Volatility: Buckle Up

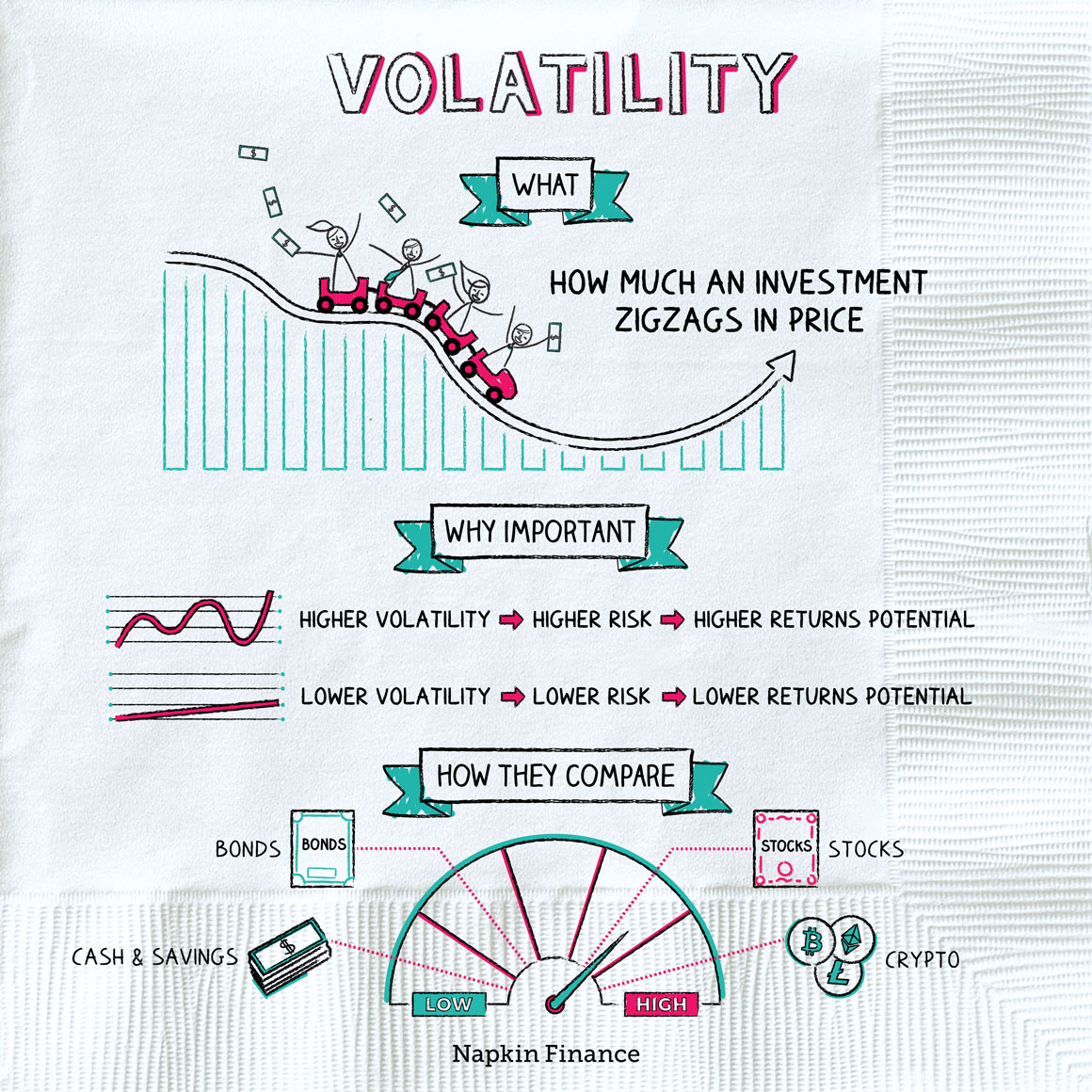

Volatility describes how investments rise and fall in price.

High volatility = an investment has big swings up and down in price

Low volatility = an investment has smaller swings up and down in price

Usually, when people talk about volatility they’re talking about the stock market. And lately, there’s been a lot to talk about. The market has been taking some unusually crazy swings since the start of August, with stock prices jumping up and down by as much as 2% to 3% from day to day. (For the stock market, those are huge moves to make in a single day.)

The stock market gets crazy when investors start to worry about the future, or feel like they’re not sure where the economy is going. Some of the things driving crazy stock-price moves now include:

Volatility tends to increase when stocks head into a bear market (which is a time when stocks suffer a big fall). But also, sometimes volatility increases for a while without it signaling any major shift in the economy.

The only thing anyone can be sure about is that we don’t know for sure what higher volatility means.