Foreclosure

Bottom Dollar

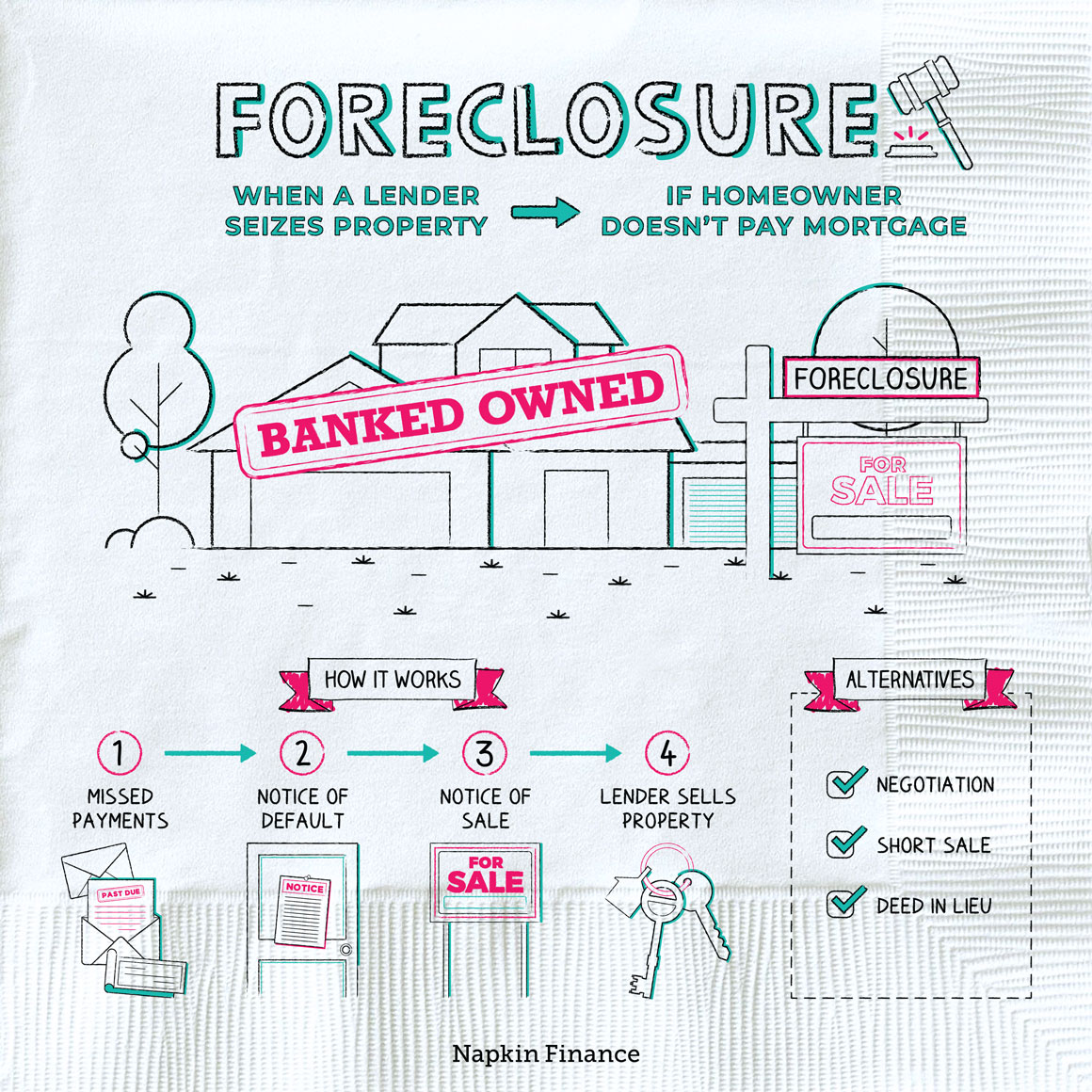

Foreclosure is a legal process that lets a lender seize possession of a house or other real estate. It’s what typically happens if a homeowner doesn’t pay their mortgage.

Mortgages are risky for lenders. To provide some protection, the borrower’s house acts as collateral for the mortgage—which means the lender can seize the house if the borrower doesn’t pay.

Mortgage documents include a foreclosure clause. If the owner stops making payments, this lets the lender evict a homeowner, take control of the property, and sell the house to recoup some costs.

While there are some differences from state to state, a foreclosure usually goes like this:

Default.

Homeowner misses mortgage payments

↓

Notice of default.

Issued by the lender if the homeowner doesn’t try to catch up on payments

↓

Notice of sale.

Lender indicates its intent to sell the property

↓

Sale.

Lender sells the property

Banks don’t usually start the process until the owner is a few months late on payments. (And the lender usually gives the owner a chance to catch up on payments first.)

Foreclosures can be either voluntary or involuntary:

- Involuntary: When an owner wants to stay in the house but can’t make their mortgage payments. In this case, the bank may need to evict the homeowner.

- Voluntary: If the home is worth less than the mortgage (which can happen if a home has fallen significantly in value), then the homeowner has no equity and may decide to walk away.

They can also be either judicial or nonjudicial:

| Judicial | Nonjudicial | |

| Main difference | Lender has to go to court to get the “ok” to foreclose. | Lender can foreclose without going to court. |

| How common is it? | More common. (Used in 45 states.) | Less common. (Used in 30 states.) |

| How long does it take? | Longer. Often takes a year or more. | Shorter. Can happen in a few months or less. |

If a homeowner falls behind on their mortgage, there are usually a few options available instead of foreclosure:

- Negotiation

- A homeowner can work with their lender to make up missed payments or agree on a new payment plan.

- Short sale.

- The homeowner may be able to avoid foreclosure by selling the house for less than it’s worth.

- The lender must approve the sale. The sale proceeds go to the lender first, and anything leftover goes to the homeowner.

- Deed in lieu.

- The homeowner gives up the home without going through the foreclosure process by signing the deed to the house over to the bank.

- The homeowner doesn’t have to pay the outstanding mortgage, and the bank can sell the house.

Foreclosure, short sale, and deed in lieu can all hurt your credit score for years. None of these are steps to be taken lightly, which is why experts typically recommend that you never take on a mortgage that’s larger than you can truly afford.

Foreclosure is when a lender takes a property away from a homeowner if the owner is missing mortgage payments. The lender can then sell the house to recoup what it’s owed. Lenders often give homeowners the chance to make up missed payments or sell the house for less than it’s worth before foreclosing.

- Lenders will ultimately foreclose on one of every 200 homes. Some 250,000 new families will enter foreclosure every three months.

- Contrary to popular belief, banks generally don’t make money on foreclosures. Lenders frequently lose $50,000 or more on each one.

- Foreclosure is a legal process that lets a lender seize a house or other real estate if the owner is missing mortgage payments.

- The foreclosure process doesn’t start with the first missed payment. Altogether, the process can take a year or more.

- There are two main types: judicial, which requires a judge’s approval, and nonjudicial, which is handled outside the court system.

- Before foreclosing, a bank will usually let the owner catch up on payments, complete a short sale, or enter a deed in lieu agreement.

- Foreclosure can do a number on your credit score. That’s why it’s important to never go into a mortgage lightly.