Loans

Lend a Hand

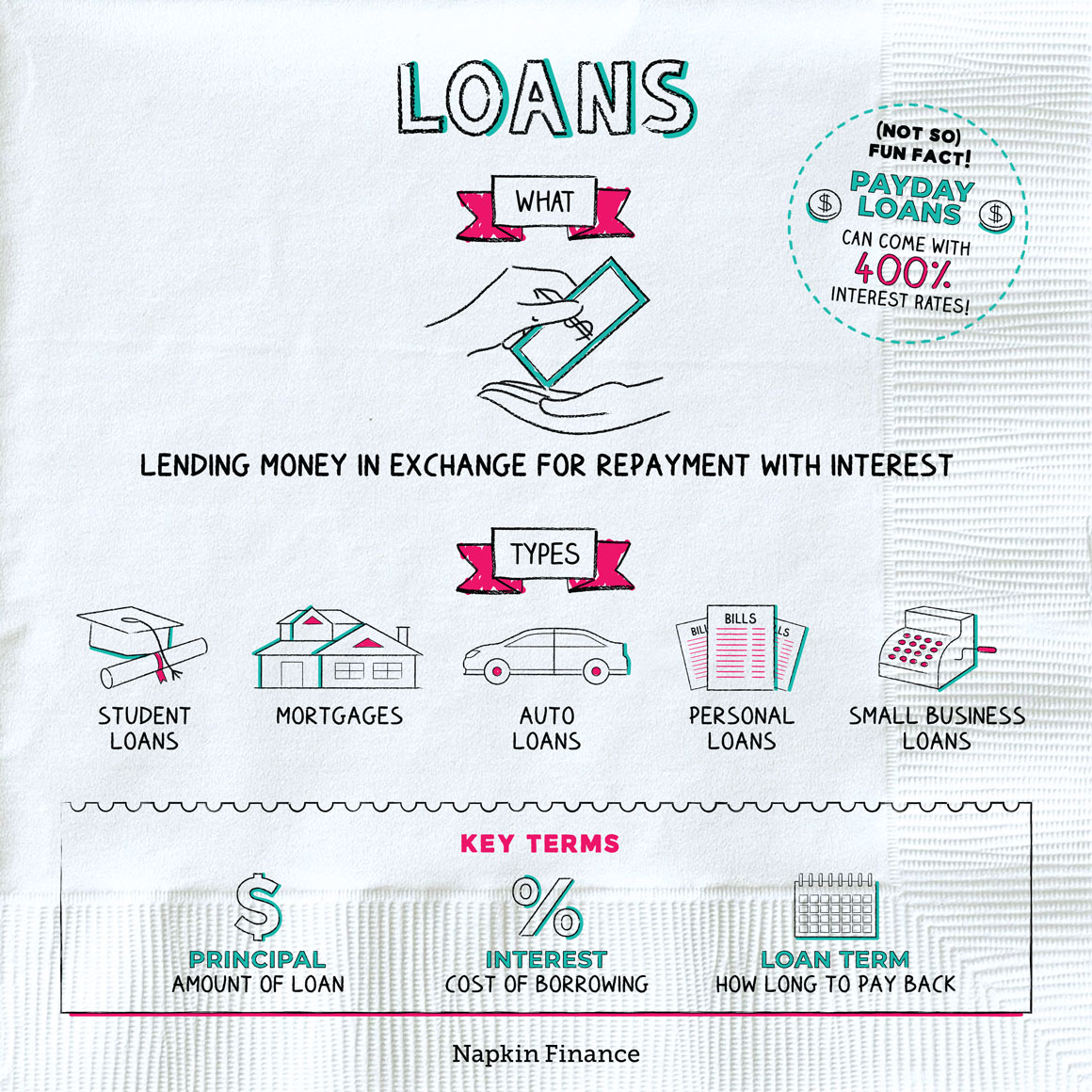

A loan is when someone gives money to someone else in exchange for future repayment of that money, usually with interest.

When you need to borrow money to make a purchase you can’t otherwise afford on your own, the process looks something like this:

You apply for a loan from a lender

(such as a bank or other financial institution)

↓

Lender reviews the application

↓

Lender approves or denies the application

(if denied, the process ends here)

↓

If approved, you and the lender

agree to the loan terms

↓

Lender gives you the loan amount

↓

You use the money to make the purchase

↓

You make regular payments to the lender until the loan is repaid

But banks and other businesses aren’t the only ones that make loans—you could get a loan from a friend or family member. And not all loans involve money. If you check a book out from your library, the library is making you a loan.

Although there are many different kinds of loans, the ones you’ll most commonly encounter include:

| Type | What it is |

| Student loan | Offered to students and their families to help cover the cost of college or grad school |

| Mortgages | Loans to help people buy homes |

| Auto loans | Similar to mortgages, they help people pay for cars |

| Personal loans | May not have a designated purpose; can be used to cover various personal expenses, such as credit card debt |

| Business loans | Given to entrepreneurs or established companies to help them start or expand operations |

Loans can also be divided into two categories depending on whether the lender requires something of value to back the loan (known as “collateral”):

- Secured: Backed by an asset (such as a car or house). If you don’t repay the loan, the lender can take ownership of your collateral.

- Unsecured: Not backed by an asset. If you don’t repay the loan, the lender might send your debt to collections or try taking you to court, but there’s nothing it can easily repossess.

Secured loans are safer for lenders because they can always seize (and sell) your collateral if you don’t pay your loan. So, secured loans typically come with lower interest rates than unsecured loans.

While your parents might be willing to loan you some cash just because they love you, banks don’t feel the same. Instead, they’ll ask for specific information to figure out whether you’re likely to repay what you borrow.

Before making a loan, lenders typically look at your:

- Credit report and score

- Income and current job

- Other outstanding debt

- Assets, such as what’s in your bank account

Some loans also require a down payment or collateral, which the lender also considers when making a decision.

Part of the loan process requires agreeing to a set of terms and conditions. The document you sign will include information on the:

- Principal: This is the loan amount, or how much you’re borrowing.

- Interest: How much the lender charges you to borrow, calculated as a percentage of the principal.

- Loan term: How long you have to pay back the principal and interest.

Your agreement will likely also spell out when payments are due (and the amount of each payment) and any other fees or penalties you could face if you don’t follow the loan agreement.

Loans let people buy things they don’t have the money to cover up front in one lump sum. In return, the borrower agrees to pay back the loan amount, usually with interest, to the lender over a set period of time. People often turn to loans to help them buy a house or car, pay for college, or get a business off the ground.

- So-called “payday loans” are notorious for charging exorbitant interest rates—with a national average rate of around 400%. The loans are essentially cash advances on your own paycheck.

- The concept of loans goes back at least to 2,000 B.C. in Mesopotamia. Farmers could borrow some seeds, plant their crops, and after their harvest repay the loan with more seeds than they borrowed.

- Americans have more than $1 trillion in student loan debt, with the average person owing around $34,000.

- A loan is borrowed money that’s paid back over time. Most lenders also charge interest on the amount borrowed.

- The various types of loans available include those that cover the cost of a college education, house, car, or personal expense.

- Loans are either secured or unsecured. A secured loan requires collateral (like a house or car) that the lender can take if you don’t pay.

- Before approving your loan, a lender might look at your credit history, income, assets, and other debts.

- Your loan agreement will let you know how much you owe, when payments are due, and what fees you could end up owing if you don’t pay on time.