Building Credit

Bit by Bit

Credit is money that’s available to you to borrow whether through a credit card, mortgage, car loan, or other type of loan.

Most people need some amount of credit in order to lead their lives—like when it comes to getting a house or an apartment, getting a cell phone contract, or just paying for life’s daily expenses.

But it can be hard to access, especially if you’re just starting out. To get approved for credit, you need to already have a credit history. But to build your credit history, you need credit.

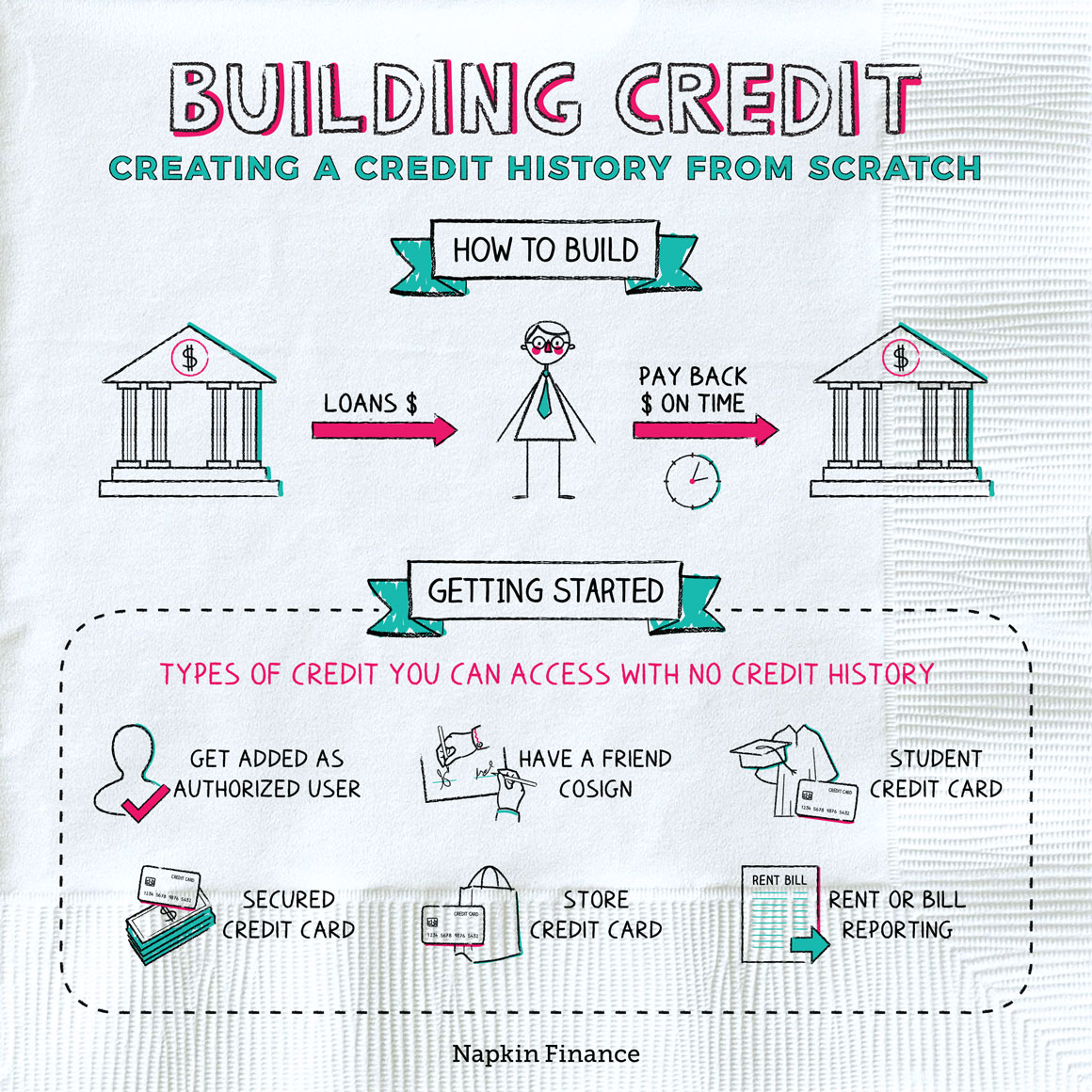

Even if you’re completely new to credit and have no credit history at all, you should still have some options to start building that solid track record. Here’s how:

- Ask a friend or family member to make you an authorized user on their account.

- Have a friend or family member with a longer credit history cosign for your loan or credit card.

- Consider a student credit card. They often have low credit limits but tend to be easier to get.

- Get a secured card from your bank. Like a debit card, you deposit money and can spend up to that amount.

- Apply for a credit card from a specific store or gas station.

If these don’t appeal to you or you aren’t ready to take on debt, another option is to ask your landlord or other service providers about reporting your bill payments to the credit bureaus. That way, when you pay your bills on time, you’ll also be building your credit history.

There are a lot of options out there for building credit. But you don’t want to apply for them all at once because submitting lots of applications is a red flag for lenders. Instead, find the one or two that make the most sense for you. Consider:

- Fees and interest rates

- Whether you can consistently make the required minimum payment

- If the credit limit or loan amount fits your needs

- How you’ll use the loan or credit card

- If you can use your new credit responsibly (a store credit card isn’t an excuse to go on a spending spree)

When you apply for credit, it’s recorded on your credit report. So are all of your on-time (or late) payments. Think of your credit report as like a record of your borrowing habits.

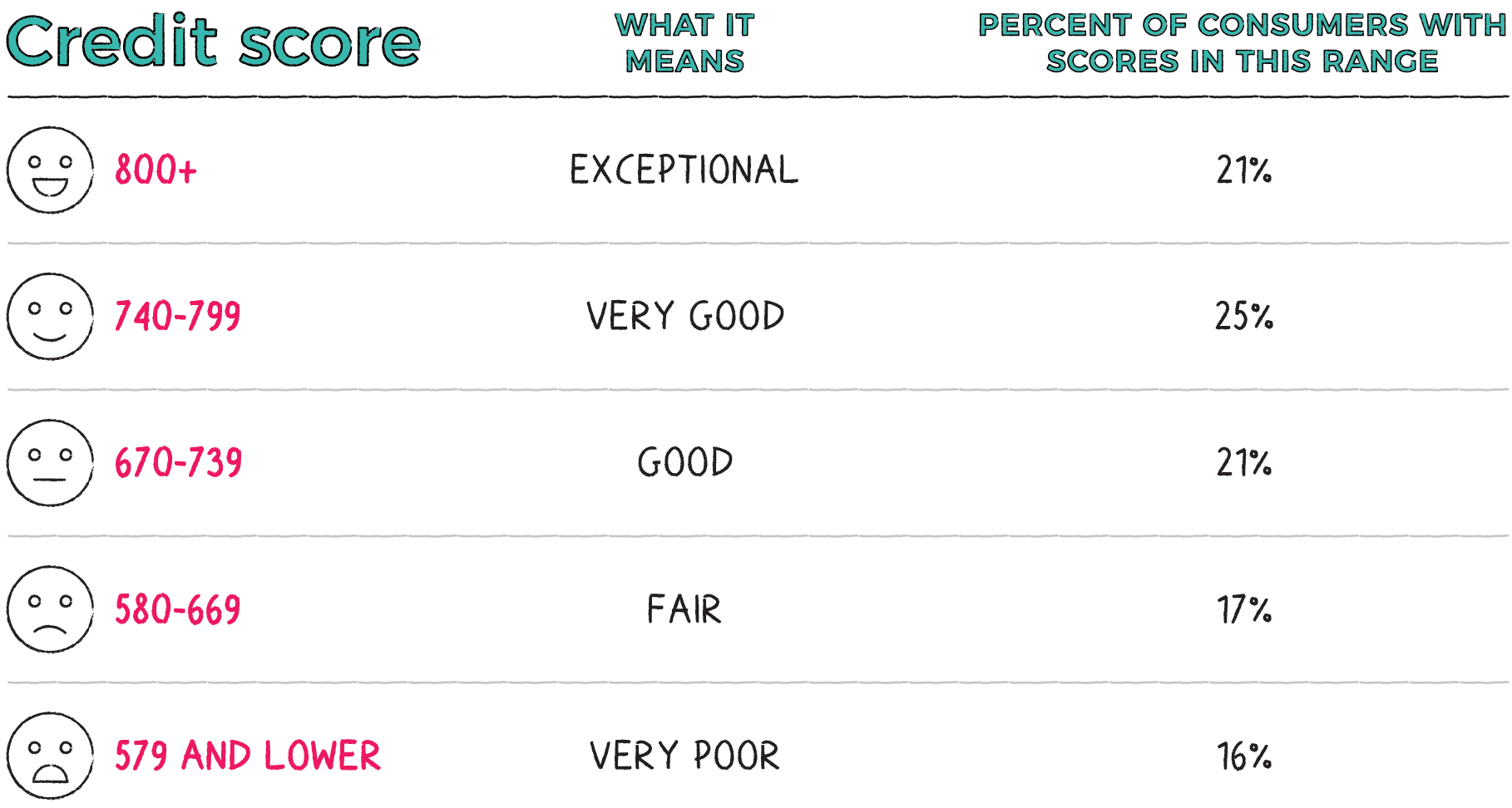

All of the information in your credit report is condensed and used to calculate your credit score. This number, which ranges from 300 to 850, is a snapshot for lenders who want to know how likely you are to pay back a loan or credit card balance. The higher the score, the easier it will be to get credit with a good interest rate and low fees.

A lender, landlord, cell phone provider, rental car agency, or employer might take a peek at your credit report or score before deciding to do business with you. This is how they gauge your responsibility.

It’s not enough to just build your credit—you want to build good credit. A good credit score makes it easier for you to get loans, open new cards, and access low interest rates. You can do this by:

- Only applying for new credit cards when you need them

- Paying all your bills on time

- Keeping the balances on your credit cards low

- Not using all your available credit

- Keeping your credit cards open even if you don’t use them much

- Checking your credit report and score regularly to keep tabs on yourself and make sure nothing looks fraudulent

“You cannot escape the responsibility of tomorrow by evading it today.“

—Abraham Lincoln

Credit is a necessary part of most people’s finances, but it can be hard to build from scratch. It’s important to build good credit by making timely payments and applying for credit sparingly. These factors impact your credit report and score, which lenders can use in the future when deciding whether to work with you.

- The closer your credit score is to your partner’s, the longer you’re likely to stay married (at least according to the Federal Reserve).

- The Land of 10,000 Lakes is also the land of good credit. Minnesota consistently has the nation’s highest average credit score at more than 700.

- It’s a Scottish tradition for homeowners to paint their doors red when they pay off their mortgages.

- Credit lets you borrow money to buy what you need and then pay it back at a later time.

- Building credit for the first time can be tough, but there are options available, including secured, cosigned, and store credit cards.

- What you borrow and repay is reflected on your credit report. Your credit score is a snapshot of that report. The higher, the better!

- Repaying the money you borrow on time can increase your credit score, while forgetting to pay or applying for too much credit hurts it.

- When you build credit, make sure you do it responsibly to protect your credit score.