Audit

Just Checking In

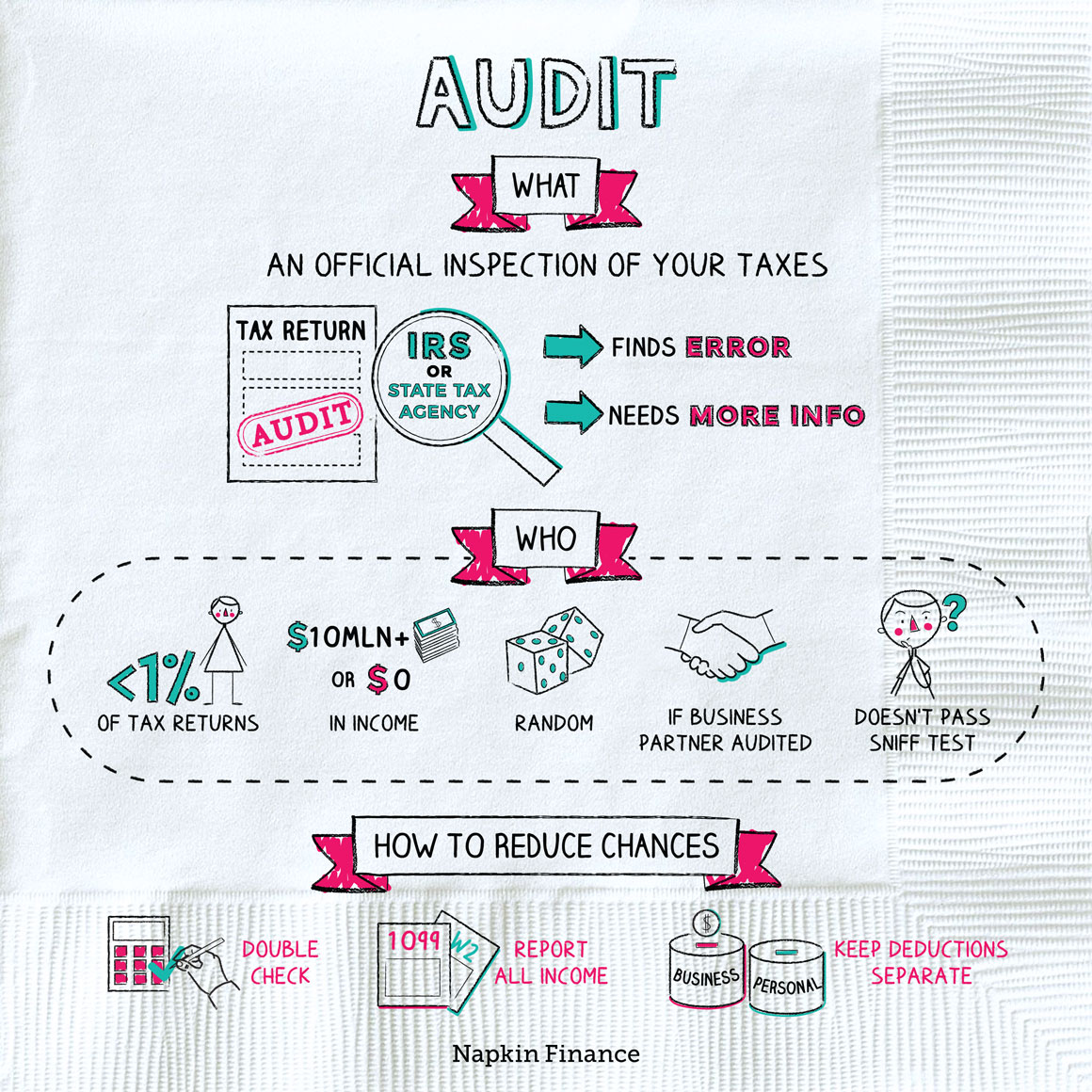

An audit can refer to any kind of official inspection of financial statements—usually to make sure that numbers have been reported correctly.

Most often when people talk about audits they’re referring to tax audits. That’s when the IRS or a state tax agency asks you for more information about your finances, typically because they want to make sure that you’ve reported information correctly in your tax returns.

Audits are kind of like quality control checkpoints. For the most part, the government trusts people (and their accountants) to follow the rules and file their taxes accurately. But periodically, the IRS wants to double-check your records and your work.

Although audits sound scary, they’re not that common. Less than 1% of tax returns are selected for an audit each year.

The IRS might pick you randomly or because its computer caught a suspected error in your return. Audits can happen to anyone, but there are some factors that can increase your chances, including:

- Reporting more than $10 million in income

- Reporting no income

- Having a connection to a person or business flagged for an audit (like if your business partner is audited)

- Anything on your tax return that doesn’t pass a sniff test (like an executive at a large company reporting only $10,000 in income)

Most audits focus on a specific aspect of a return, such as income sources, deductions, or the cost basis of an asset you sold. However, some people are selected for a line-by-line audit, which looks at everything and can be a long process.

In addition to your most recent return, the IRS may also audit your past returns. It may go back further if its accountants believe you’ve made a substantial error although usually not more than six years.

But most audits are just a request for more information and are resolved with little effort. Plus, not all audits result in a hefty tax bill. Some taxpayers actually end up with a refund.

The IRS may conduct audits in person or by mail. In a so-called correspondence audit, the IRS will contact you by mail to request additional information. You can then respond by mail or fax with the requested documentation.

The IRS does in-person audits in two ways:

- Field audit—the IRS schedules a time to visit your home or business. You provide information during the meeting and may be asked for additional documentation. This type of audit is more common for businesses than individuals.

- Office audit—the IRS schedules a time for you to bring requested documents to a local IRS office.

No matter the type of audit, the IRS will usually reach out by mail first before ever contacting you by phone or showing up at your doorstep.

Even though most people don’t get audited, there are a few things to keep in mind during tax season:

- You’re not protected from an audit just because you don’t earn much.

- Using a professional tax preparer or special software doesn’t mean you won’t be audited.

- Even if the IRS accepts your return, you can still be audited; most audits occur within the first two years after filing.

- State tax agencies can be even more aggressive with audits than the IRS, so use as much care with your state tax return as you do with your federal return.

You can’t always avoid an audit, but you can minimize the likelihood that your return will catch the attention of the tax man by:

- Double-checking your math and using exact numbers instead of rounding

- Making sure you report all your income, including W-2 and 1099 income, but also any income that didn’t result in a W-2 or 1099

- Keeping business and personal expenses separate

- Being honest about deductions

Audits help make sure everyone is paying their fair share in taxes and can help the authorities identify tax fraud. Audits are usually nothing to worry about as long as you’ve been honest in your filings. Many can be resolved with minimal fuss, and occasionally they can even result in an extra refund.

- People will go to inordinate lengths to try to avoid paying taxes, like claiming that the state of Texas isn’t actually part of the U.S. or arguing that they don’t meet the legal definition of a “person.”

- Microsoft has been under IRS audit for more than a decade over concerns that it may have illegally shifted valuable intellectual property out of the country.

- Some 3% of audits actually result in a refund.

- The IRS and state tax agencies use audits to make sure taxpayers correctly file and pay taxes.

- Audits can happen by mail or in person, and most focus only on a specific area of your tax return (like reported income or deductions).

- Audits can occur years after you file a return, especially if the IRS spots an egregious error.

- Certain factors can increase your chances of being audited, but many audits are triggered either randomly or because of a computer-identified error.