Index Funds

Copy That

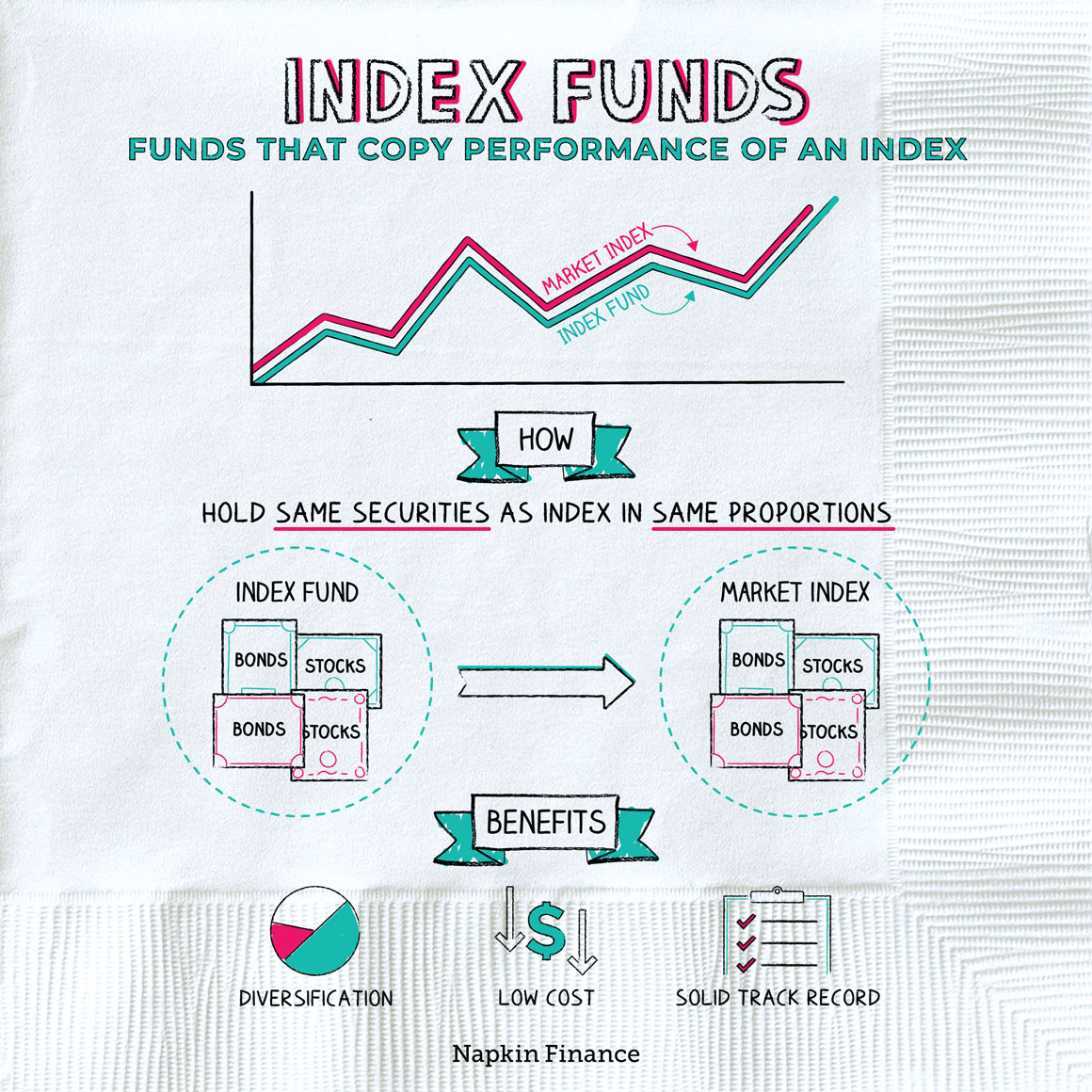

An index fund is a professionally managed collection of stocks, bonds, or other investments that tries to match the returns of a specific index, such as the S&P 500.

Index funds are usually mutual funds or exchange-traded funds. Index funds track an index, which is like a cross-section of the market. Some funds invest in all the stocks, bonds, or other investments within the index. Others choose a representative sample.

Index funds can offer instant diversification for a portfolio, which helps reduce risk. They also tend to be low-cost investment options, which is a big reason why they’re popular with investors.

Index funds stand in contrast with actively managed funds. In an active fund, one or more expert investment managers use their own judgment or calculations to pick and choose what investments to buy and sell.

Here are how the differences between the two break down:

| Index funds | Actively managed funds | |

| Goal | Match the market | Beat the market |

| Strategy | Copy the index by buying the same investments in the same proportions | Use research and analysis to try to pick specific winning investments |

| Costs | Often charge very low fees because copying an index doesn’t take much work | Tend to charge higher fees because active management takes more research (and often more trading) |

| Good to know | Won’t ever perform much better than average and will always lose when the market does | Can gain much more or lose much more than the market |

Although all index funds track an index, what they invest in can vary widely:

- U.S. stocks—some index funds track a well-known U.S. index, like the S&P or the Dow.

- Global stocks—some try to essentially track the entire global stock market.

- A specific industry—some index funds focus only on tech or healthcare stocks or those of another industry.

- A particular region or country—there are index funds that track only investments in Japan, South America, or other regions.

- Bonds—some index funds try to track the whole bond market, while others focus on a specific slice.

- Alternatives—there are index funds that track oil, gold, real estate, and more.

Index investing is popular. That’s largely because index funds charge lower fees and have better long-term track records than most active managers. However, they still come with trade-offs:

| Pros | Cons |

| They’ll always do about as well as the market. | They’ll never do much better than the market. |

| They’ve delivered better results, on average, than actively managed funds over the long term. | They’ll lose money when the market does and can’t do anything to stop those losses. |

| They’ll never do anything crazy—like make a big bet on a stock that turns out to be a loser. | They’re kind of boring (i.e., a superstar stock picker like Warren Buffett will never run them nor will they invest in the next big thing). |

“Both large and small investors should stick with low-cost index funds.“

—Warren Buffet

Index funds are collections of securities (such as stocks and bonds) that try to match the performance of a specific index. Some funds buy all the securities in the index, while others pick a sample. Index funds are popular because they can offer broad diversification and low costs, but an index fund will basically never perform better than the market index it tracks.

- Warren Buffett once placed a $1 million bet that a low-cost index fund would do better than an actively managed hedge fund over ten years—and won.

- Even though it’s called Standard & Poor’s 500-stock index (i.e., the S&P 500), the popular index actually includes 500 companies that issue 505 stocks.

- An index fund is an investment option that attempts to match the returns of a specific market index.

- Index funds are usually structured as mutual funds or ETFs.

- Index funds stand in contrast to actively managed funds, which try to beat the market by choosing winning stocks or other investments to buy.

- Index funds tend to be popular with investors because they can offer diversification, low costs, and solid long-term track records.