Financial Aid

Lean on Me

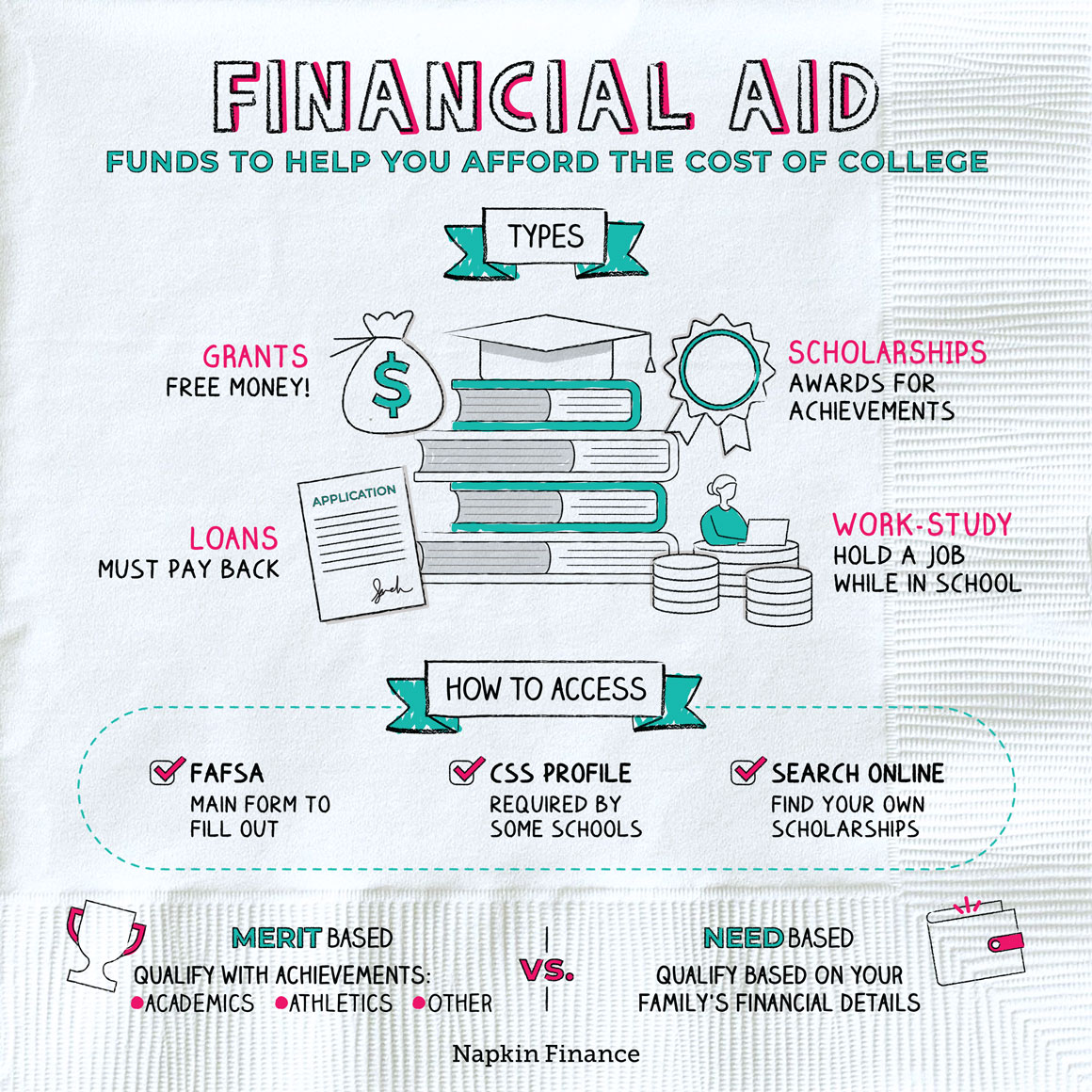

Financial aid can refer to any of a number of types of assistance that help students afford the cost of higher education (whether college or grad school).

Financial aid is there to help you close the gap between how much money you need and how much you have.

While there are many ways you can pay for college (from savings to a long-lost rich uncle to summer jobs slinging burgers), financial aid comes in a handful of specific forms.

| Type of aid | What it is | Where it can come from |

| Grants | Funds you don’t have to pay back (unless you violate the grant terms) |

|

| Loans | Money you borrow for school and repay later |

|

| Scholarships | Free money that you don’t need to pay back; often awarded for accomplishments, talents, or a certain field of study |

|

| Work-study | A federal program that gives you money for working part-time at a specific job |

|

The various types of aid fall into two categories:

- Merit based: Aid provided for some type of achievement. For example, you might be eligible for merit-based aid if you’re a star athlete, earned perfect grades in high school, or are a gifted painter.

- Need based: Aid for students whose personal finances or family finances can’t cover the cost of attendance. This isn’t just for low-income families; because college is so expensive, many people qualify.

Qualifying for need-based aid is fairly straightforward: based on your family’s finances, you either qualify or you don’t.

When it comes to merit-based aid, half of the work can come in searching for and finding these opportunities in the first place (such as for smaller awards offered by a nonprofit or community group). That’s why experts often recommend you do your own research on grants and scholarships instead of only applying for opportunities that your financial aid office refers you to.

You’ll need to apply for financial aid to qualify and get your money. The process typically looks something like this:

Fill out and submit the FAFSA

(some schools also require a second form, the CSS Profile)

↓

Receive your award letter from the school(s) you applied to

↓

Accept, reject, or negotiate the offer

↓

Complete any required paperwork

↓

Receive the money

(it might come to you or go straight to your school)

Scholarships can be a little different in that you often need to search them out on your own and complete a dedicated application.

Navigating loans and grant terms can be overwhelming when you’re also navigating classes and schoolwork. Here are some tips to help you stay on track:

- You have to resubmit the FAFSA once a year—for every year you’re in school.

- Missing an aid deadline almost guarantees your rejection, so take the deadlines seriously.

- Know the fine print on all your aid. For example, although many types of loans don’t require any payments until after you’ve graduated, some require you (or your parents) to start making payments while you’re still in school.

And remember that even if you think you won’t qualify for aid, there’s no harm in applying.

Financial aid is there to help you bridge the gap between the sticker price of college and what you and your family can actually afford. Aid can come in a number of different forms, including grants, loans, scholarships, and the federal work-study program. All aid is either merit based—such as based on academic, athletic, or other achievements—or based on financial need.

- If you can dream it, you can probably get a scholarship for it. You could receive $7,500 for being an excellent golf caddy, $3,000 for writing about ghosts or telepathy, or $10,000 for designing your own greeting card.

- More than 85 percent of first-time college students at a four-year school receive some kind of financial aid.

- Financial aid encompasses a variety of types of financial assistance that aim to help students cover the cost of college.

- You might receive financial aid in the form of grants, loans, work-study jobs, or scholarships.

- Need-based financial aid is available to families who can’t afford the full price of college. You can generally qualify for this type of aid by submitting details on your family’s finances through a form, such as the FAFSA.

- Merit-based aid is typically awarded on the basis of academic qualifications, athletic achievements, extracurricular interests, or personal traits.

- Financial aid can come from the federal government, your state, private lenders, your school, corporations, nonprofits, or community groups.