Appraisal

For All it’s Worth

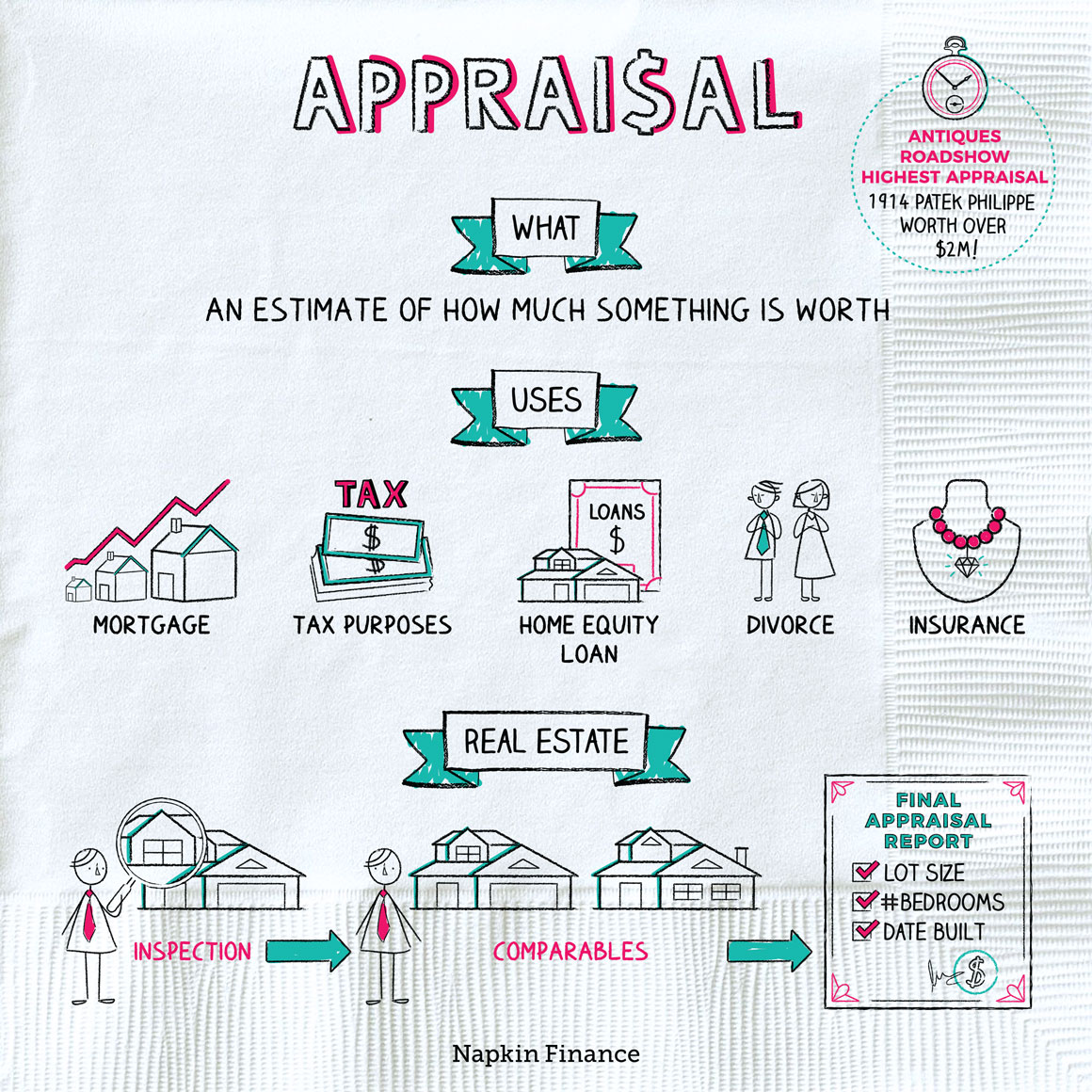

An appraisal is an estimate of how much something is worth. People may get appraisals for real estate, jewelry, paintings, antiques, or other collectibles.

Normally, if you need to know the value of something, you can form an estimate by looking at recent sales of similar items. For example, if you want to know the value of stock you own, you can look at its recent share price. Or if you want to know the value of your car, you can look online for recent value estimates for the same model from the same year.

But if you need to know the value of something that’s unique or that isn’t bought or sold frequently, you may need to obtain an appraisal from an expert.

Appraisals may be necessary for:

- Obtaining a mortgage or home equity loan

- Tax purposes, like if you need to report the value of a gift to the IRS

- Divorce proceedings to make sure both spouses receive a fair share of assets

- Insurance, like if you’re buying a policy to protect an expensive piece of jewelry

Home appraisals are, by far, the most common kind. They’re typically necessary if you ever need to:

- Obtain or refinance a mortgage or home equity line of credit

- Appeal your property taxes

- Evaluate the benefit of a remodel or renovation

- Split assets during a divorce

Appraisals typically cost a few hundred dollars for a single-family home. The cost varies based on property type, location, and square footage (appraisals for apartment buildings or for properties located in remote areas can cost more).

A home appraiser is an expert who’s trained to give an unbiased value of a home. They usually have a certificate or license from the state where they work and are heavily regulated. Their knowledge comes from training, continuing education requirements, and on-the-job experience.

Appraisers do their best with the information and knowledge they have. But they’re human, and their work isn’t always perfect. If you don’t agree with an appraisal, you can always get another one done.

A home appraisal has three main parts:

- Inspection—an appraiser visits the property and inspects it

- Comparables—the appraiser researches similar homes in the area and recent sales

- Final appraisal report—the appraiser uses all the data collected from the inspection and comparables research to issue a value estimate and create a final report

During the appraisal process, an appraiser looks at a home’s features and condition, including:

- Lot size

- Square footage

- Date built

- Number of bedrooms and bathrooms

- Features (like swimming pools, patios, garages, and updated floorings or fixtures)

- Neighborhood

Removable items don’t count, so you don’t have to worry about making beds or emptying the trash before the appraiser arrives.

But fixing cracks in the wall or dealing with missing siding could help you get a good value. Experts recommend you consider using the $500 rule: If it costs more than $500 to fix, it’s probably worth doing. Why? Because appraisers often value houses in $500 increments.

There are lots of websites that offer free appraisals, but experts recommend that you have an appraisal conducted in person to get the most accurate value. For collectibles and jewelry, you might even want to take your item to a few different appraisers, especially if you’re considering selling it.

Appraisals help determine how much something is worth. They’re done by trained professionals who deliver an unbiased value of the item based on its condition, selling price of similar items, and other factors.

- Unlike the cheese in the back of your fridge, home appraisals don’t expire, but lenders usually like to see one completed within the past six months. Some require that the appraisal be no older than 90 days.

- The highest appraisal ever given on Antiques Roadshow was for a 1914 Patek Philippe pocket watch, which was valued at $2 million to $3 million (to the surprise of its owner, who’d been told in a previous appraisal it was worth only $6,000).

- Home appraisers are overwhelmingly male—making up around three-quarters of the working appraisers in the U.S.

- Appraisals are used to determine the value of items that are unique or that aren’t bought and sold frequently.

- Appraisals are most often used for homes but are also done for antiques, furniture, jewelry, art, and other collectibles.

- A home appraisal involves an in-person inspection and review of comparable properties and recent sales. An appraiser uses this information to determine a final value.

- Appraisers are usually required to get a license or certification and are subject to regulations. But the appraisal process relies on human judgment, so it’s not perfect.