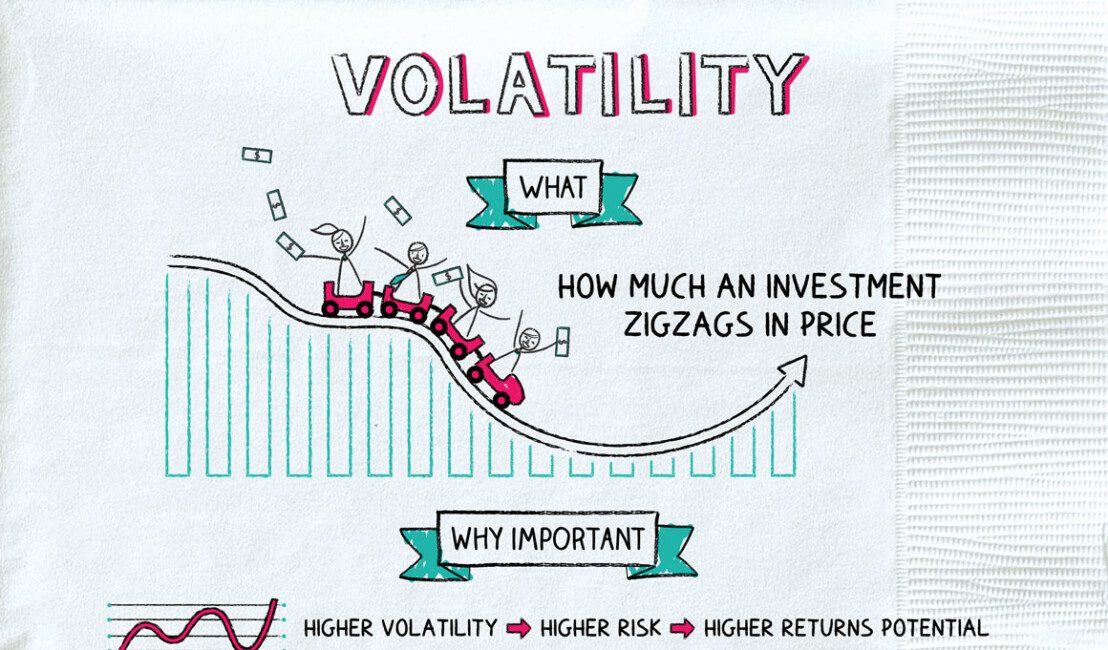

Volatility: Buckle Up

August 27, 2019

A $10,000 investment in Amazon 20 years ago would be worth about $230,000 today.

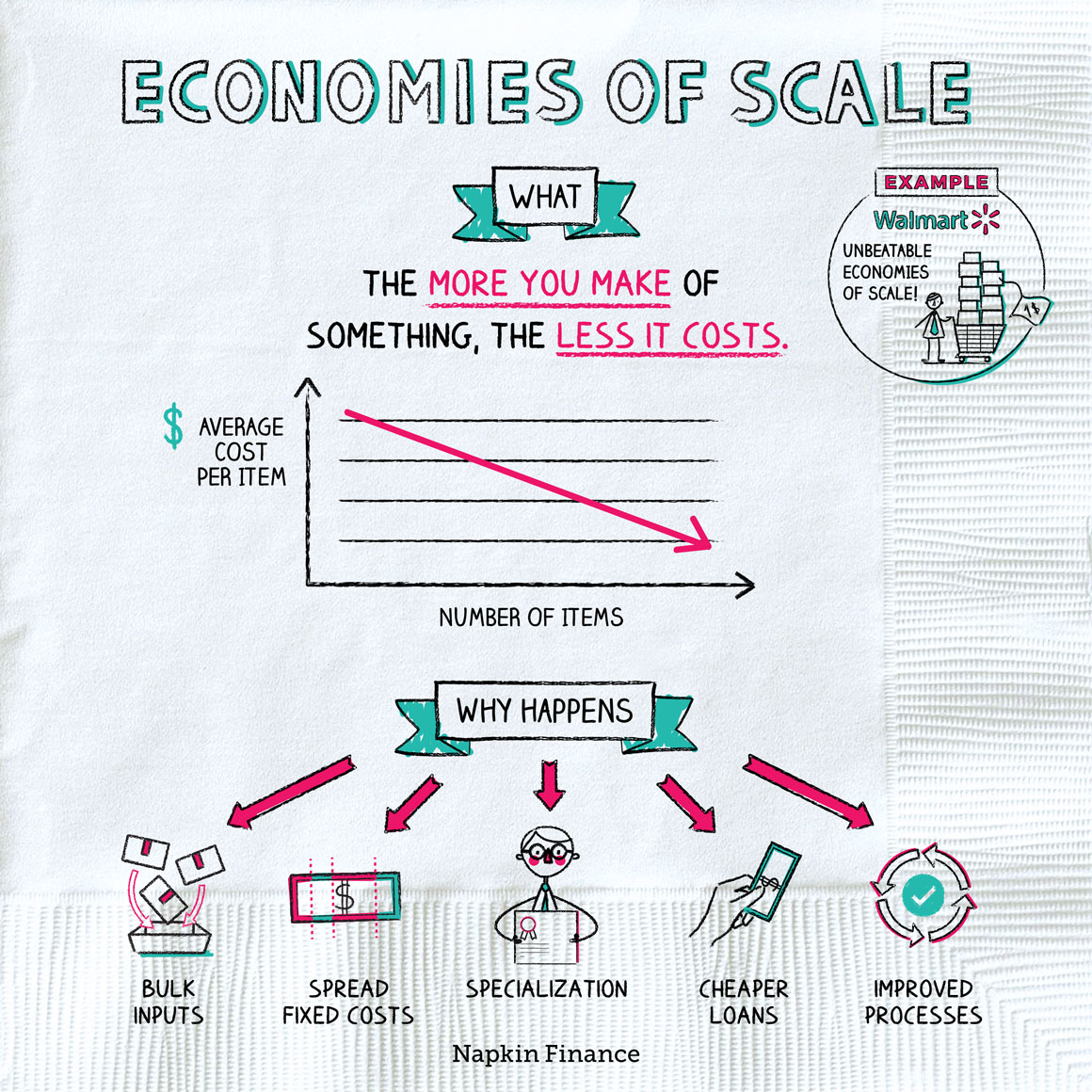

What are the secrets to the company’s success? For one thing, a ruthlessly efficient corporate culture, in which employees are supposed to treat each day of the job as though it’s “Day One” for the company, executives carry around laminated cards printed with the company’s “Leadership Principles,” and warehouse workers may be expected to pick up an item “every eight seconds.”

Then there’s also the company’s uttery mastery of economies of scale—aka dominance through sheer size.