Financing a Start-up

Sink or Swim

If you’re trying to get a start-up off the ground, chances are you’ll need some cash to get going.

While there are many types of outside funding sources, the right choice for your company may depend on what stage of development your business is in, how much money you need, and whether you’re comfortable giving up some ownership in your company.

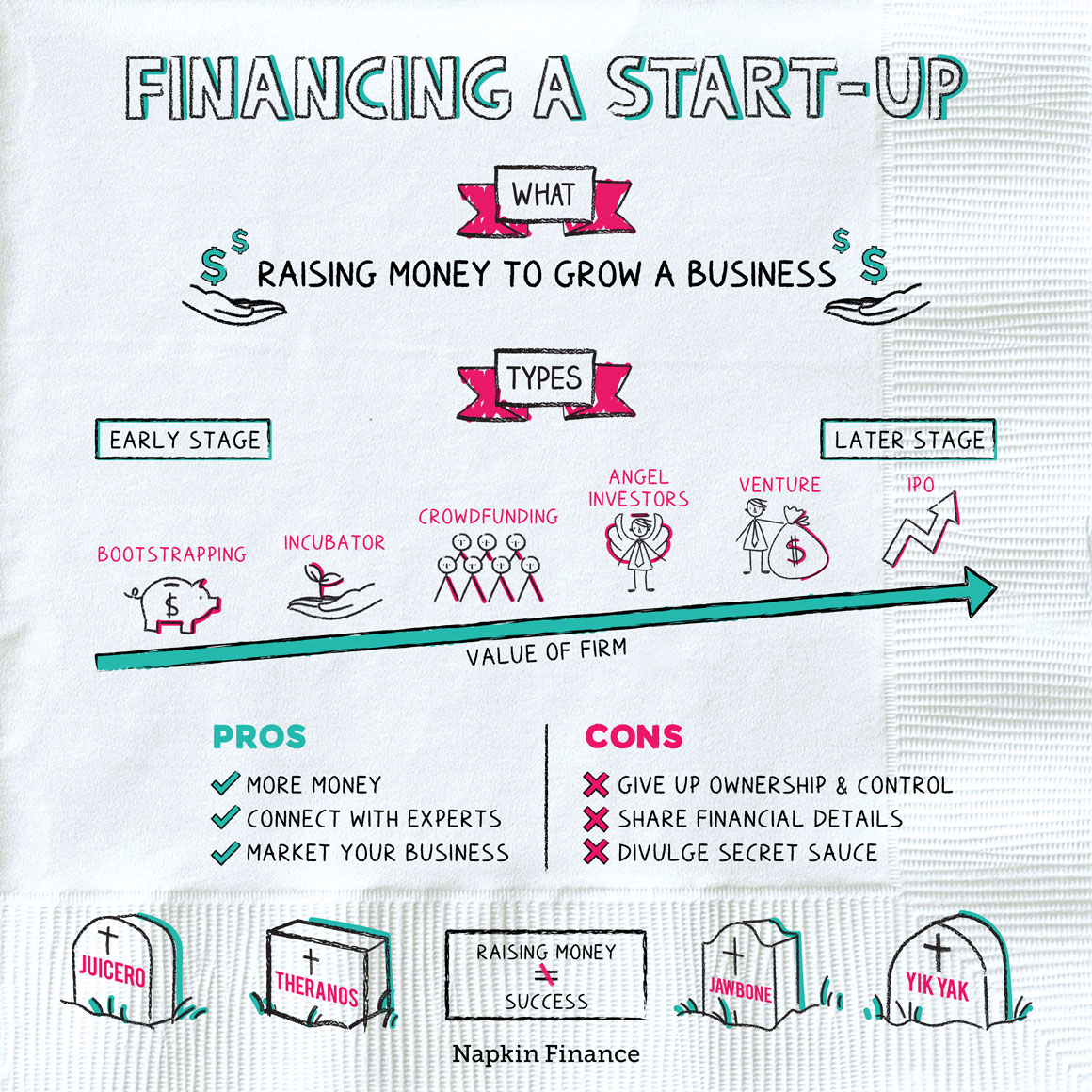

Here’s a survey of the main types of financing:

| Funding source | Stage | How it works |

| Bootstrapping | Very early | Tap personal sources of funds, such as savings, investments, home equity, or even a credit card. |

| Friends and family | Very early | Ask those who believe in your idea for a loan to get off the ground. |

| Incubator program | Very early | Get accepted into a development program for young companies, where you’ll have resources to help you work out your idea and access to mentors. |

| Crowdfunding | Early | Put a description of your business plan online on a crowdfunding website and let the money come to you. |

| Traditional lenders | Early | Apply for a small-business loan with your bank or credit union. |

| Angel investor | Early | Find a wealthy individual who’s willing to write a big check in exchange for an ownership stake. |

| Accelerator program | Medium | Once your idea has some traction, apply and get accepted into a short-term startup boot camp to fuel your growth. |

| Venture capital | Medium | Sell an ownership stake to sophisticated startup investors. |

| IPO | Late | List your company’s shares on a stock exchange and get access to funding from a large number of investors. |

| Issuing bonds | Late | Once your company is established, sell bonds that mature in 10, 20, or 30 years and pay a set interest rate. |

The variety of funding options available might make it hard to decide which one is best. While there is no universal right or wrong answer, there are some questions you can ask yourself to guide your decision-making:

- How much do I need?

- What do I need the money for?

- How much control or information am I willing to give up?

- How far along is my business?

- Can I show that my business is a worthy investment?

- Are there any changes I need to make to the business to make it a more attractive investment?

- Whom do I know who might be willing to help?

Of course, choosing a potential funding option is the easy part. Much harder is actually convincing investors or lenders to take a chance on your idea.

Banks and investors prefer to minimize risk, and they do that in part by looking at your finances and plans. Try to pull together as much information as you can, including:

- A business plan

- Financial projections

- Bank statements

- Market analysis

- Marketing plans

- Personal financial statements (if you’re at a very early stage)

Have these (and anything else you think might be useful) at the ready so that you can quickly fulfill a bank’s or an investor’s request. After all—it never hurts to look organized!

Taking on outside funding can be important to continuing growth, but it comes with trade-offs.

| Pros | Cons |

| Get access to vastly more money | Give up some ownership; give up some control |

| Connect with mentors and experts | Share your company’s financials |

| Market your business model | Divulge your business model’s secret sauce |

There are many options for financing a start-up, from using your own money to crowdfunding to taking out a loan to finding investors. Each comes with its own trade-offs, so picking the right one requires doing your research and balancing your needs, wants, and preferences. If you decide to go with outside funding, arm yourself with as much information as possible to impress banks and prospective investors.

- It can pay to keep control. Native Deodorant, a natural deodorant start-up, was sold for $100 million to Procter & Gamble just two and a half years after it launched. Its founder still owned more than 90% of the company.

- Juicero was a start-up that sold $400 machines that would squeeze a juice pack into a cup—just like a Keurig for fruits and veggies. The company raised $120 million before anyone noticed that you could just squeeze its juice packs by hand—no fancy machine necessary. (The company shut down.)

- Most start-ups need money to get up and running.

- There is a wide array of funding sources, from self-funding to seeking out deep-pocketed investors to borrowing from a bank.

- Consider why you need the money, how much you need, and what types of funding you’re comfortable with before picking a funding source.

- Bringing in outside investors means gaining access to resources and expertise in exchange for giving up control and ownership.