Buying a Home

Happy Homeowner, Happy Life

Buying a house is one of the biggest steps you can take in your life. But it’s one you want to take carefully because becoming a homeowner has significant long-term financial consequences.

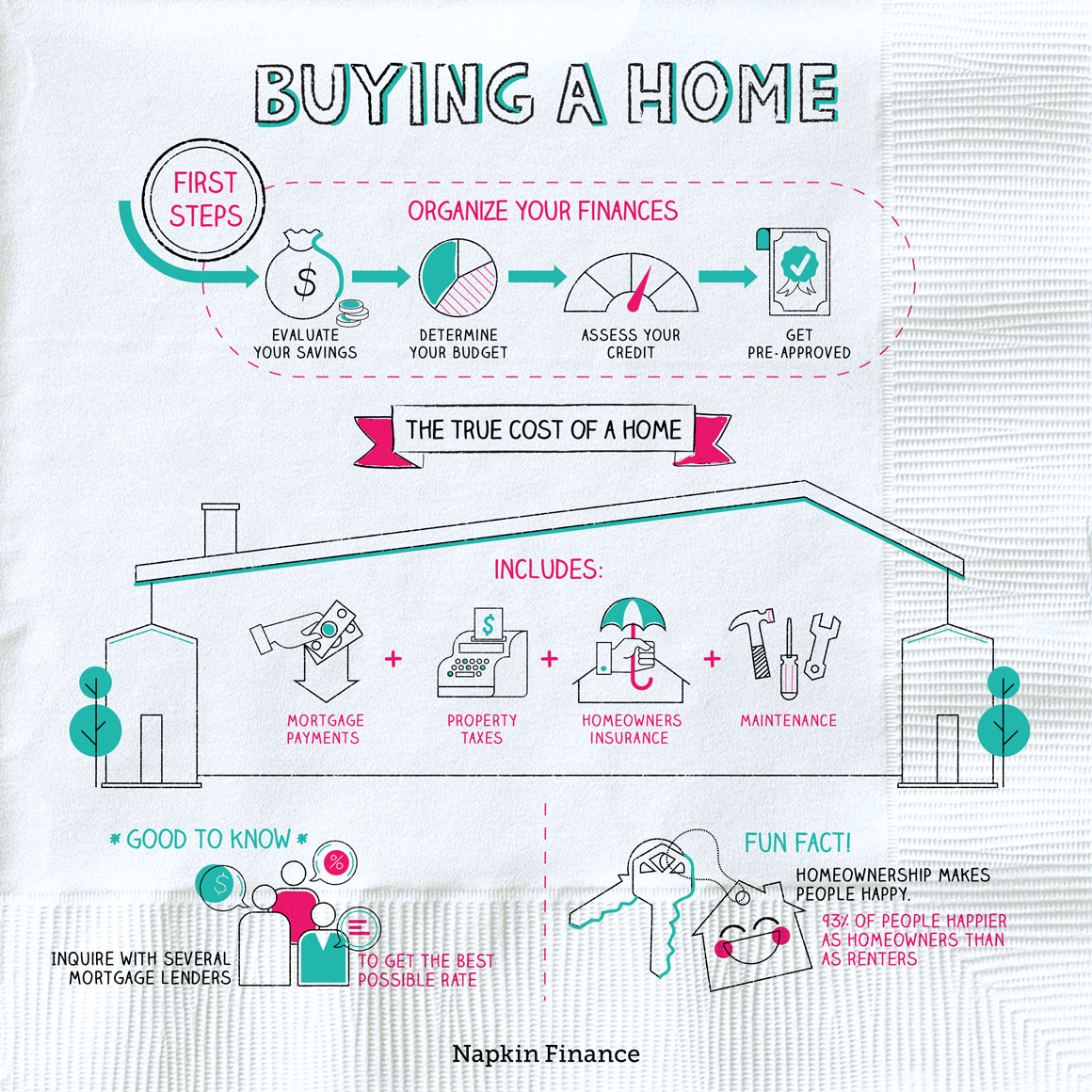

Before you contact lenders or look at houses, organize your finances.

- Evaluate your savings: You’ll need at least a 3% down payment to qualify for a mortgage. It’s also wise to have a fund for maintenance costs that crop up as a homeowner.

- Determine your budget: How much can you afford in monthly mortgage payments? Keep in mind costs, such as property taxes, homeowners insurance, and homeowners association fees, as well.

- Assess your credit: What’s your score? If it’s low, consider improving your credit before applying for a loan. A good credit score can help you get a better interest rate.

- Get preapproved: Request a preapproval letter from your lender before you start looking at houses.

Preapproval letters:

- Reassure sellers that you can afford to buy their home

- Give real estate agents confidence to schedule showings on your behalf

- Provide an estimate of how much you can borrow and what your price ceiling should be

The true cost of a home includes several ongoing factors, all of which you want to account for when figuring out how much home you can afford.

- Down payment: The more money you put down, the smaller your mortgage and the less you’ll pay in interest. Putting down at least 20% will help you avoid private mortgage insurance (PMI), which lenders often require for smaller down payments. If your down payment is low, you’ll need to factor PMI premiums into your monthly loan amount.

- Property taxes: It’s a good idea to find out the property tax rate in the local area and look into local real estate trends. If you’re moving into an up-and-coming neighborhood, your taxes may go up as property values increase.

- Maintenance: Upkeep adds up quickly, especially for older or larger homes. Think about how much it will cost to maintain a yard or replace old pipes and fixtures so that you can build a buffer into your budget.

Tip #1: Decide where you want to live. You don’t want to find your dream house in a neighborhood you don’t like, so consider your location first. Think about your commute, the local amenities, and if it’s important to be in a good school district. Then narrow your search to homes in that area.

Tip #2: Focus on the foundation, not aesthetics. You can repaint walls and replace backsplashes with relative ease, but replacing a roof or doing lead abatement is a much taller order. Look beyond decorative details to make sure you’re buying a sturdy home.

Tip #3: Think about how long you want to be in the house. If you’re looking for your forever home, consider how your family may grow or your needs may change. Keep those plans in mind for a house that can accommodate those changes.

Once you’ve found your perfect home, you can make a formal offer. A real estate agent can guide you through this process, since local laws around writing an offer and what should be included may vary.

If you’re in a hot market, you may want to include a letter telling the seller why you want to buy their home. No guarantees that’ll sway them in your favor, but it could persuade a sentimental seller to accept your offer instead of someone else’s.

You may want to apply for a mortgage from several lenders at one time. This lets you compare their rates and fees to find the best deal. Applying simultaneously gives you the most accurate comparison, since their offers are based on the same information.

Submitting your applications at the same time has another benefit as well. Every time you apply for a loan the lender does a hard credit inquiry—basically a request for your credit report. Hard inquiries appear on your credit report for two years, and they temporarily lower your score. When you request quotes from several lenders at the same time, they’ll all be working with your current credit score rather than that lower number.

To choose the right loan, it helps to compare the costs associated with each lender’s loan.

| Cost | Definition |

| Interest rate | A percentage of the loan paid monthly on top of principal payments |

| Annual percentage rate (APR) | How much you pay yearly on the loan, including interest and fees |

| Origination fee | Amount the lender charges to process your loan application |

| Credit score check | Fee for the lender pulling your credit report |

| Closing costs | Can include lead paint inspection, escrow fees, attorney fees, homeowner’s association fees, title insurance, appraisal fees, and other expenses depending on the lender and type of loan, homeowner’s insurance, property taxes, and private mortgage insurance |

A note on closing costs: Closing cost amounts vary based on your lender and the type of loan you take out, along with how much you put down as a down payment. It’s important to ask your lender what fees they charge and for the total cost of the loan before you accept their mortgage offer.

After you’ve received an initial approval for a loan, you’ll submit documents on your finances, employment history, and any other details your lender requests for verification. The application then goes to an underwriter who analyzes your application and decides whether or not to approve the loan. Assuming all goes to plan, your lender will arrange a closing date.

Closing is when you officially become a homeowner. You’ll sign the final loan documents, the lender will transfer payment to the seller, and you’ll get the keys to your house at long last.

Becoming a homeowner is a major milestone, and the more prepared you are, the richer the experience will be. If you prepare your finances and let your budget guide your search for that dream home, you’ll be in great shape to make the leap to buying your own place.

- Homeownership makes people happy. A recent study found that 93% of people surveyed were happier as homeowners than as renters, and 79% said they had become better people since buying their houses.

- Jeff Bezos isn’t just one of the world’s wealthiest people. He also owns the ritziest home in Los Angeles. Bezos purchased the $165 million house with a golf course, tennis courts, and gas pumps, so he never has to fuel up among the commoners.

- To woo millennial homebuyers, a luxury condo development in Vancouver offered a year of free avocado toast as an incentive. Those who purchased a unit the first weekend of the development’s opening received a gift card to a local restaurant with money equaling the cost of an avocado toast one day a week for a year.

- “Not so fun fact”—- the word “mortgage” stems from the Old French word ”morgage” or “mort gaige,” which means “dead pledge.” The reason? Because your mortgage “dies” once you pay it off or when you fail to make payments.

- It’s important to consider all of the costs associated with homeownership, not just the monthly mortgage payment.

- The more you can save up for a down payment, the more money you’ll save in interest and insurance.

- Speaking with several lenders will help you understand the market and get the best possible offer.