Liability

Much Obliged

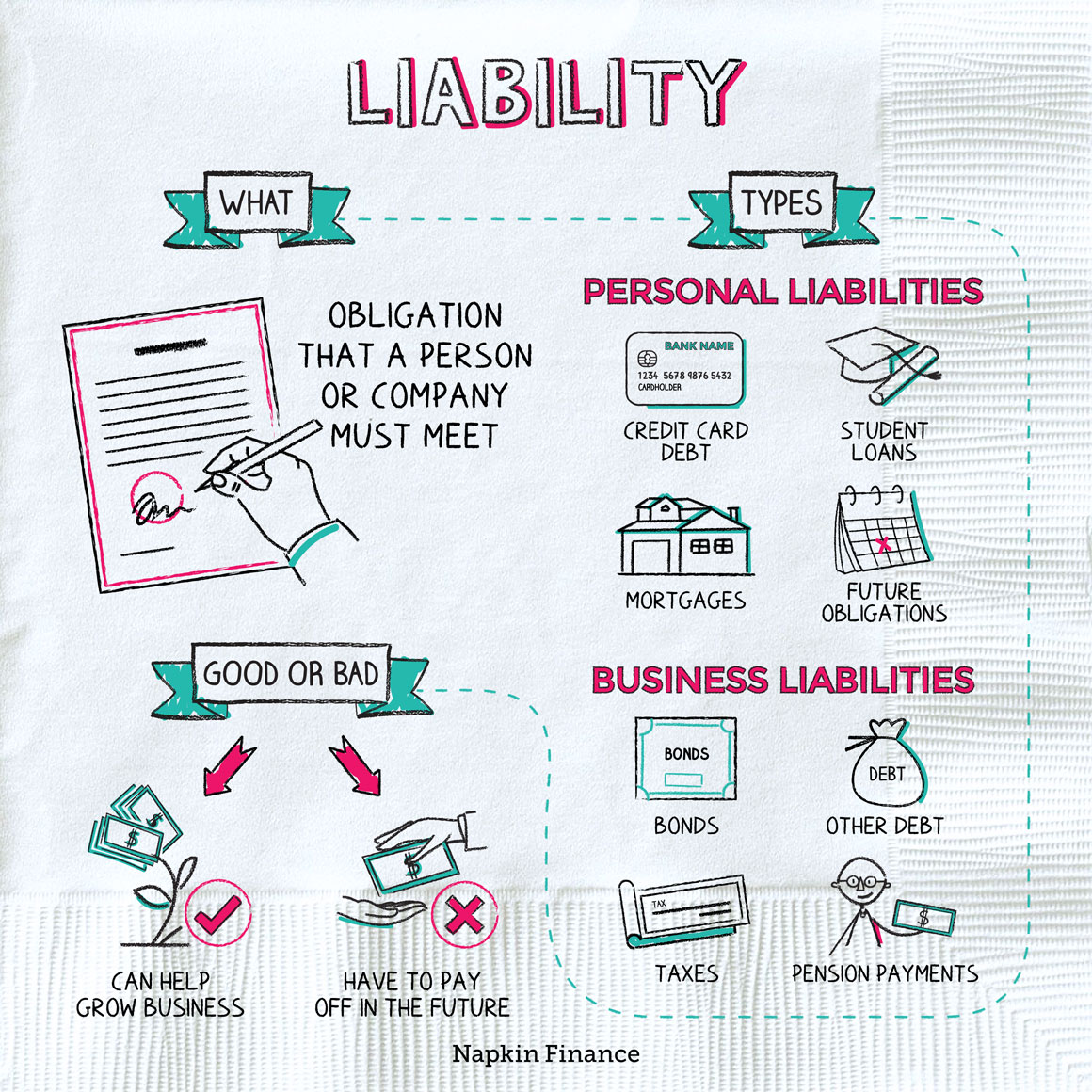

A liability is something that will require you (or a company) to spend money or resources in the future. For example, your student loans are a liability because you have to pay them off.

Companies and people can have a range of liabilities:

| Business | Personal |

|

You can divide liabilities into two categories based on when they’ll come due:

- Current: Usually due within one year

- Long term: Usually due in more than one year

You might also hear about contingent liabilities. These are liabilities that may or may not come to fruition at some point depending on the situation.

For a business, this might include a product warranty. It’s possible a consumer could ask the company to make good on the warranty next week, two years from now, or never. For an individual, a contingent liability could be a loan you cosign for. If the loan holder pays it back, great. If not, you’ll be on the hook for it.

If you open your wallet, look at your bank account, or marvel at your house, you might feel pretty good moneywise. Unfortunately, these assets don’t give you the bigger picture on how you’re doing financially.

To figure that out, you need to compare your assets with your liabilities. One way to do this is with a balance sheet, which is basically a snapshot of financial health.

- A personal balance sheet can tell you your net worth, whether you’re on track to meet your financial goals or get out of debt, and whether you have enough cash on hand for any potential emergencies.

- A business’s balance sheet tells investors and corporate leadership if the company’s debt load is manageable, what bills it has coming due soon, and what the company might be worth.

Although the word “liability” sounds bad (like the way your cranky uncle is a liability at the Thanksgiving dinner table), taking on liabilities can be helpful. If you take on student loans so you can go to college, there’s a good chance you’ll end up earning more money as a result.

If a company takes on debt to grow its businesses, it can end up financially stronger. And if the company has liabilities because it owes taxes on its profits or it owes money to its employees because business has been booming, then those liabilities aren’t necessarily bad things.

Liabilities can help predict outflows of money in the future—but on their own, higher liabilities aren’t necessarily good or bad.

A liability is something you or a company will need to spend money on in the future. For people, this might mean loans or credit card payments, while for a business it might include payroll or supplier payments. Liabilities aren’t always bad and can actually support the long-term earning potential of a person or business.

- Receiving money can create a liability. If a company is paid in advance, it has to create a liability for unearned revenue (since it owes the customer something).

- One classic accounting shenanigan is when a company creates a separate legal entity to buy its bad assets or take on extra debt on its behalf. If the new entity is legally distinct, the parent company may not have to share details in its financial statements. (We’re looking at you, Enron.)

- A liability is something that you or another person or company will have to spend money or effort on in the future.

- Any kind of debt generally counts as a liability and so can promises of future services.

- Liabilities can be short term or long term in nature. Some liabilities are certain, while others are contingent, which means they may or may not come due.

- People and companies can track liabilities on a balance sheet along with assets to see their overall financial shape at a given moment in time.

- Although liabilities can represent owed money, higher liabilities aren’t necessarily a bad thing.