Estimated Taxes

Four Times the Fun

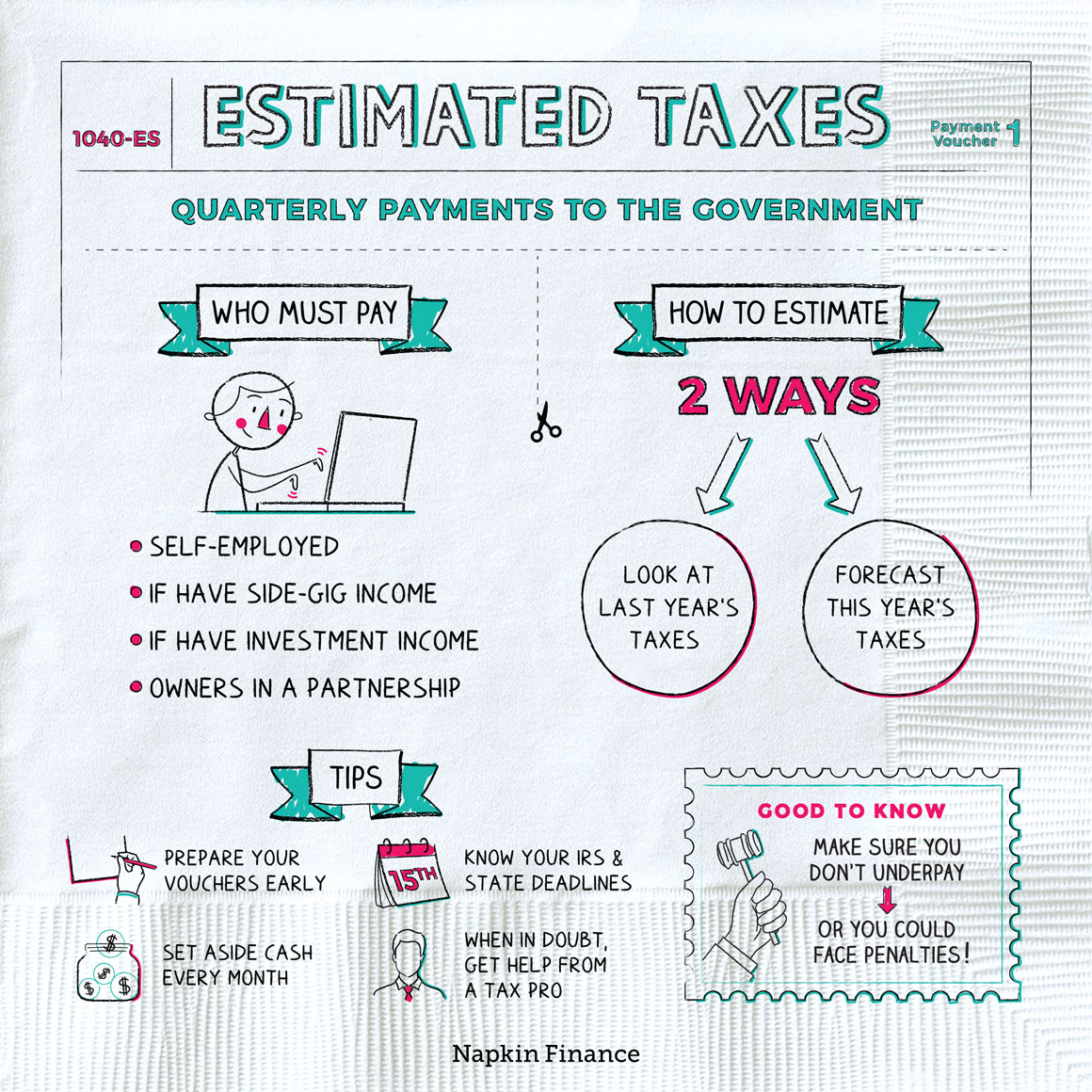

Estimated taxes are payments to the government that some people have to make four times a year. They’re mainly relevant for freelancers and people with nonemployment income.

Employees usually have taxes taken out (or “withheld”) from every paycheck they receive. This helps ensure that the government gets the money it’s due and helps employees receive a smoother, more reliable stream of income (by paying taxes gradually over time).

Nonemployee workers, on the other hand, must make those payments themselves since there is no one withholding taxes for them. Without estimated taxes, freelancers and other nonemployees would face an enormous tax bill each April. Estimated taxes make their obligations more manageable and also help ensure people are paying into the system as they go.

Self-employed people and corporations typically owe estimated taxes, but you can owe for other reasons too. Here’s who is likely to be on the hook:

- Contractors (aka freelancers or gig workers)

- Sole proprietors

- Partners in a business

- Employees who also have side gig income

- Anyone with significant income from asset sales or investments—whether traditional stocks and bonds, real estate rental income, or something else

- Corporations

A good rule of thumb is that you want to make sure you’ve paid at least 90% of your total tax for the year (whether through withholding or estimated payments) before you submit your annual tax return. If your nonemployment income puts you at risk of falling below that 90% mark, then you probably need to file estimated taxes. Otherwise, you could face penalties.

Accurately estimating your quarterly taxes helps you avoid a huge bill when it comes time to file plus potential late fees and penalties.

One simple way to figure out your quarterly taxes is to go by what you earned and owed last year. If you expect your income to be about the same, you can look at what you paid last year and then divide that up over four quarters.

But if your income is changing or you want to be more precise (to avoid overpaying or underpaying), here’s how to figure out how much you owe:

Track your income in a spreadsheet

so that you know how much you earn each quarter

↓

Calculate your deductions

and subtract them from your taxable income

↓

Calculate your income and self-employment tax rates

based on taxable income

↓

Submit your quarterly payments

to the U.S. Treasury and your state treasury

You can avoid the penalties if you pay at least 90% of your current year taxes before you file your tax return, but it’s still a good idea to be as accurate as possible. After all, no one likes a tax bill.

The estimated tax filing deadlines for the IRS are usually:

- Quarter 1: April 15

- Quarter 2: June 15

- Quarter 3: September 15

- Quarter 4: January 15

However, your state’s deadlines may differ from the federal schedule. To be safe, make sure you’re always staying on top of both sets of deadlines.

Doing four extra tax filings a year may not be your idea of a good time. But if you do owe estimated taxes, there are some steps you can take to ease the pain:

- Set up automatic monthly transfers from your checking (or business checking) into a separate account that’s earmarked for your estimated payments. That can help you avoid a cash squeeze when it’s time to file.

- If you can, calculate your payments at the start of the year and get your 1040-ES vouchers lined up ahead of time. That way when each deadline rolls around, the hard part is already done.

- When in doubt, seek help from a professional tax advisor.

If you work for yourself, you probably owe estimated taxes. It’s important to account for your estimated taxes accurately and pay them on time because the penalties, fees, and interest for late payments can add up quickly.

- Freelance income reaches almost $1 trillion a year, representing nearly 5% of U.S. gross domestic product (GDP).

- Working for yourself can pay off even with estimated taxes. Thirty-one percent of freelancers make more than $75,000 a year, and 73% say they bring in more money by going solo than they did as employees.

- Sole proprietorships make up 73% of U.S. businesses.

- Estimated taxes are payments to the federal and state government that some people have to make four times a year.

- Self-employed workers—including freelancers and sole proprietors—generally must pay quarterly estimated taxes.

- Even if you work as an employee, you may owe the payments if you receive significant income from nonemployment sources, such as from investments or real estate that you rent out.

- You can make filing your estimated taxes easier by setting cash aside for the payments each month, getting your payment vouchers ready ahead of time, and working with a professional if you ever need extra guidance.