Debt

It All Adds Up

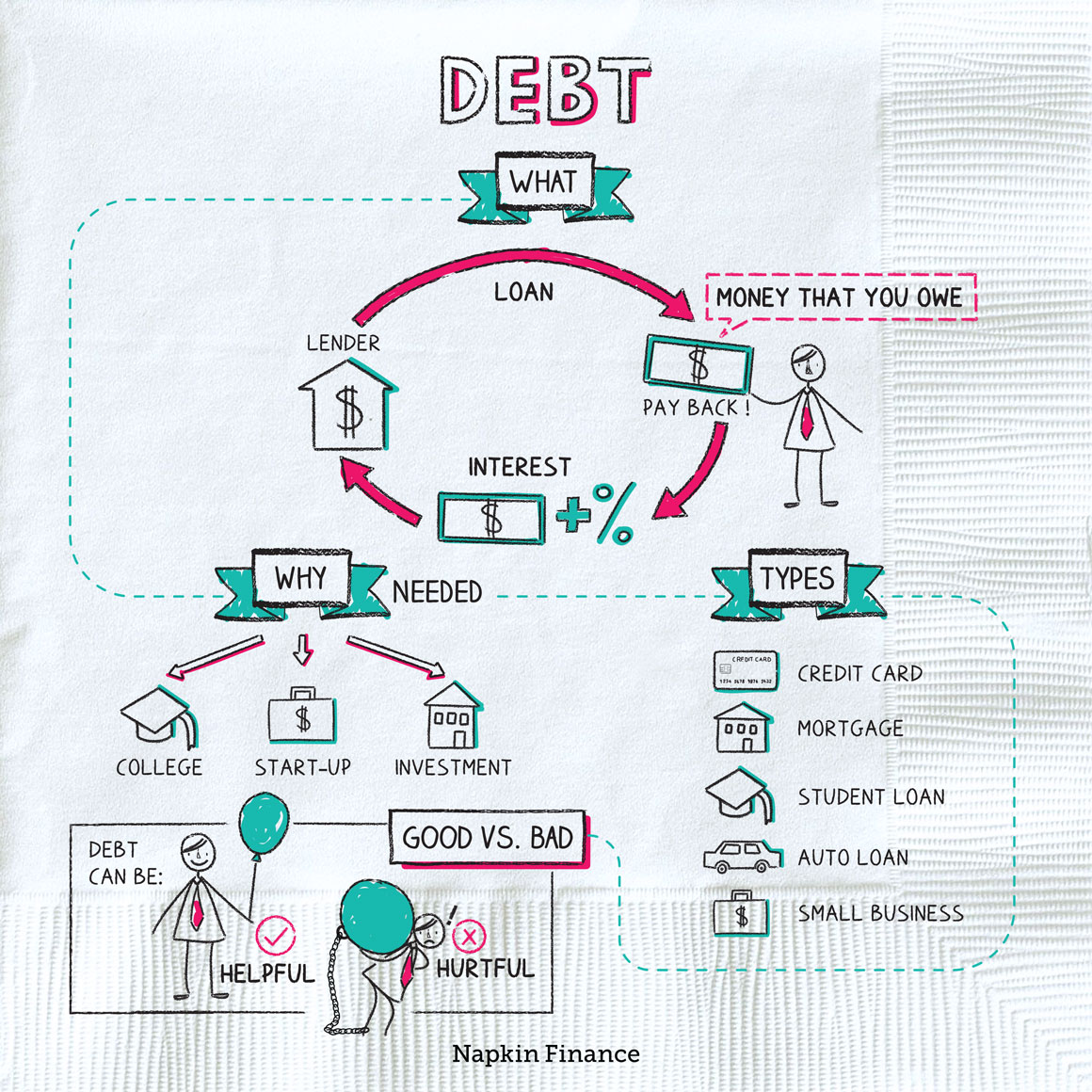

Debt is money that you owe to another person or a financial institution.

When you borrow money, you typically agree to pay it back over a certain period of time—called the loan’s term. And you usually have to pay interest in addition to the original amount you borrowed.

You may use several types of debt at different points in your life. Some of the most common types include:

- Credit card—Any time you pay with a credit card, you are borrowing money. When you pay down your balance, you are paying off the debt.

- Mortgage—A mortgage is a loan to buy real estate. A typical mortgage is paid back over a 15- or 30-year period.

- Student loan—You may take on student loans to pay for undergraduate or graduate school.

- Auto loan—An auto loan can help you buy a car.

- Small business—Companies borrow money too. Small-business loans can help new companies get off the ground.

You can also categorize debt as secured or unsecured. Secured debt means you have agreed to use some asset—such as your home or car—as collateral for the loan. If you don’t repay your debt in a timely manner, the lender can take that asset from you and sell it to make up for any money you still owe.

Unsecured debt doesn’t involve collateral, but there are still consequences if you don’t pay what you owe: The lender could sue, or it might send your bill to a debt collector.

“If you think nobody cares if you’re alive, try missing a couple of car payments.“

—Earl Wilson

While you should always be careful about borrowing money, in some cases taking on debt today can help put you in a better financial position in the future (as long as you can afford to pay it back on time).

Businesses, for example, often take on debt so that they can develop a new product, open additional locations, or invest in new technology—all with the goal of growing future profits.

Whether a given debt is considered “good” or “bad” generally depends on the interest rate and whether you’re taking on the debt in order to make a smart investment.

| Mortgage | Federal student loans | Credit card debt | |

| Good or bad? | Good | Good | Bad |

| Interest rate | Low | Low | High |

| Smart investment? | Yes.

There’s a good chance your home will rise in value. Owning your own home can make you more financially secure. |

Yes.

A college education increases your earning power over the rest of your life. |

No.

That five-star prix fixe brunch you splurged on was amazing, but it won’t pay any dividends. |

In most cases, you agree to a set of repayment terms when you first take on a new loan. These terms include how much you borrowed, how long you have to repay, when your payments are due, minimum payment amounts, and your interest rate.

Credit cards and other types of revolving debt are different. In these cases, there’s no deadline for paying off the whole amount, but you have to make a minimum monthly payment to avoid additional charges.

When reviewing these agreements, you’ll see that the interest charged on your debt is shown in two ways. Both numbers are expressed as percentages but mean different things:

- Interest rate—This number tells you how much it costs to borrow the principal amount.

- Annual percentage rate (APR)—An annual figure that includes interest but also other costs or fees associated with your loan.

If you wanted to borrow $200,000 to buy a house and your interest rate was 6%, your APR might be 6.15% after accounting for closing costs and the lender’s fees. Knowing both numbers can help you comparison shop and better understand whether you can afford a particular loan.

Although debt can sometimes be helpful, it can also pile up quickly—particularly if it’s racking up interest at a high rate. If you don’t pay off your credit card balances, for example, you’ll accrue interest charges each month, plus any new debt you take on will start accruing interest too.

Taking on an unmanageable amount of debt can also put you at risk of wrecking your credit score—which can have long-lasting impacts on your finances. That’s why you should always be cautious about taking on new debt (even “good” debt).

Chances are you’ll take on debt at many different points and for many different purposes in your life. In some cases, taking on debt can benefit you in the long run. Be careful, however, about taking on more than you can handle. Shop around for the best interest rates and always have a realistic plan in place for paying it off

- American households carry more than $13 trillion in debt, including $9 trillion in mortgages, more than $1.5 trillion in student loans, and $1.2 trillion in auto loans.

- Twelve years is how long it would take for the average U.S. household that carries credit card debt to pay off its balance by making only the minimum payments.

- The last time the U.S. government did not have a national debt was in 1835. This debt-free period lasted for only one year.

- Debt is borrowed money that must be repaid, usually with interest.

- Chances are that at some point in your life you’ll take on debt, such as student loans, credit card debt, or a mortgage.

- Whether debt is considered “good” or “bad” depends on whether it comes with a low or high interest rate and whether or not you’re borrowing the money to make a good investment.