Tax Form 1040

Any Way, Shape, or Form

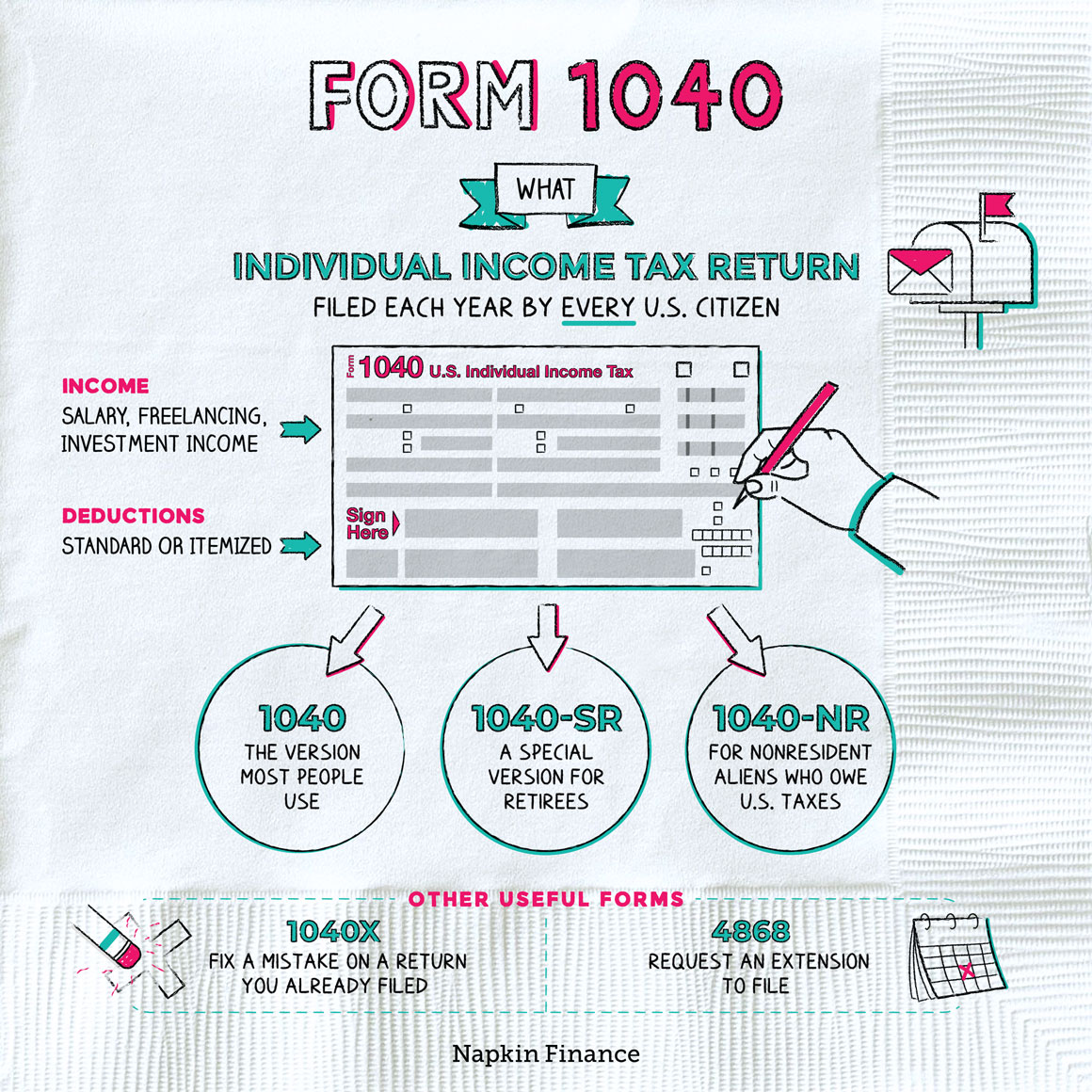

The IRS’s Form 1040 is the master form that most people use to file their tax returns each year.

If you made money in a given year, chances are you’ll need to fill out a 1040 and file it with the IRS.

The 1040 comes in three main varieties:

- Form 1040: The standard, run-of-the-mill tax form that most people use.

- Form 1040-NR: A form for nonresident aliens (i.e., people who are neither citizens nor green-card holders) who owe taxes in the U.S.

- Form 1040-SR: A form for people aged 65 and older. It includes information that’s specific to retirees on deductions and filing rules, and comes in a larger font.

Before you start working on your Form 1040, you’ll need to gather your information.

When filling out Form 1040, the IRS expects you to include your:

- Name and address (plus your spouse’s, if you’re filing jointly)

- Social Security number

- Filing status (single, married filing jointly, etc.)

- Dependents

- Wages, salary, and tips (from your W-2)

- Social Security benefits

- Capital gains and losses

- Interest or dividend income

- IRA distributions

- Tax credits or deductions you qualify for

- Other sources of income (alimony, royalties, unemployment benefits, etc.)

If you’re getting a refund, you’ll also add your bank account information so the IRS knows where to route your funds.

In addition to the 1040, some tax filers must include other forms, known as Schedules (which have absolutely nothing to do with your plans for the week). The most common schedules include:

| Schedule | Used to |

| Schedule 1 |

|

| Schedule 2 |

|

| Schedule 3 |

|

There are additional Schedules specifically for individuals such as sole proprietors, those with self-employment income, or someone with itemized deductions.

Filing your 1040 isn’t the most exciting thing you’ll ever do, but the process is relatively straightforward.

Collect your tax documents (W-2, 1099s, deductions, etc.)

↓

Download the form from the IRS website (or use software or visit a tax preparer)

↓

Report your income

↓

Claim your credits and deductions

↓

Note the taxes you’ve already paid (through payroll or otherwise)

↓

Determine your tax liability

↓

Celebrate if you’re getting a refund (or cry if you still owe money)

↓

Sign and date the form

↓

File electronically or by mail, and include any required documents (such as your W-2)

- If you make a mistake on your filing (we’re all human!), you can use Form 1040X to file a correction.

- If you’re not going to make the April 15 filing deadline, Form 4868 lets you request an extension on filing the form (but not paying the money).

- You can file your taxes on paper at home, pay someone to do it for you, use tax software (free and paid versions are available), or, if you’re low income, various organizations offer free in-person filing assistance.

- Not everyone has to file, but the IRS recommends filing just in case both to avoid penalties down the road and scoop up any refunds waiting for you.

The 1040 is an IRS tax form that Americans use to file their personal income taxes. There are three primary types, each for a different set of filers. Filing the 1040 requires adding your personal information, income, deductions, and credits. Once you’ve totaled all the numbers, you’ll find out if you owe the IRS more or if you’re getting a refund. Certain taxpayers must include Schedules when submitting a 1040 to list other types of income, deductions, and credits.

- Form 1040 might be easy to fill out, but the accompanying instruction manual runs more than 100 pages.

- More than 70% of households get a tax refund each year; filers in the Houston, Midland, Brownsville, and McAllen, Texas, metro areas get some of the nation’s largest refunds.

- Taxpayers use Form 1040 each year to file their personal income tax return with the IRS.

- Two variants, 1040-SR and 1040-NR, are available for taxpayers over the age of 65 or who are nonresident aliens, respectively.

- You’ll report your personal information, such as name and address, plus income, credits, and deductions on Form 1040.

- Some filers must complete Schedules, which list specific deductions, credits, and income not included on Form 1040.

- The process to complete Form 1040 is pretty straightforward: you calculate your income, deductions, credits, and previous tax payments to figure out whether you’re getting a refund or need to send the IRS a check.