy ends after your 80th birthday.

- If you like to live life dangerously, read the fine print on your life insurance policy. Some plans won’t pay out benefits if you die doing certain activities, like skydiving or bungee jumping.

- You can take out a life insurance policy on someone else, but you have to have an “insurable interest” in their continued survival (i.e., you’d suffer a hardship if they died). The rule is designed to keep people from gambling on strangers’ lives (or worse, having a reason to bump them off).

- Corporations often take out life insurance policies on their top executives.

- Term and permanent life insurance policies can help you financially support your family or other loved ones after your death.

- Term life insurance only pays a benefit if you die within the life of the policy (known as the “term”).

- Permanent life insurance will make a payment to your beneficiaries no matter when you die (as long as you’ve paid your premiums).

- Term insurance can be very affordable, while permanent policies are generally much more expensive.

- Term life insurance is best used to cover expenses only for a certain period of time (such as while your kids are young), while permanent coverage lets you leave a legacy and can be part of an estate plan.