Independent Contractor

Free Agent

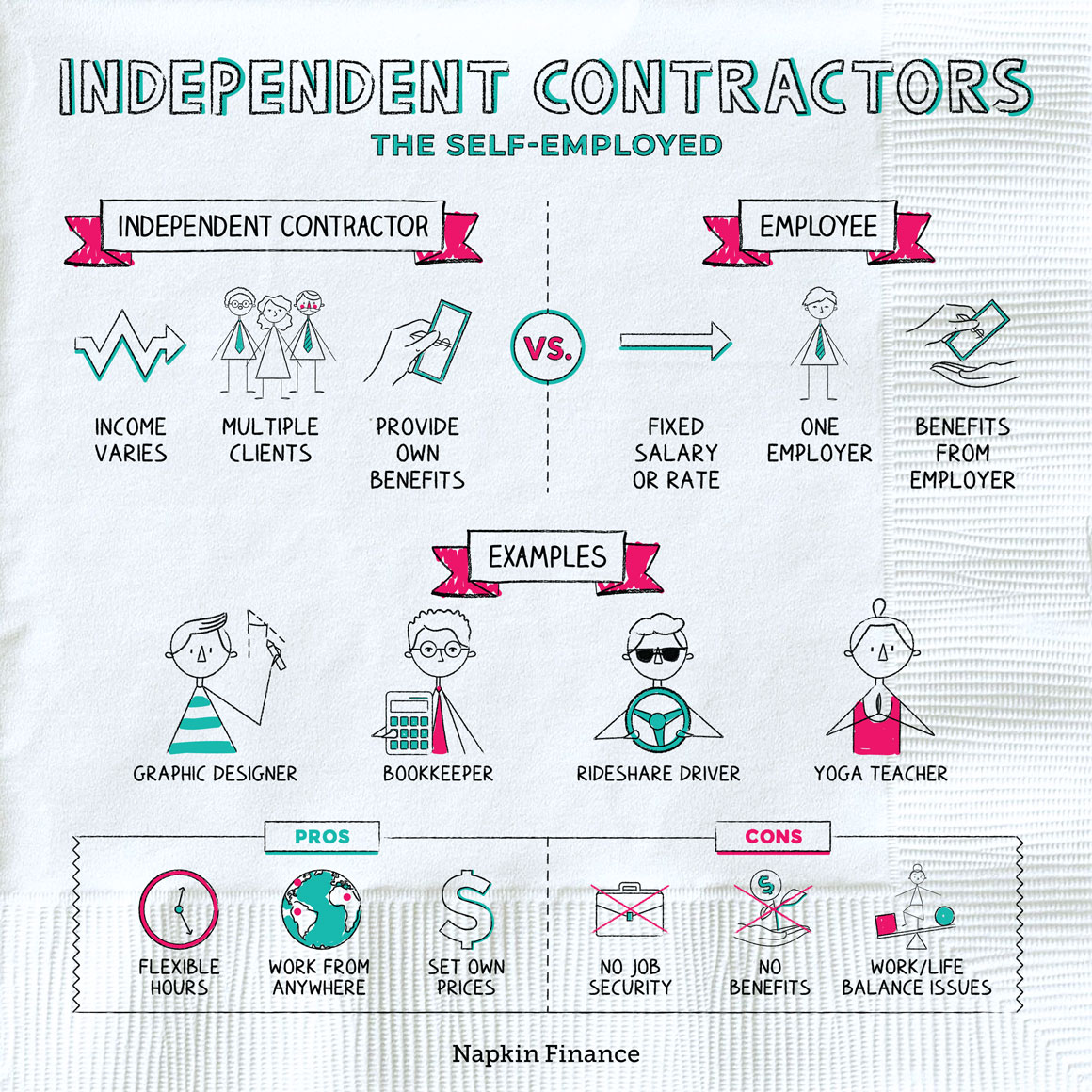

An independent contractor is someone who is self-employed and works for clients as a nonemployee.

Independent contractors generally work on a project-by-project basis. They don’t have a guarantee of continued work with their clients or receive employer-sponsored benefits, like health insurance, retirement savings plans, or sick leave.

Lots of people can fall into the independent contractor category, including:

- Attorneys

- Bookkeepers and accountants

- Doctors and dentists

- Fitness instructors

- Musicians, photographers, and designers

- Rideshare drivers

- Writers, editors, and bloggers

Here are the main differences between independent contractors and employees:

| Independent contractor | Employee | |

| Income | Varies, depending on how many clients or projects they have | Receives a fixed salary or hourly rate |

| Benefits | Finds and pays for health insurance and a retirement plan on their own | Receives benefits from employer |

| Taxes | Receives 1099s from clients | Receives W-2 from employer |

| Number of employers | Could have one main client or hundreds of clients | Typically just one employer |

| Length of relationship | Varies by contract | Ongoing |

| Work hours | Often flexible | Often set by employer |

| Workplace | Potentially anywhere | Often on-site |

Although employers have some leeway in deciding whom to treat as an employee or as a contractor, the law sets out rules and guidelines they’re supposed to follow.

Control is key. Typically, the less control you have over your work (and the more control your employer has), the more likely it is that you ought to be classified as an employee.

If you’re a contractor, a company can hire you to design a website, but it can’t tell you where you have to work or what hours you have to work. On the other hand, if the company wants you working in its office during specific hours while you design that website, you probably should be classified as an employee.

Employers often prefer to classify people as contractors instead of employees because it’s cheaper for them. But if you think you’ve been misclassified, you may be able to seek relief through the IRS.

Independent contractors face a very different tax situation than employees. Typically, they:

- Receive 1099s from clients

- Pay higher tax rates because of the self-employment tax (which consists of extra Social Security and Medicare taxes)

- Make quarterly estimated tax payments

- Can deduct many business expenses, such as the costs of using a cell phone or car for work, to reduce what they owe

Setting your own hours and working in your PJs might sound great, but it’s definitely not for everyone. Here are some of the trade-offs:

| Pros | Cons |

| Flexible hours and chance to pick (or pass on) new opportunities | Sometimes difficult to find new work |

| Work from almost anywhere | Hard to maintain work/life balance |

| Set your own prices | No job security or benefits |

| Own what you do | Higher stress of running your own business |

An independent contractor is someone who is self-employed. Independent contractors have to find their own work, pay their own taxes (quarterly), and provide their own benefits. Being an independent contractor can mean setting your own hours, picking your clients, and owning what you do, but downsides can include a lack of job security and work/life balance.

- You might think your interests are weird, but there’s probably independent contractor work out there for you. People have found work as fortune cookie writers, online forum moderators, cat catchers, golf ball divers, and professional TV watchers.

- More than a third of the U.S. workforce is now freelance, with creative fields like design and entertainment having the highest concentration of contractors.

- Independent contractors are self-employed and work for clients.

- Contractors are responsible for paying their own taxes, covering their own benefits, identifying clients, and setting their own rates.

- Writers, photographers, doctors, lawyers, accountants, and bookkeepers are just some of the individuals who might be independent contractors.

- Life as an independent contractor has some benefits, such as the ability to work from anywhere, at any time, for any client. But trade-offs can include a lack of stable work and higher stress from running your own business.