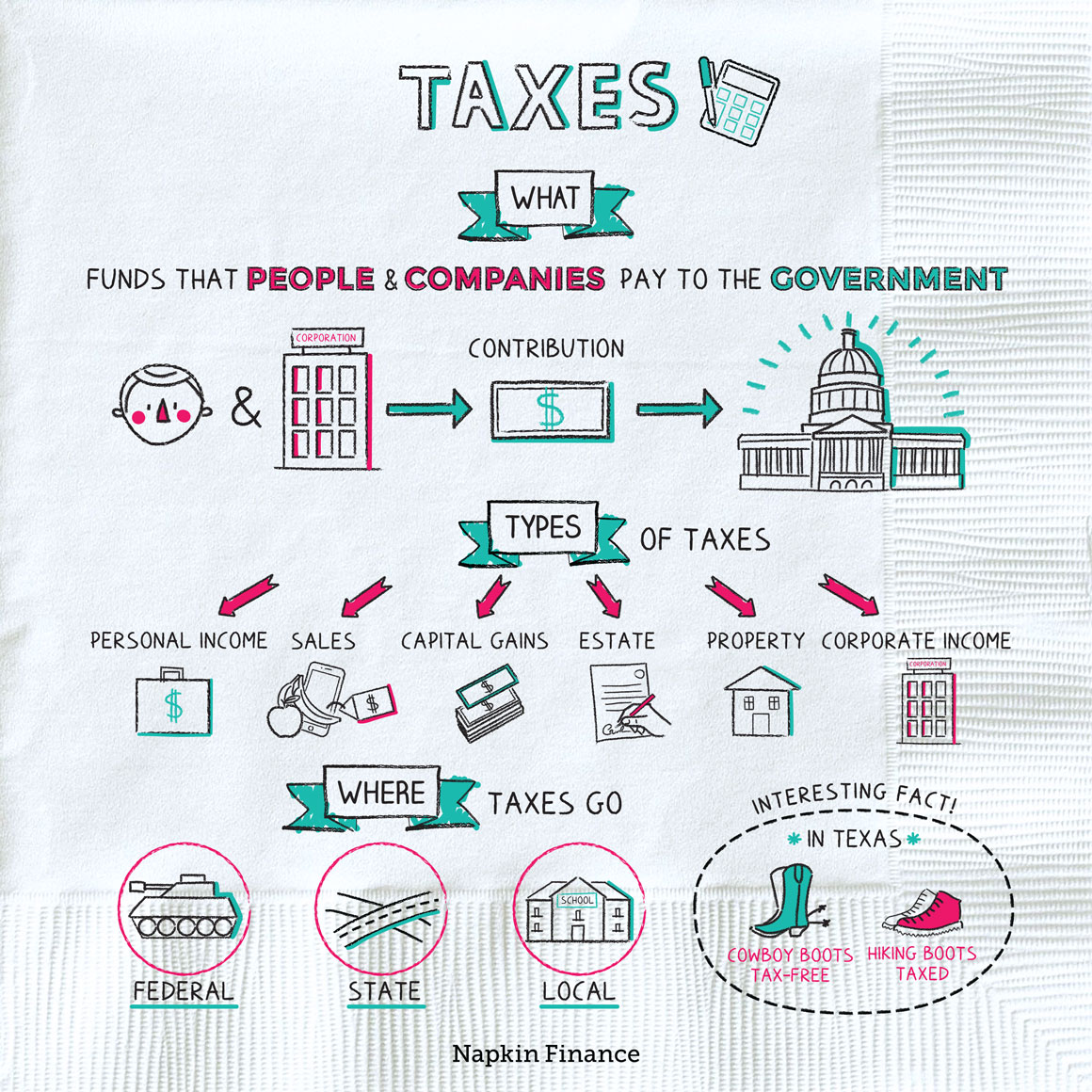

Taxes

Pay Up

Taxes are funds that people and companies must pay to the government.

The government wants a piece of the action pretty much any time a person or company earns money. Here are a few ways we all pay:

- Income tax—You pay this on your salary, but also on most gig-economy income and investment income.

- Sales tax—You pay when you buy something in a store, or a restaurant, or online.

- Property tax—You pay if you own real estate.

- Capital gains tax—You may owe if you sell an investment for a profit.

- Estate tax—When someone wealthy dies, the government will probably get a cut.

- Corporate income tax—The government gets a slice of corporate profits.

The government (whether state, local, or federal) collects your taxes in two primary ways:

- Directly: You pay taxes straight to the taxing authority or relevant government entity (e.g., the check you write to the U.S. Treasury when you file your tax return or pay your estimated taxes)

- Indirectly: You pay someone else, who eventually hands that money over to the government (e.g., you buy a pair of pants and the store passes the sales tax on to the government)

Your taxes pay for all kinds of things, from senators’ paychecks to fixing bridges to funding foreign aid. More specifically:

- Federal income tax goes to the U.S. federal government, and pays for:

- Military spending

- Social Security

- Medicare and Medicaid

- Interest payments on the national debt, and more

- State sales and income taxes pay for:

- Public schools

- Medicaid

- Transportation

- State prisons, and more

- Property taxes and other local taxes pay for:

- Public schools

- Fire and police departments

- Road maintenance, and more

“Taxes are what we pay for a civilized society.“

—Oliver Wendell Holmes, Jr.

There’s more than one way for the government to decide how much of a cut to take. In general, governments apply taxes in three main ways:

| Type | Regressive | Progressive | Flat |

| What it looks like | Any tax that’s a fixed amount and doesn’t vary with your income | A percentage that increases with your income | The same percentage of income for everyone |

| In effect | Poorer people pay more as a percent of their income | The wealthy pay more in percentage terms | Impacts everyone equally |

| Examples | Property taxes, sales taxes | Federal income taxes, estate taxes | Certain states’ income taxes |

When people say the U.S. follows a progressive system, they’re really talking about federal income taxes.

Taxes are money collected by the government. Almost everyone pays some kind of tax, whether through sales taxes on what you buy or income tax on what you earn. The federal, state, and local governments use your tax dollars to fund public projects, from building schools and roads to funding the military.

- In Texas, cowboy boots are exempt from sales tax but hiking boots are not.

- If you buy a whole bagel in New York, you don’t pay a sales tax. If the store slices the bagel for you then it’s considered prepared food, and you do pay sales tax.

- In Kansas, riding a hot air balloon that’s tethered to the ground is subject to an amusement tax. If it’s not tethered then it is considered a form of transportation and your ride is tax-free.

- New Mexico residents who live to one hundred get a break for the rest of their lives on state income tax.

- Taxes are what people and companies pay so that the government can function.

- You may pay taxes on what you earn, what you buy, and property you own.

- You pay taxes directly or indirectly. And you may pay taxes at the federal, state, and local levels—which go to pay for different types of services.

- U.S. income taxes follow a so-called “progressive” system, in which the wealthy pay more as a percentage of their income. Other types of taxes follow “regressive” or “flat” systems.