Recession

Feel the Pinch

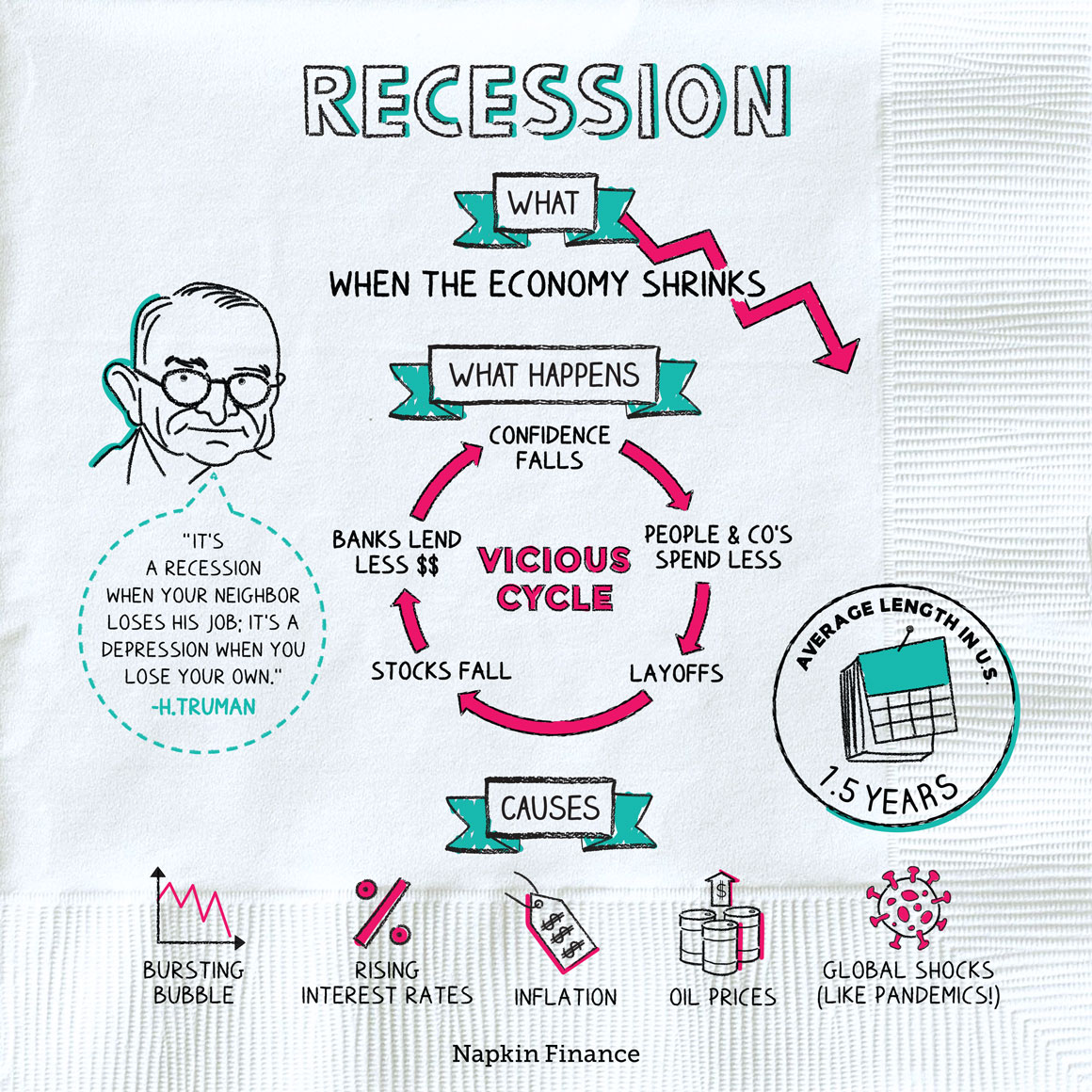

A recession refers to a time when the economy shrinks instead of grows. More specifically, economists typically define it as a time when GDP falls for at least two consecutive quarters.

Recessions are economic downward spirals. Sometimes they can be fairly mild, and the economy (potentially with the help of the government) rights itself after only a few months. Sometimes they can be extreme. Here’s how a recession typically plays out:

- Confidence declines—People and businesses start to worry about the economy. Since they’re worried, they spend less money.

- Profits fall—As people and companies spend less, corporate profits fall or turn into losses.

- Workers lose their jobs—With profits falling, companies try to cut costs. That means layoffs.

- Stocks fall—If companies are earning less money, then their stocks are worth less. Falling stocks compound the problem—people and companies feel less rich (because their investments are worth less), meaning they spend even less money.

- Banks lend less money—With the economy heading south, banks start to worry that loans they make won’t be paid back. Reduced lending also compounds the problem.

Recessions are complicated, and even experts disagree about their exact causes. Some causes that are at least partly to blame may include:

- Bursting bubbles

- If a particular investment shoots way up in price—beyond what it’s truly worth—then it’s called a bubble. When the bubble pops, the investment’s price falls fast and may pull other prices down with it.

- Rising interest rates

- Higher interest rates hit the brakes on the economy.

- Inflation

- Very high inflation makes it hard for the economy to run smoothly.

- Oil prices

- Several historical recessions were at least partly caused by sudden spikes in the price of oil.

- Events out of left field

- In April 2019, no one had the phrase “coronavirus pandemic” on their mind. By April 2020, it had thrown the world economy into a deep recession.

Recessions and depressions are both times of economic decline, but they differ in their severity and timing.

- Recession: A downturn that lasts months or possibly as long as a few years. Often, only one or two industries feel the worst of it. It’s painful but not catastrophic for most people.

- Depression: Starts as a recession but is longer and worse. It touches almost every part of the economy and daily life. It can be economically catastrophic for lots of people.

“A Recession is where you tighten your belt; a Depression is when you haven’t any belt to tighten, and a Panic is when you have lost your pants.“

—Ephraim Enterprise newspaper

Recessions often end with the help of government policies that restore people’s confidence in the economy. For example, when the government lowers interest rates and makes stimulus payments, it can help people and businesses start to spend and borrow money again. That can kick off a positive cycle that restarts the engine of economic growth.

At other times, government policy and improved consumer confidence can only go so far. During the coronavirus pandemic, for example, most economists predicted the fate of the world economy would be tied to the timeline for a vaccine or more effective treatments.

However—no matter how awful they can seem when you’re in the middle of one—recessions in the U.S. have always ultimately ended.

A recession is a period of economic decline. It’s generally defined as a time when economic activity, as measured by GDP, falls for at least two consecutive quarters. During a recession, people typically spend less money, unemployment increases, stocks decline, and banks stop making loans. Recessions can be scary, but many have come and gone throughout U.S. economic history.

- The average length of a recession in the U.S. is about a year and a half.

- More than 500 U.S. banks failed because of the Great Recession of 2007–09. About 7,000 failed during the Great Depression. (That’s why we have FDIC insurance today.)

- A recession is a time when the economy shrinks.

- During a recession, confidence falls, profits fall, incomes fall, and unemployment rises.

- Recessions can be caused by bubbles, inflation, government policy, and left-field events, like the coronavirus pandemic.

- A recession differs from a depression, which is longer and more severe.

- Although a recession can look and feel awful when you’re in the middle of it, U.S. recessions have always eventually ended.