Title Insurance

On the House

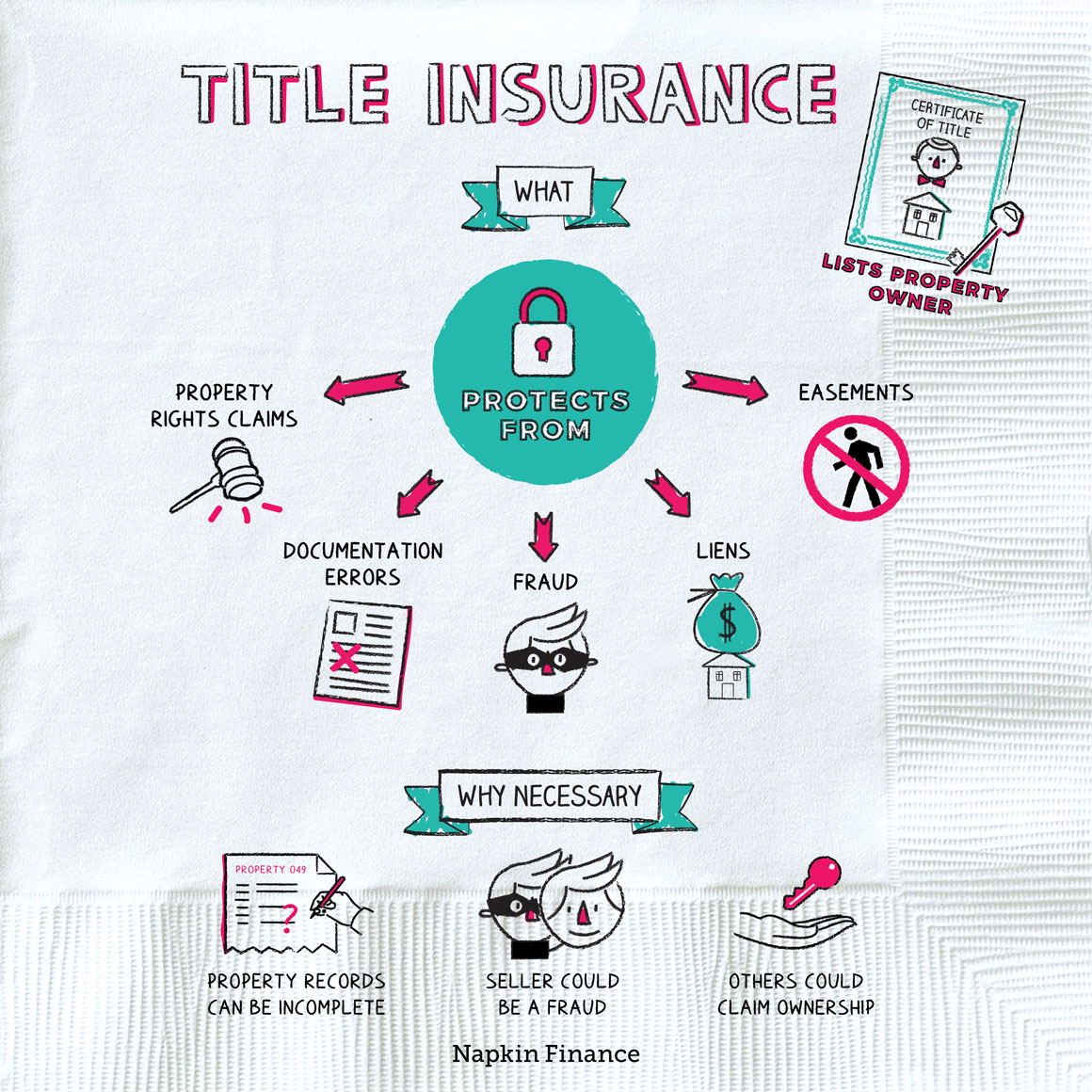

A “title” is a document listing the legal owner of a piece of property. Title insurance protects homeowners (or in some cases mortgage lenders) from any unknown issues with the title that could come up down the road.

When you buy a property, what you’re really getting is the title, which says you’re the legal owner. However, because properties can change hands many times over decades (or even centuries), coming up with an ironclad history of the property and its ownership can be hard.

So, a title insurance policy protects you from these unknown issues that might come from:

- Property right claims

- I.e., if one day someone comes knocking on your door to say that actually their great aunt left them the property in her will 20 years ago (and would you please pack up and leave)

- Documentation errors or forged documents

- Such as if your local recorder’s office has an error in its documented history of your property

- Fraud

- Like if the person you thought you bought the house from didn’t actually own it themselves

- Liens

- A claim a lender could have on the property if a previous owner used the home as collateral

- Easements

- An easement gives someone else the right to cross your property—like if sewer or other utility pipelines pass through your property, or if a hiking trail passes through your backyard

- Perhaps you didn’t think there were any easements on your property when you bought it, but one day someone asserts otherwise

There are two types of title insurance:

- Lender’s policy: Protects the lender’s claim, usually for the duration of the mortgage. Your lender will likely require that you buy this.

- Owner’s policy: Protects the buyer’s investment for as long as they (or their heirs) own the property. These policies are optional, and either you or the seller can cover the cost.

Before you can buy a home, a title company researches the property to find any potential issues that might impact your right to ownership. However, this isn’t a foolproof system. Property records are typically maintained by local offices and could go back as far as the founding of the country. These records can be messy, and it’s possible for them to get mixed up over time.

Let’s say a previous owner never paid $10,000 in property taxes, and now the government wants its money. If you have title insurance, the insurance company might pay for:

- Your lawyer’s bills

- Compensation for any financial loss (i.e., that $10,000), up to the policy’s face value

If you don’t have title insurance, you could be on the hook for those back taxes.

An owner’s policy (which you go out and buy on your own) can run somewhere between $500 and $3,500. The lender often wraps the cost of the lender’s policy into your mortgage amount.

Unlike other types of insurance, you’ll only pay the premium once, usually at closing.

Title insurance protects buyers and mortgage lenders from unknown issues with a property’s title. Many lenders require a buyer to get a lender’s policy, while an owner’s policy is optional. Policies can cover title problems arising from heirs with a claim to the property, forged documents, unknown easements, and many other issues.

- Mark Zuckerberg ran into title problems when he bought a 700-acre estate in Hawaii in 2014. State laws grant native Hawaiians the right to own lands (and have their ownership pass down through generations), without going through the formal process of transferring deeds and titles, and there were potentially hundreds of such ownership claims against his property.

- One out of every three title searches reveals an error or claim that someone must address before the transaction closes.

- Title insurance protects buyers and lenders from problems in a property’s title that could crop up in the future.

- Problems can arise from documentation errors, fraud, undisclosed easements, or unknown heirs.

- Lenders typically require a lender’s policy before financing a purchase, but it’s optional for a homeowner to buy their own policy.

- Title insurance might cover legal fees if someone sues a property owner over a title issue or could provide financial compensation if the owner loses money over an issue.

- The buyer or seller pays the policy premium only once, at the time of closing. There are no ongoing costs to maintain a title insurance policy.