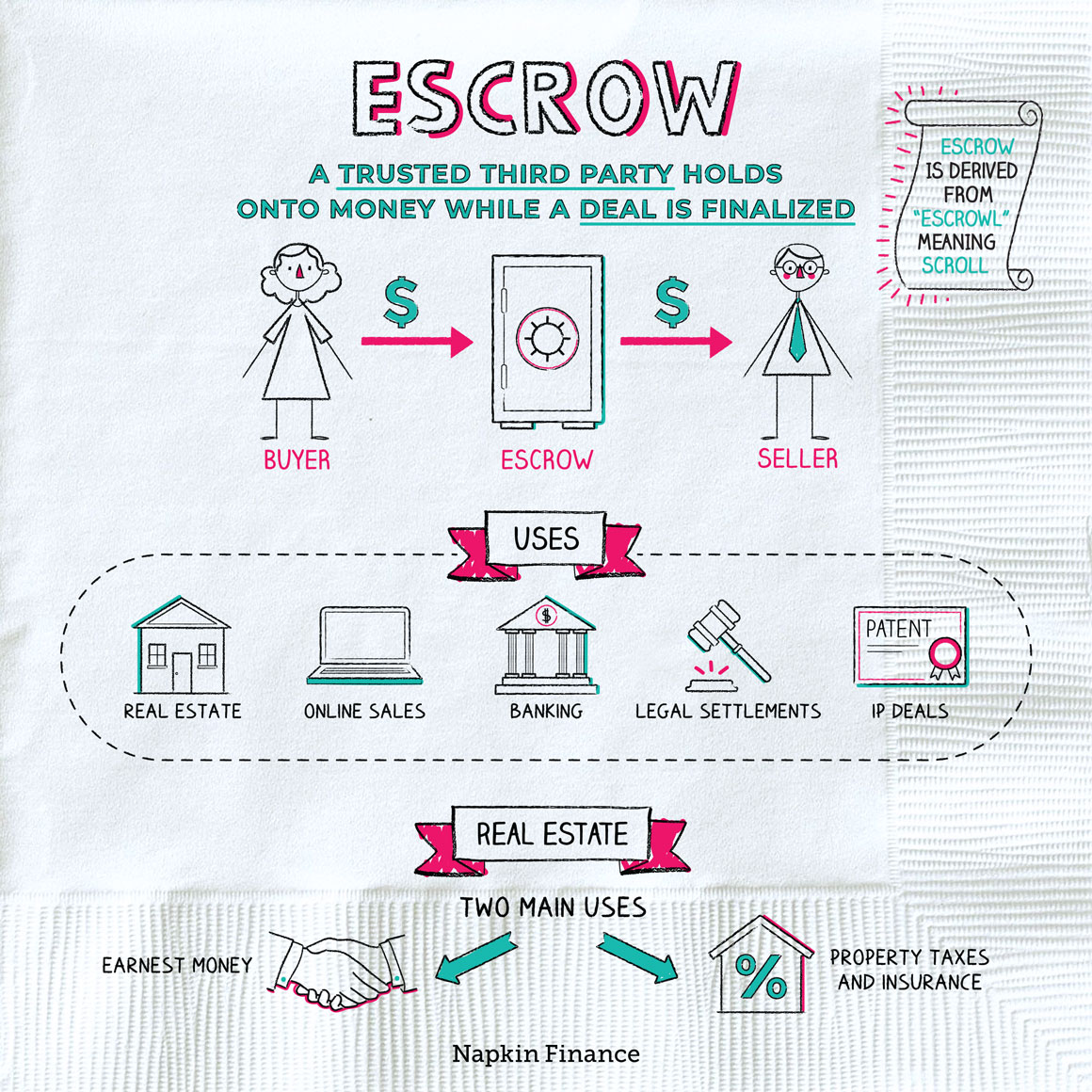

Escrow

In Good Hands

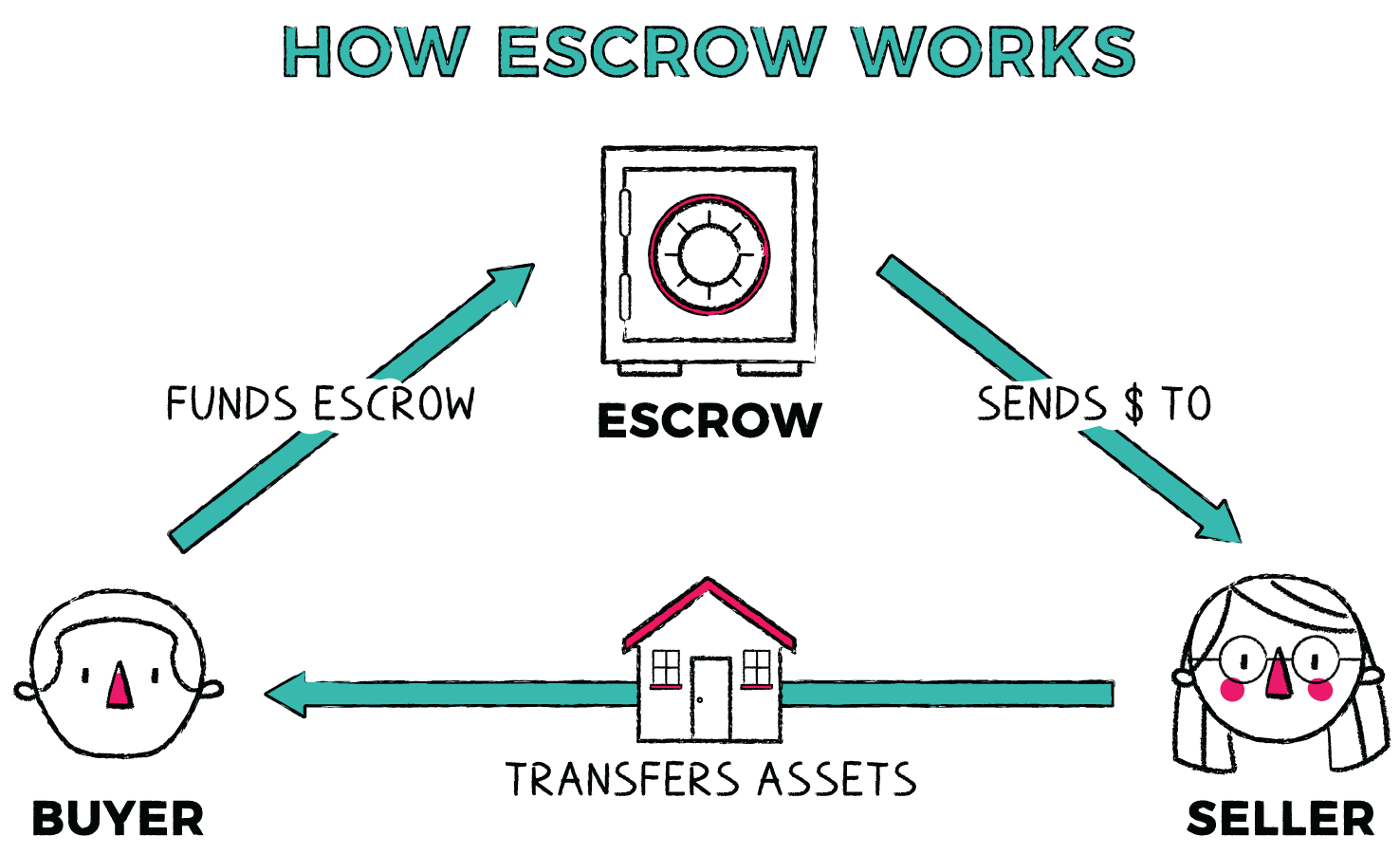

Escrow is an arrangement in which a trusted third party temporarily holds onto some kind of asset, keeping it safe.

Escrow is typically used to help real estate and other large deals go through successfully.

Escrow has two key features that make it particularly useful for high-value deals:

- Neutrality: The third party holding the asset has nothing to gain or lose if the deal falls through and no bias toward one or the other party.

- Security: Neither of the two parties to the deal can run off with the money while it’s in escrow.

In high-value deals (like home sales or business mergers), there’s often significant money involved and fears on both sides that the other party won’t live up to its side of the bargain.

Escrow is a tool for easing those concerns. When a buyer puts money into escrow, the seller can feel more confident that the buyer actually has enough money to complete the purchase. But putting the money into escrow first (instead of handing it straight over to the seller) also protects the buyer while the final details of the deal are being worked out.

You may be familiar with escrow if you’ve ever bought or sold a house. In real estate, it has two main roles:

- Earnest money: Once a buyer accepts your offer on their house (but before the sale closes), you put earnest money into an escrow account. That money tells the seller that you’re serious about buying.

- Taxes and insurance: After you close, your mortgage lender may collect your property tax and insurance payments—holding them in escrow and then paying those bills on your behalf.

When it comes to buying a house, escrow follows a fairly standard process:

You make an offer on a house

↓

The buyer accepts your offer

↓

You put earnest money into an escrow account

(usually a percentage of the purchase price)

↓

You and the buyer complete the sale

↓

The escrow holder returns the earnest money to you

(buyers often put it toward closing costs or other fees)

However, there are variations on that standard process if your real estate deal falls through for some reason. In that case:

- If the sale falls through because the buyer backed out, the seller might get to keep the earnest money.

- If the sale falls through because the home fails inspection or the seller backs out, the buyer gets their earnest money back.

In some other cases, depending on the terms of the contract, the buyer and seller may split the earnest money if the deal falls through.

Besides real estate, escrow can also be used in:

- Online sales—Money a buyer pays in an online transaction may first go into escrow. When both parties agree that they’re ready to finalize the sale, the third party releases the money.

- Banking—When a customer makes a deposit at an ATM, the machine holds the money while counting it. If the ATM doesn’t approve the total, the machine returns the money.

- Legal settlements—Money from a cash settlement often flows through escrow. The defendant pays the settlement amount to the escrow fund, and the fund distributes the money to the plaintiff.

- Intellectual property transactions—The IP creator or owner may place patent paperwork, designs, or other related materials into an escrow account.

Escrow is an arrangement in which a neutral third party holds an asset (most often money) while a deal is being finalized. Escrow is often used in real estate transactions but can also be used in legal settlements, online sales, and intellectual property claims.

- Although the whole point of escrow is to keep your money safe, fraudsters are sometimes able to steal homebuyers’ money by setting up fake escrow companies with real-sounding names. Incidents of escrow fraud have risen some 1,000% in recent years.

- Escrow accounts were originally established in the U.S. in the 1930s during the Great Depression as a way to force homeowners to save enough money to pay their taxes by spreading out the payments into smaller amounts held in an escrow account.

- The word “escrow” is derived from the Middle English word “escrowl,” meaning “scroll.”

- Escrow refers to an asset being held by a third party until a deal is complete.

- It offers a sense of security to the parties involved in a deal that everyone will try to negotiate in good faith.

- Escrow is frequently used in real estate transactions, both as earnest money before a sale and to pay property taxes and insurance costs for the lifetime of a mortgage.

- You can use escrow for other sales and agreements, including legal settlements and online purchases.’