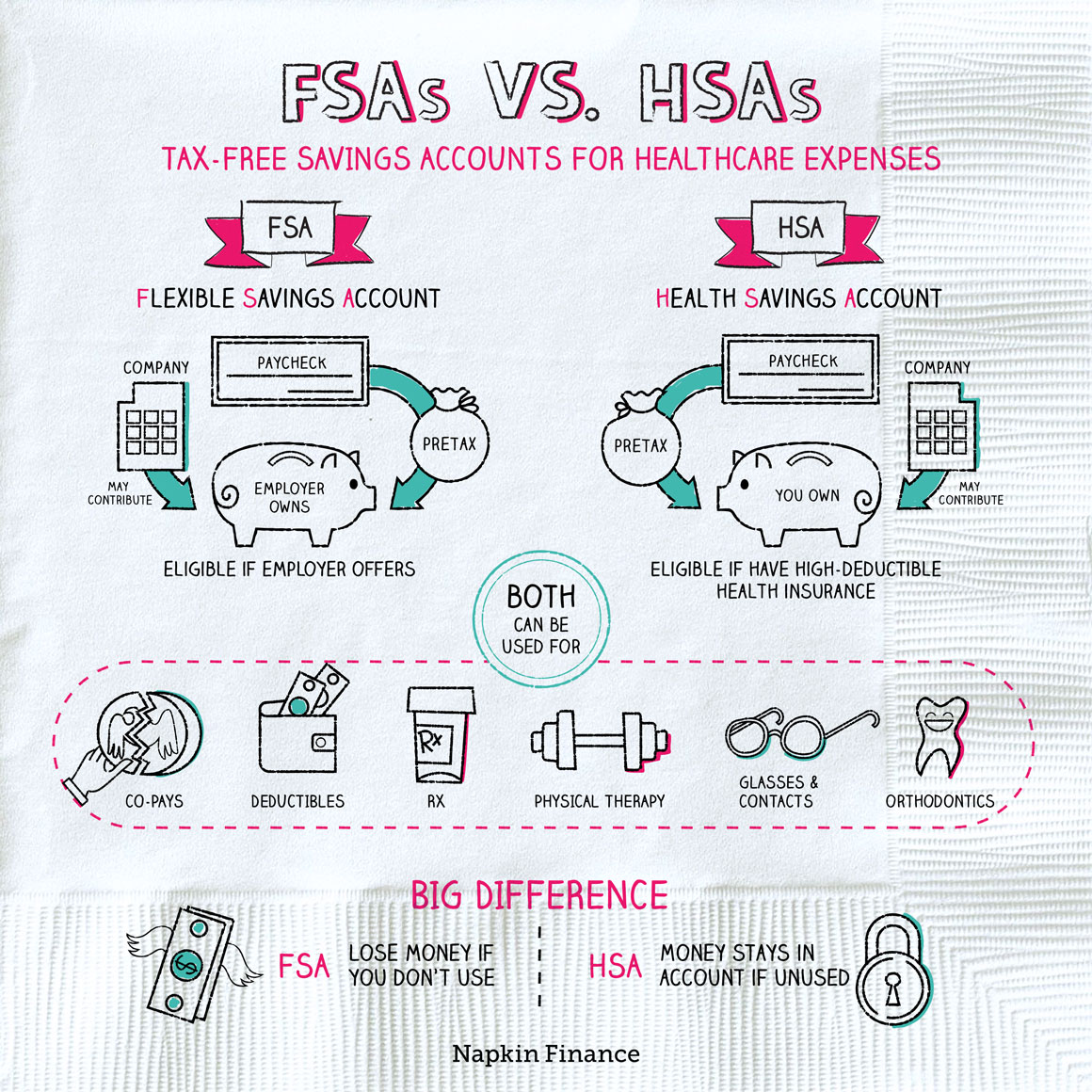

FSAs vs. HSAs

Health is Wealth

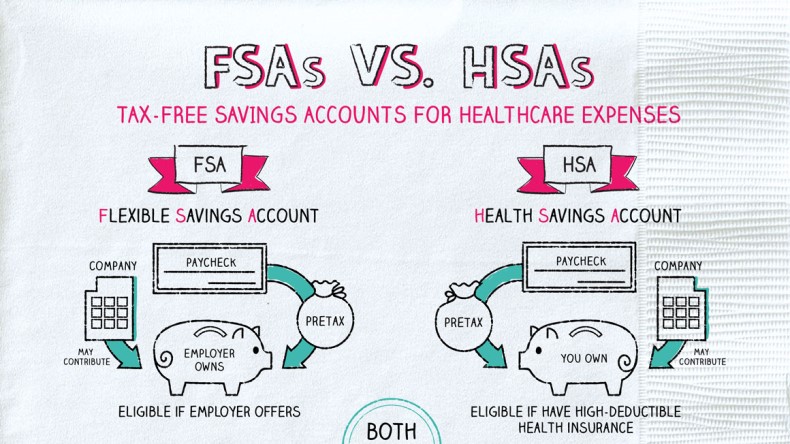

Health care FSAs and HSAs let you save money for out-of-pocket medical expenses (basically the things your insurance doesn’t cover). Think of them as tax-free savings accounts for your well-being.

First, the basics:

- FSA: Flexible spending account

- HSA: Health savings account

You can use the money saved in HSAs and FSAs to pay for a range of health care expenses (chosen by the IRS), including:

- Co-pays and deductibles

- Prescription drugs

- Braces or dental work

- Glasses and contacts

- Vaccines

- Physical therapy

- Surgery

You can’t use them to cover:

- Most insurance premiums

- Toiletries, such as deodorant, shampoo, or lotion

- Gym membership fees

- Makeup and cosmetic surgery

Not everyone is eligible for, or benefits from, an HSA or FSA. Here’s how they stack up:

| HSA | FSA | |

| Who’s eligible? |

|

|

| Owner | You | Your employer |

| Contributor |

|

|

| Annual contribution limits (2019) | $3,500 for anyone flying solo or $7,000 for a family | $2,700 per account no matter how large your family |

| When are the funds available to spend? | Like a bank account, you can only spend the money you’ve saved so far | You have access to your entire yearly planned contribution on January 1 |

| When can you adjust contributions? | Anytime during the year (up to the annual cap) | Only at the start of each year (unless something major happens in your life, such as a birth, marriage, or divorce) |

| Do you lose the money if you don’t use it? | No, your money remains in the account for as long as you have it open, and there is no lifetime cap on savings | Mostly yes, but employers can choose to offer a grace period for spending or a $500 rollover from year to year |

| What happens if you leave your job? | You can generally take the account with you to a new job or keep it if you become self-employed | Unless your FSA meets certain exceptions, you typically can’t take it with you |

The benefits of these accounts are that they save you money, reduce your tax liability, and help you set aside funds for unexpected or large medical expenses. And if your HSA has an investment option, your savings can even grow tax free.

You generally can’t contribute to both account types in the same year. However, HSA holders may be eligible for a separate Limited Purpose FSA (specifically for dental and vision expenses), and both HSA and FSA holders might be able to set up a separate dependent care FSA for certain child care expenses.

And although you don’t owe taxes on your contributions if you withdraw the money for qualified expenses, you may owe taxes if you withdraw HSA money for non-health care expenses. In that case:

- If you’re under age 65: You’ll have to pay taxes on the withdrawal along with a penalty

- If you’re 65 or older: You’ll be hit with taxes on the withdrawal but no penalty

FSAs and HSAs have their own pros and cons. But if you’re eligible for either account, there’s a good chance you’re better off contributing than not.

- Although there are limits on what these accounts cover, you can use your funds for some unexpected products and services, such as sunscreen, shoe insoles, lip balm, acupuncture, addiction treatment, and even guide dogs.

- An estimated $400 million in FSA funds are forfeited each year because people forget to spend them or don’t know what’s eligible.

- Around 13% of Americans have an FSA, while 17% have an HSA. Those numbers are higher for millennials at 18% and 26%, respectively.

- In 2018, the average household spent $5,000 on out-of-pocket medical expenses and health insurance premiums. That’s up more than 100% since 1984.

- HSAs and FSAs let you set aside pretax money for certain health expenses.

- HSAs have higher contribution limits, let you roll over unused money from year to year, and are more flexible, but also require that you have a high-deductible health insurance policy to make contributions.

- FSAs make your annual contribution available on January 1, so there’s no need to wait to spend those funds on a big health expense. An HSA is like a bank account; you can only use the money you have saved.

- FSAs generally follow the use-it-or-lose-it principle, with unspent funds forfeited.

- Some HSAs even let you invest your money and earn tax-free gains.