Crowdfunding

Pound the Pavement

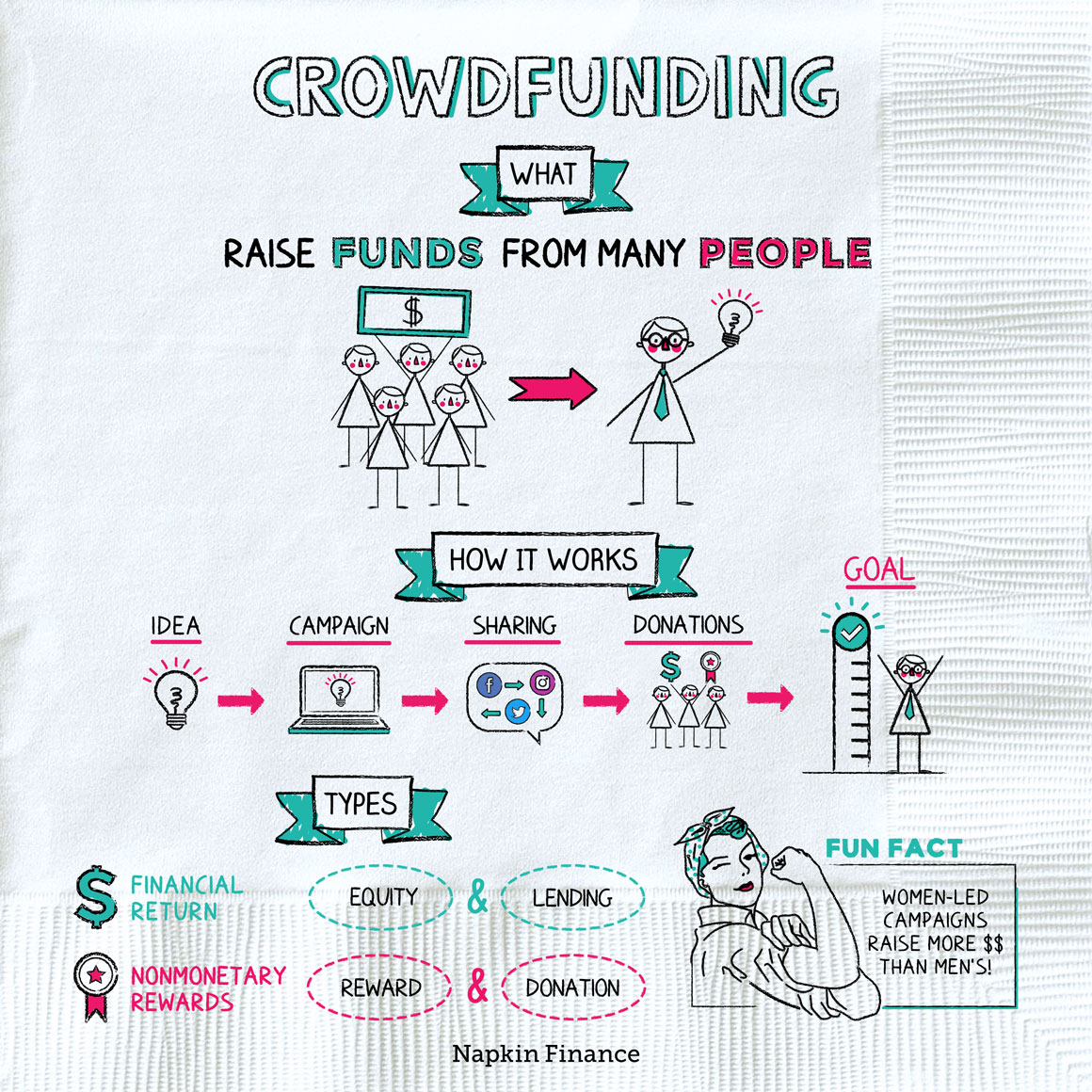

Crowdfunding is a way to raise money from many people, thanks to the power of the Internet. Crowdfunding websites such as Kickstarter are platforms you can use to advertise the idea you’re hoping to fund and to receive donations.

A typical crowdfunding campaign looks something like this:

- Step 1: Have an idea. It could be something you’ve already been working toward or a completely new concept.

- Step 2: Figure out how much money you would need to make your idea a reality. That number will be your fund-raising goal.

- Step 3: Choose a crowdfunding website. (See the table below for a list of some of the major players.)

- Step 4: Write up your pitch. Ask friends to help you create a compelling story that will get some clicks.

- Step 5: Launch your campaign.

- Step 6: Promote your campaign through social media and any way you can. Try to reach as many people as possible! Go viral!

- Step 7: Rake in those donations and (hopefully) hit or exceed your fund-raising goal.

- Step 8: Bring your idea to life.

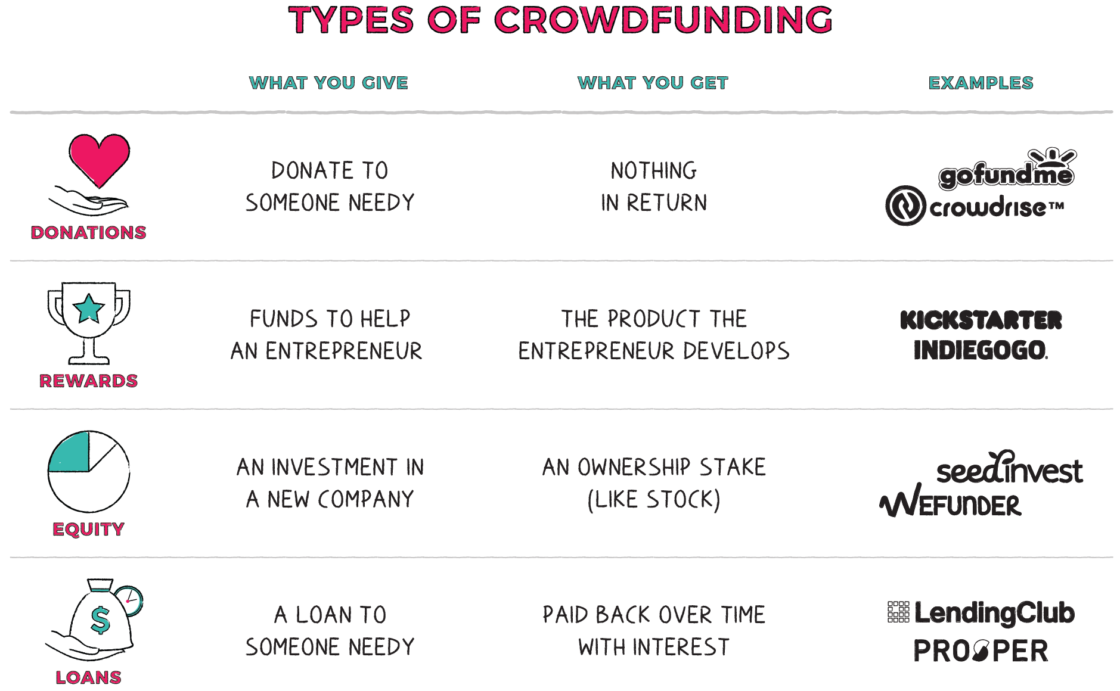

Although crowdfunding can refer to almost any online fund-raising strategy, there are some important differences among the main types:

Whether you’re hoping to launch a campaign or looking for a worthy cause to contribute to, the right type for you may depend on what (if anything) you’re hoping to receive in return.

Crowdfunding can lead to amazing, viral success stories. But as with almost any financial transaction, it still comes with risks. Here are the main trade-offs:

| Pros | Cons | |

| For fund-raisers | Simple and easy;

Potential to reach a wide audience |

At first, you’re asking for money from people you know (awkward);

No guarantee you’ll reach your goal |

| For donors/investors | Help a real human instead of a faceless organization;

Get in on the ground floor of something cool |

Not much protection; scams can happen;

Donations often not tax-deductible |

“Small opportunities are often the beginning of great enterprises.“

—Demosthenes

Crowdfunding can be a potential lifesaver for people or families dealing with a financial crisis. In these cases, crowdfunding might yield more money (sometimes a lot more) than a yard sale or church collection.

For an entrepreneur, it offers an alternative (or complement) to getting a traditional bank loan or courting investors. The appeal for startups and other businesses can include:

- Ease: Convincing a bank or an angel investor to give you money is tough, especially without a formal business plan, extensive market research, revenue projections, or collateral.

- Flexibility: Traditional investors may want to see the company quickly commit to a business model and bring a product to market. With crowdfunding, a startup can test different products and try out ideas over a longer period of time before turning a profit.

- Potential to avoid repayment: Depending on the type used, if your idea is a dud, you might not have to pay anyone back.

Whether you’re a donor or a fund-raiser, be sure to go in with your eyes open. Keep in mind:

- If you don’t hit your donation goal, you might not get any money

- All crowdfunding sites are not created equal; make sure you pick one that does the type of fund-raising you’re interested in

- Platforms usually take a percentage of what’s raised

- Vet projects carefully before you contribute; there are plenty of people out there trying to take advantage of the kindness of others

Crowdfunding is a way for people or businesses to raise money online from donors around the world. There are four types—donations, loans, equity, and rewards—each of which has its own pros and cons. Some businesses prefer crowdfunding over traditional loans or investments because it can make raising money easier, may pose less risk, and could give the company more room to innovate.

- Half-baked business plans that nevertheless received thousands of dollars in funding on Kickstarter have included: making potato salad, shooting a Doctor Who–style police box into orbit, and sending an inflated Lionel Richie head on a trip around the world.

- Female-led crowdfunding campaigns tend to raise more money than those backed by men, possibly because women are seen as more trustworthy.

- Crowdfunding is a way to raise large amounts of money through small contributions on the Internet.

- Crowdfunding can be used to solicit charitable donations or funds to get a new business off the ground.

- Although crowdfunding can be easy and convenient for both fund-raisers and donors, it offers few protections or guarantees for either side.