Hedge Funds

Hedge Your Bets

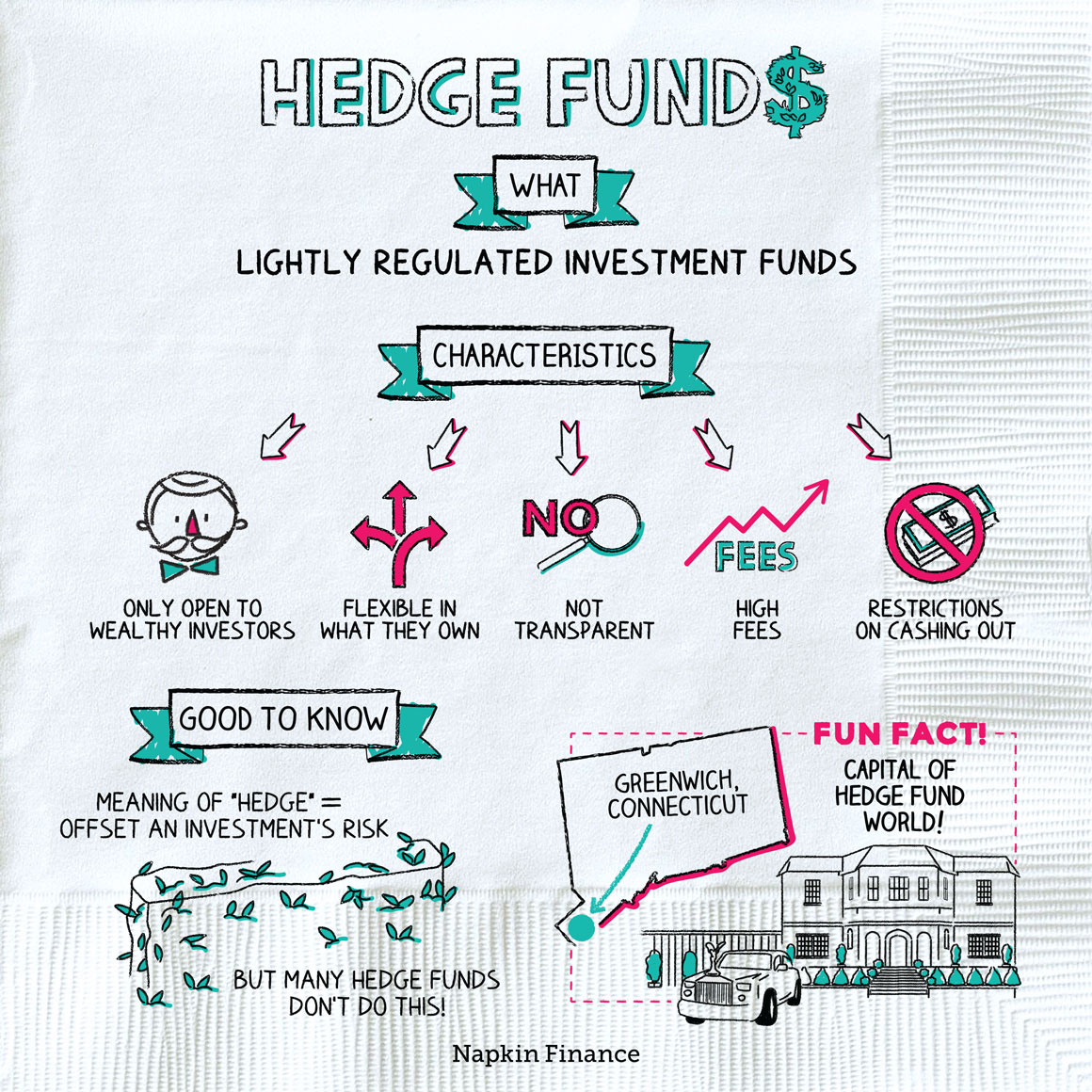

Hedge funds are investment funds that pool many investors’ money and then hire one or more professional managers to buy and sell specific investments.

Although that basic structure is a lot like that of mutual funds, unlike mutual funds, hedge funds are lightly regulated and often high risk. You can think of them as like mutual funds on steroids.

The main thing that hedge funds and mutual funds have in common is that (not surprisingly) both are funds. Their differences, however, are many:

| Hedge funds | Mutual funds | |

| Who can invest? | Only the wealthy (regulators set a certain minimum level of assets or income). | Anyone. |

| What can they invest in? | Almost anything—from traditional stocks and bonds to derivatives to life insurance contracts. | There are strict legal limits on what they can invest in, and most stick to vanilla stocks and bonds. |

| Do you know what your fund owns? | Not necessarily. Hedge funds don’t have to tell investors (or the government) much about what they’re investing in. | Yes. Mutual funds have to file periodic reports in which they detail every single investment that they own. |

| How expensive are they? | Very. A typical fee structure is 2% of all money invested plus 20% of profits. | Moderately. The average fee for mutual funds is about 0.5% of assets per year. |

| Is it easy to exit a fund? | No. There are generally strict restrictions on when investors can (and can’t) withdraw their money. | Yes. Investors can generally sell mutual fund shares on any day the market’s open. |

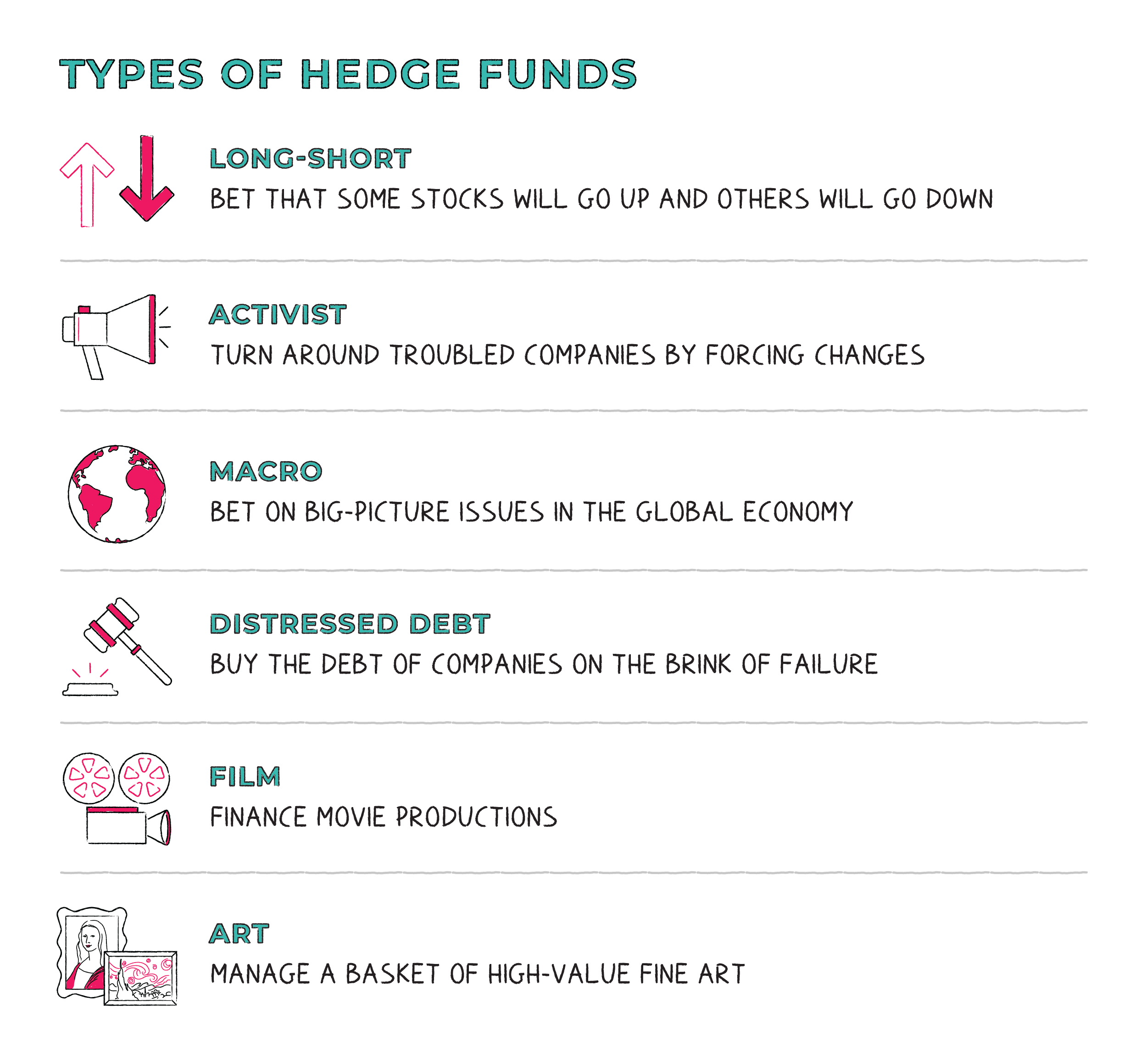

The many flavors of hedge funds can include:

“A hedge fund is a fee structure in search of a strategy.“

—Unknown

With high fees and high risk, you might wonder why anyone would choose hedge funds over other types of funds. It generally comes down to two potential benefits:

- The chance of higher returns.

- Because of their aggressive approaches and because looser regulations give them more leeway to boost returns, hedge funds have the potential to generate much higher returns than other funds.

- The need for diversification.

- Investors are always on the hunt for investments that don’t move in lockstep with traditional stocks and bonds (particularly for investments that may rise when stocks or bonds are falling). Because they can invest further afield, hedge funds can have an easier time delivering those types of returns than mutual funds or other mainstream investments.

Given the barriers to entry for the average person, hedge fund investors typically include:

- Pension funds

- Foundations

- University endowments

- Family offices (a private company that handles investments for a very well-to-do family)

- Wealthy people

Hedge funds are pooled investment funds managed by a professional who pools investors’ money. They can invest in traditional stocks and bonds but also in riskier alternatives, like derivatives and commodities. They can be a good investment opportunity for people willing to take on greater risk for the potential of greater rewards, but they typically come with high fees.

- The word “hedge” has a specific meaning in investing—it means to reduce risk by making an investment that offsets the risk of another investment. A common misconception is that hedge funds engage in hedging. Some do, but plenty don’t.

- At one point in time, Bernie Madoff’s hedge fund was thought to be the largest in the world.

- Just like Silicon Valley is the capital of the tech world, Greenwich, Connecticut, is the capital of the hedge fund world.

- Hedge funds are professionally managed funds that pool investors’ money, like mutual funds.

- Unlike mutual funds, hedge funds generally charge high fees, offer limited disclosures to investors, and may restrict when investors can withdraw their money.

- Although hedge funds can follow many different types of investment strategies, they tend to be a high-risk investment option.

- Because of their higher risk, hedge funds are typically only available to wealthy investors and institutions, like university endowments and pension funds.

- The main potential benefits for those who do invest are the chance at higher returns and the opportunity for diversification.