Fixed vs. Variable Costs

At All Costs

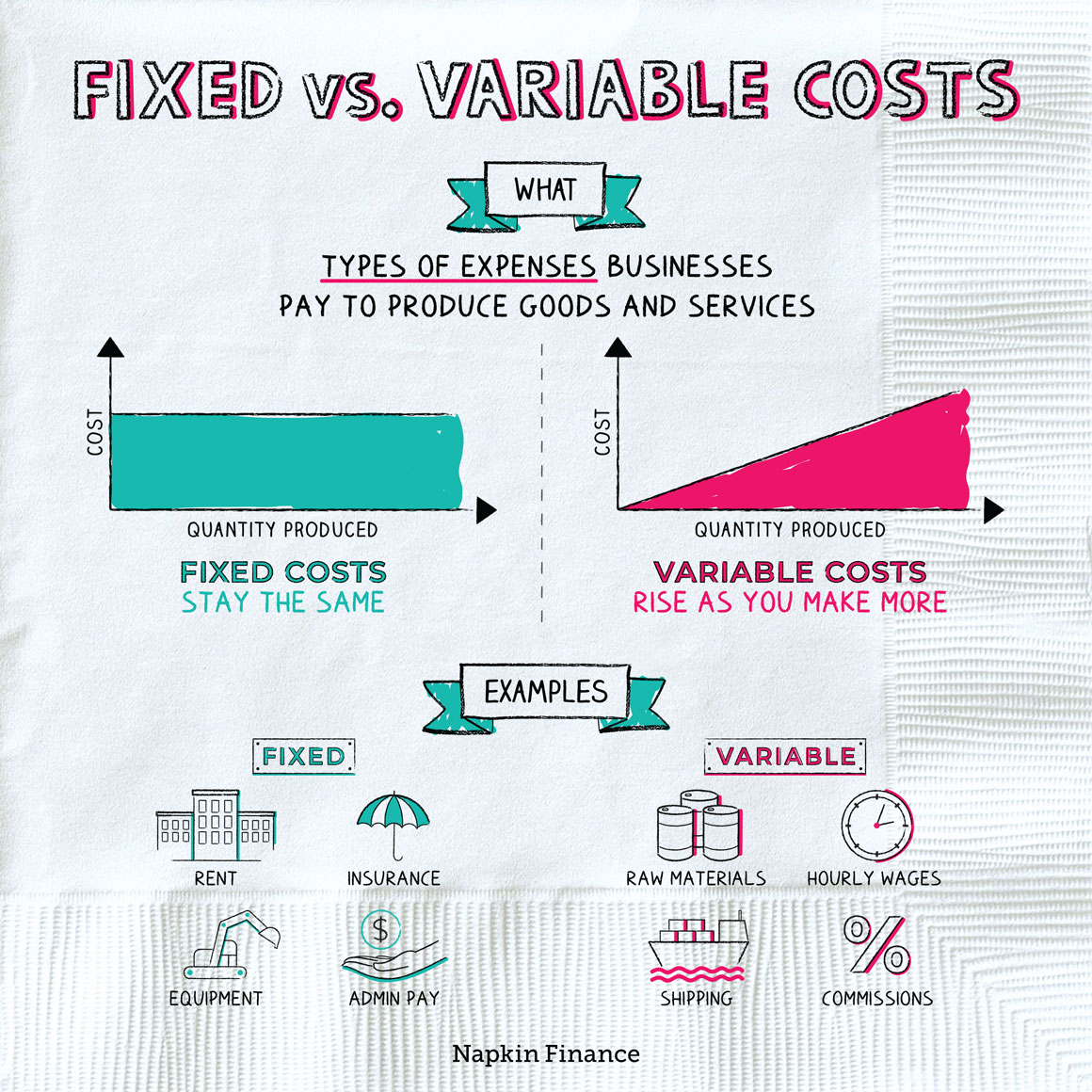

Fixed and variable costs are types of expenses that businesses pay in order to operate.

The difference between fixed and variable costs is simple:

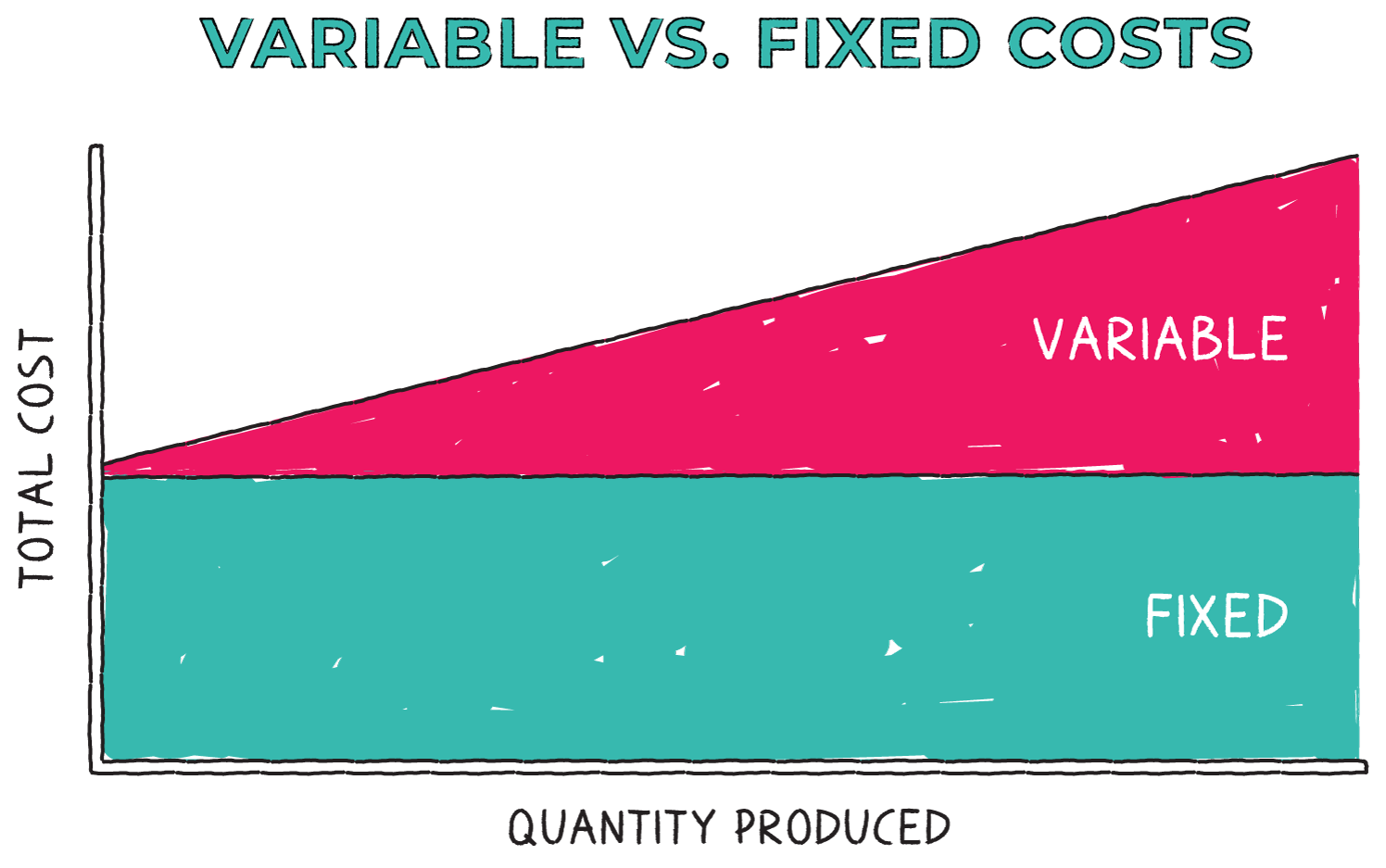

- Fixed costs remain the same no matter how much the business produces.

- Variable costs change with output—rising as a business makes more stuff or provides more services.

Let’s say you own a cupcake bakery. If you sell 200 cupcakes a day, you’ll need to buy a lot more flour and sugar and maybe even hire more bakers than you will if you only sell 20 cupcakes a day. But you need to pay monthly rent and other bills no matter how many cupcakes you sell.

Let’s say you own a cupcake bakery. If you sell 200 cupcakes a day, you’ll need to buy a lot more flour and sugar and maybe even hire more bakers than you will if you only sell 20 cupcakes a day. But you need to pay monthly rent and other bills no matter how many cupcakes you sell.

That’s why your rent would be considered a fixed cost, while ingredients and your bakers’ wages would be considered variable costs.

Here are some common examples of fixed vs. variable costs:

| Fixed costs | Variable costs |

| Rent payments or property tax | Raw goods and inputs |

| Salaries for people who run the company (e.g., executives, administrative staff) | Wages for employees involved in production, like assembly-line workers |

| Insurance premiums | Shipping and delivery costs |

| Loan payments | Sales commissions |

| Equipment depreciation | Employee bonuses |

How you classify some expenses, like utilities and taxes, can change with the situation. An accounting firm, for example, may have relatively steady utility costs—whether it’s processing 100 or 1,000 tax returns. A manufacturing company’s gas and electricity bills, by contrast, may rise when its factories produce more stuff and fall when they produce less.

In order to turn a profit, companies have to cover all their expenses—whether fixed or variable. The higher a business’s fixed and variable costs, the lower its profits (aka net income) will be. And a lower net income means a smaller profit margin (the percentage of every dollar of sales a company keeps).

Fixed and variable costs also affect the break-even point. That’s the point at which a company’s revenue and expenses are equal, meaning it isn’t earning a profit or losing money. Businesses with higher fixed costs generally have higher break-even points, meaning they have to make and sell more stuff in order to turn a profit (and survive).

Considering fixed and variable costs can help business owners find expenses that are too high or look for ways to boost their income and profits. Some ways to reduce fixed and variable costs can include:

| Fixed costs | Variable costs |

| Relocating to a cheaper area | Using cheaper inputs |

| Laying off administrative or managerial staff | Cutting salaries for hourly workers |

| Refinancing loans or reshopping insurance | Outsourcing part of the production process |

Think back to the cupcake bakery. If you, as the owner, see that your profits are falling or you’re not breaking even, you might decide to reduce your fixed costs by moving to a smaller storefront. Or you might target your variable costs by reducing your bakers’ pay or using cheaper ingredients.

Fixed and variable costs are the two main types of expenses that companies must pay in the course of doing business. While variable costs rise and fall based on how many goods and services a business produces, fixed costs generally stay the same. Both types of expenses are important drivers of a company’s income and profitability.

- Online businesses with no physical inventory, such as companies that only sell downloadable software, have very low fixed costs—often just the cost of maintaining a website.

- Companies with lots of equipment or large factories have much more significant fixed costs. An auto manufacturer, for example, would have huge fixed costs due to the space, factory equipment, and inventory storage required.

- Fixed costs are business expenses that don’t change, like rent or insurance. Variable costs rise and fall with how much a business produces.

- Whether a given cost is classified as fixed or variable may depend on the business. Utilities might be considered a fixed cost for a retail store but a variable cost for a manufacturing plant.

- As a company’s fixed and variable costs go up, its income and profitability go down. Higher costs also affect how many products or services a company needs to sell to break even.

- Analyzing their fixed and variable costs can help companies identify expenses to trim in order to become more profitable.