Valuing a Company

What’s it Worth?

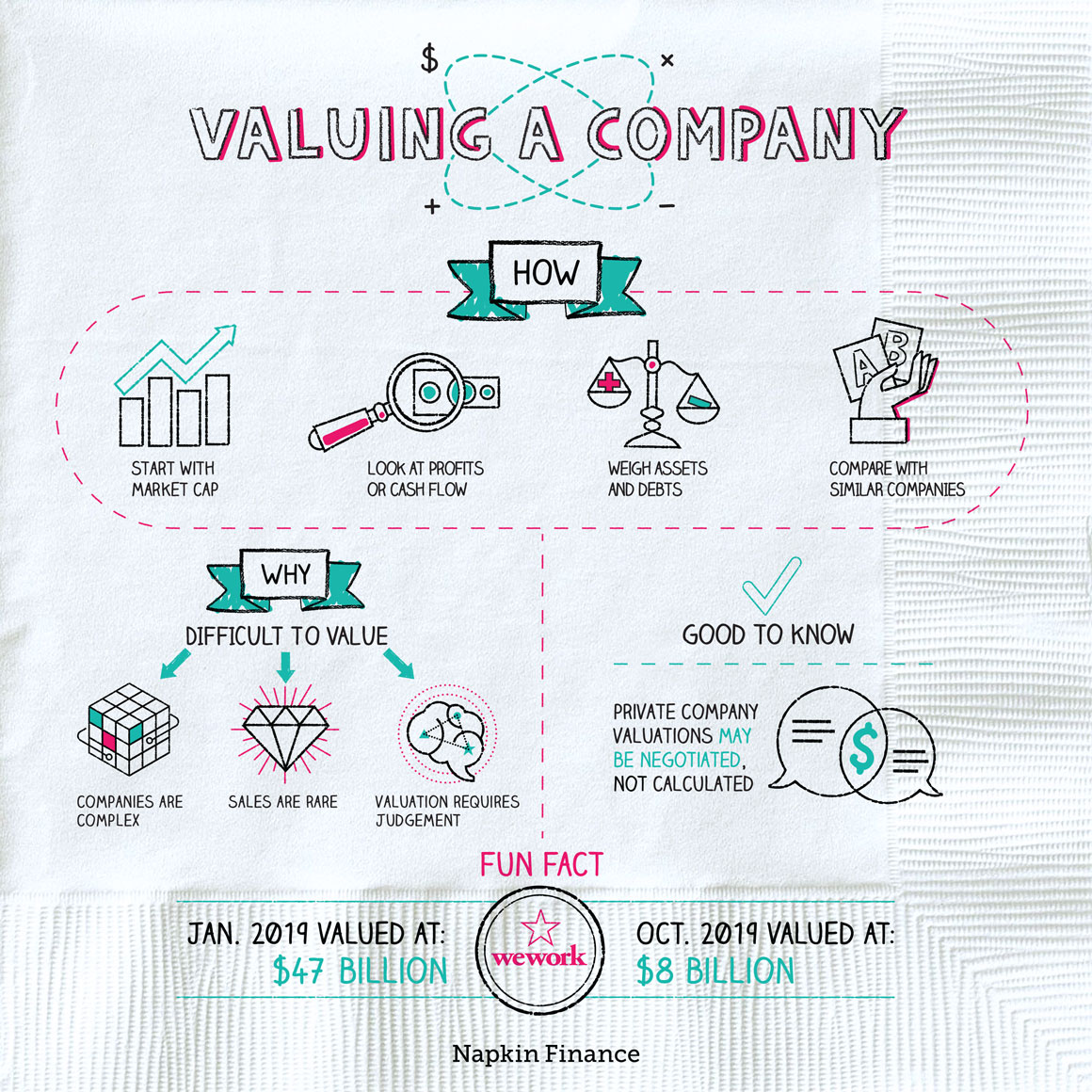

A company’s value is the dollar figure that it might sell for if a person or another company decided to purchase the whole thing.

Company valuations are more subjective and less hard and fast than other types of valuations.

Compared with, say, a barrel of oil or one share of Facebook stock or a new car—in which case you can look up prices (or price ranges) online—company valuations can be pretty squishy.

That’s because:

- Companies are complex.

- Coming up with a value may mean considering the land the company owns, its intellectual property, its debts, its future profits, and more.

- Valuing one requires judgment.

- If you think the economy is about to go into a recession, then you’ll expect the company’s profits to be lower. In that case, the company will be worth less.

- If you think the economy will keep on roaring, then you’ll estimate higher future profits. In that case, the company will be worth more.

- They don’t trade often.

- The process of buying and selling something helps set what it’s worth. But it’s rare for a whole company to change hands.

There are many ways to value a company. Experts can disagree on which is the right way—and it’s possible for one method to be better suited in one situation but another to be better in a different context. Here are a few ways:

- Start with share price

- Publicly traded companies—meaning ones with shares that trade on an exchange—have a readily available share price, which can be used as a starting point for valuing the whole company.

- Look at profits or cash flow

- Analysts may estimate what a company’s profits will be for the next five, ten, or twenty years—then decide what they think those future profits are worth today.

- Some investors and analysts prefer to focus on cash flow instead of profits.

- Look at assets and debts

- Adding up everything the company owns and subtracting what it owes can give a low-ball estimate for a company’s value.

- This method can make sense for companies that are nearing bankruptcy.

- Compare with similar companies

- The valuation of similar companies that have recently been sold can be a starting point or a sanity check for a particular company’s valuation.

For publicly traded companies, when you hear about a company being “valued at” a certain figure in the news, you’re usually hearing about market capitalization. That’s equal to the company’s share price multiplied by its total number of outstanding shares and is a quick-and-dirty way of valuing a whole company. (A newly high valuation just means the company’s stock price has gone up.)

For private companies, any figure you hear about in the news is probably one that’s been negotiated between the company itself and an investor. These negotiations can happen when an investor is taking on an ownership stake or buying the company outright. Here’s how it works:

Suppose an investor wants to put

$1 million into your kombucha startup

↓

If the company is only worth $5 million,

then the investor’s stake will be worth 20%

(and you’ll own only 80%)

↓

If the company is worth $10 million,

then the investor’s stake will be worth only 10%

(and you’ll own 90%)

↓

You both want to own a bigger percentage,

so you’ll negotiate and agree on a valuation

Company valuations can affect:

| What | How |

| Investors’ returns | Share prices are directly connected to a company’s value. Higher value = bigger returns. |

| Company transactions | A company’s value may affect its ability to raise money, buy other companies, or sell itself. |

| Employees’ compensation | If employees receive stock, a company’s value directly affects their compensation. |

| Owners’ net worth | Kylie Jenner is only “worth” $1 billion because people have estimated how much her company, Kylie Cosmetics, is worth. |

| Overall economy | When company valuations are rising, investors and owners feel richer, and the economy does better. The reverse can happen when valuations fall. |

Like the value of anything, a company’s value represents what someone might pay for it. Sometimes a company’s valuation rests on elaborate number crunching, while in other cases it may rest on a handshake.

- Although founders usually want their companies to be valued as highly as they can be, too high can be bad. Just ask WeWork. It was valued at $47 billion in early 2019 in anticipation of an IPO. But when investors started questioning that sky-high number, they also started questioning its whole business model. The company almost went bankrupt in the aftermath. By later that same year it was valued at only $8 billion.

- Apple was the first company to reach a $1 trillion valuation. Microsoft caught up shortly afterward, and the companies have been neck-and-neck for the number-one spot ever since.

- Microsoft raised eyebrows in 2007 when it made an investment in Facebook that valued the social network at $15 billion (only the year before, it had been valued at $550 million).These days Facebook is worth more than $500 billion.

- Companies that brand themselves as “tech companies” tend to have higher valuations. (Even if they’re really kombucha companies.)

- A company’s valuation is an estimate of what it might sell for.

- Valuing companies is trickier than valuing, say, your 2012 Kia, because doing so rests on complex calculations and judgment calls.

- Companies are generally valued by looking at financial metrics, such as profits, cash flow, share price, assets, and liabilities.

- However, the private company valuations you read about in the news are often negotiated figures rather than the result of a single precise calculation.

- A company’s value can affect its ability to raise money and do business, and also affects the income and net worth of its investors and other owners.