FICO

Score Some Points

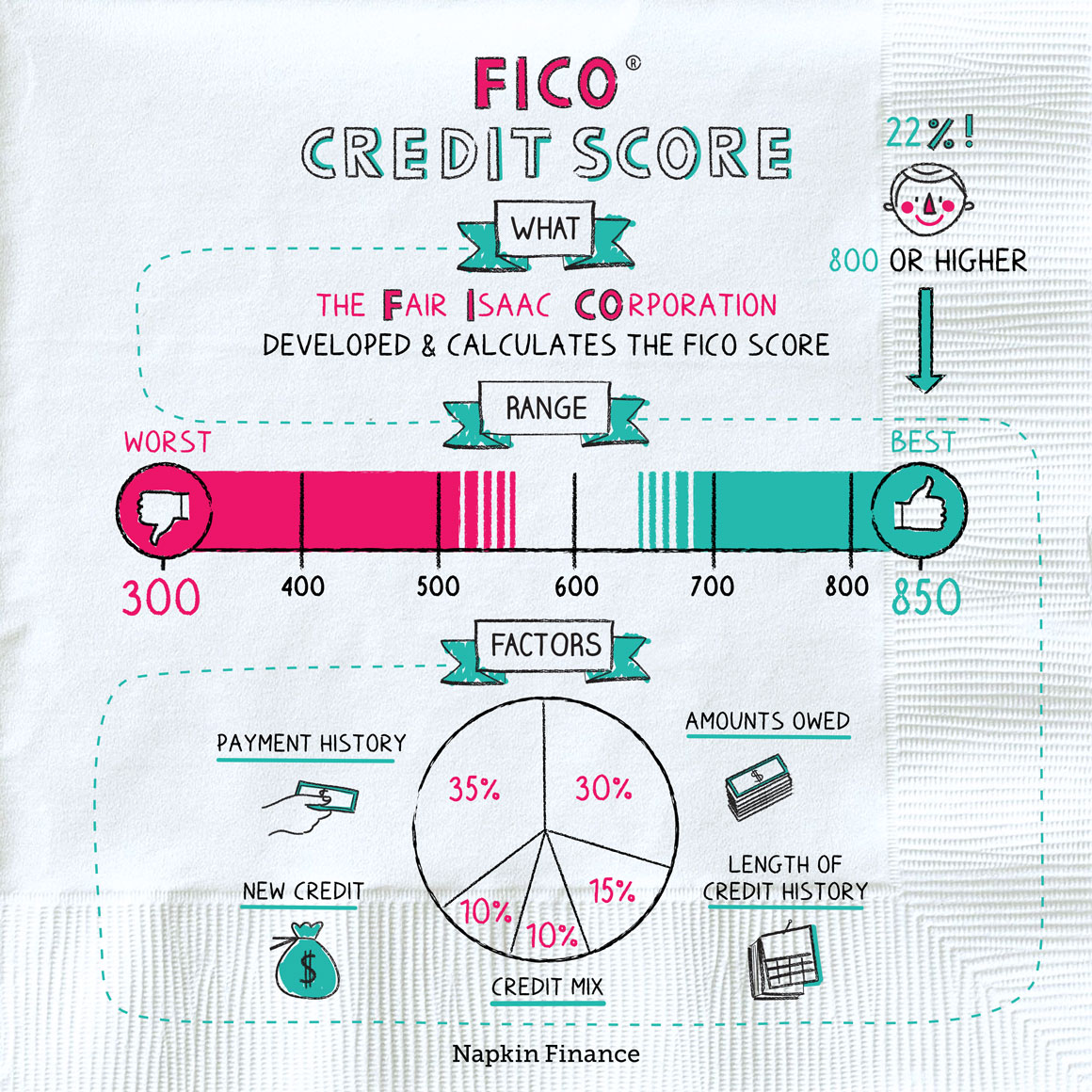

Although you might hear the phrase “your credit score” tossed around, you actually have multiple credit scores—potentially hundreds. Of these, a FICO® score is probably the most common and well known. It’s named for the company that calculates the score: the Fair Isaac Corporation.

Companies use your FICO score when deciding whether to do business with you. Someone might check your score if you’re trying to:

- Take out a loan

- Open a credit card

- Set up utilities

- Rent an apartment

- Buy a cell phone plan

- Get a job

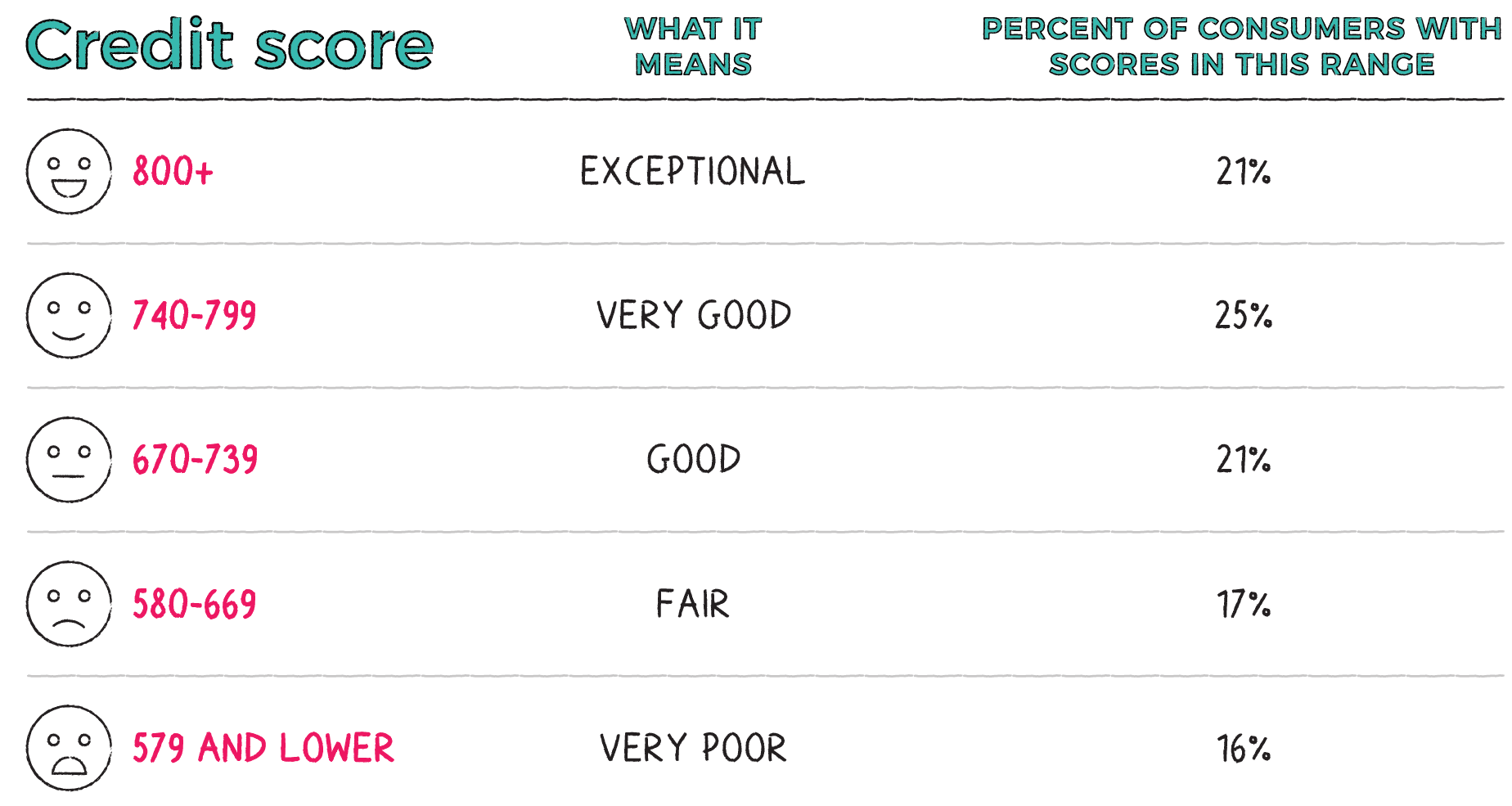

A higher score signals that you’re responsible with your money and you typically pay your bills on time, while a lower score can signal that you’re a habitual payment-misser. Those with high scores usually get lower interest rates on loans and credit cards, while those with poor credit might have trouble getting approved for loans and cards in the first place.

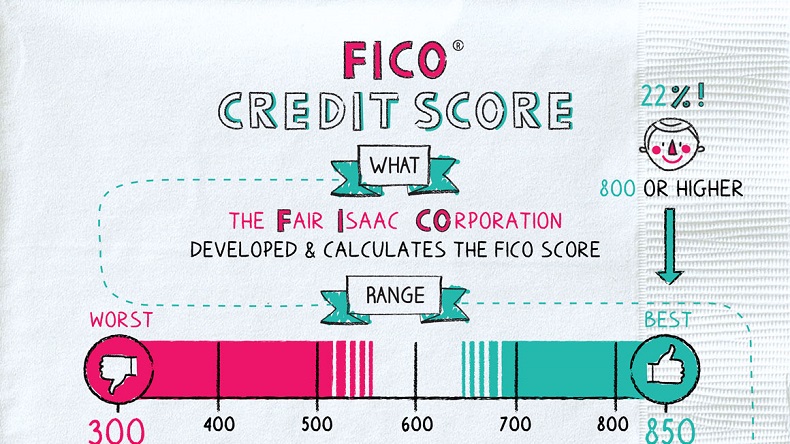

FICO scores can range from 300 to 850—the higher, the better.

There are five main factors that go into your FICO score, and some are more important than others:

| Factor | Weighting in your score | What is it? |

| Payment history | 35% Most important |

Have you made payments on time in the past, or have you missed payments? |

| Amounts owed | 30% Very important |

Do you max out your cards or only use a small portion of your total credit limit? |

| Length of credit history | 15% Less important |

Do you have a long or short credit history? (Longer is better.) |

| New credit | 10% Least important |

Have you applied for 20 new credit cards in the last month, or do you use new credit sparingly? |

| Credit mix | 10% Least important |

Have you only ever managed a credit card, or do you also have a track record with student loans, a mortgage, or other types of loans? |

While FICO scores are the most well-known and prevalent type of credit score, they’re not the only game in town. Some lenders instead use the VantageScore.

Both are a snapshot of all the information included in your credit report. However, there are a few key differences between the two:

- A FICO score requires you to have at least a six-month credit history; VantageScore may create a score for you before the six-month mark.

- Unlike your FICO score, your VantageScore may consider how often you pay your credit card balance in full (as opposed to only making the minimum payment).

- FICO ignores any accounts in collection if your original balance was less than $100, while VantageScore doesn’t.

- Newer FICO models only ding your credit report once when you’re shopping around for certain loans as long as you do all your applying within 45 days. VantageScore gives you only a 14-day window.

The FICO score is one of the most well-known and widely used credit score models. Banks, lenders, and other companies use this number to determine your responsibility when it comes to borrowing and repaying money. Those with higher scores can usually obtain lower interest rates and more financing options, while those with low scores could have difficulty borrowing money.

- It’s not called the “Fair Isaac” company to advertise that the scores are fair. It’s because the company founders’ names were William Fair and Earl Isaac. (And “William-Earl Score” is much less catchy.)

- The “UltraFICO” score is a new type of credit score that considers how much cash you have in the bank. It may be helpful for people with spotty or no credit history.

- A FICO score is probably the most common and well-known type of credit score.

- Companies rely on your credit score to gauge your responsibility when it comes to borrowing money and repaying debts.

- FICO scores can range from 300 to 850. The higher your score, the better.

- The most important factor to your FICO score is whether you have a good record of repaying borrowed money in the past. How much you borrow, the length of your credit history, and other factors also matter.

- FICO’s main competitor is VantageScore, which calculates your credit score somewhat differently.