Saving for College

Pay Your Dues

Saving for college means setting aside funds for education expenses. It means making a dedicated investment in your (or a child’s or other loved one’s) future higher education.

Saving before you (or your kids) head to college can help you:

If you’re on the fence, keep this in mind: On average, tuition and fees at a private, four-year school can cost upwards of $41,000 per year, while in-state tuition at a public school can run you more than $11,000 per year.

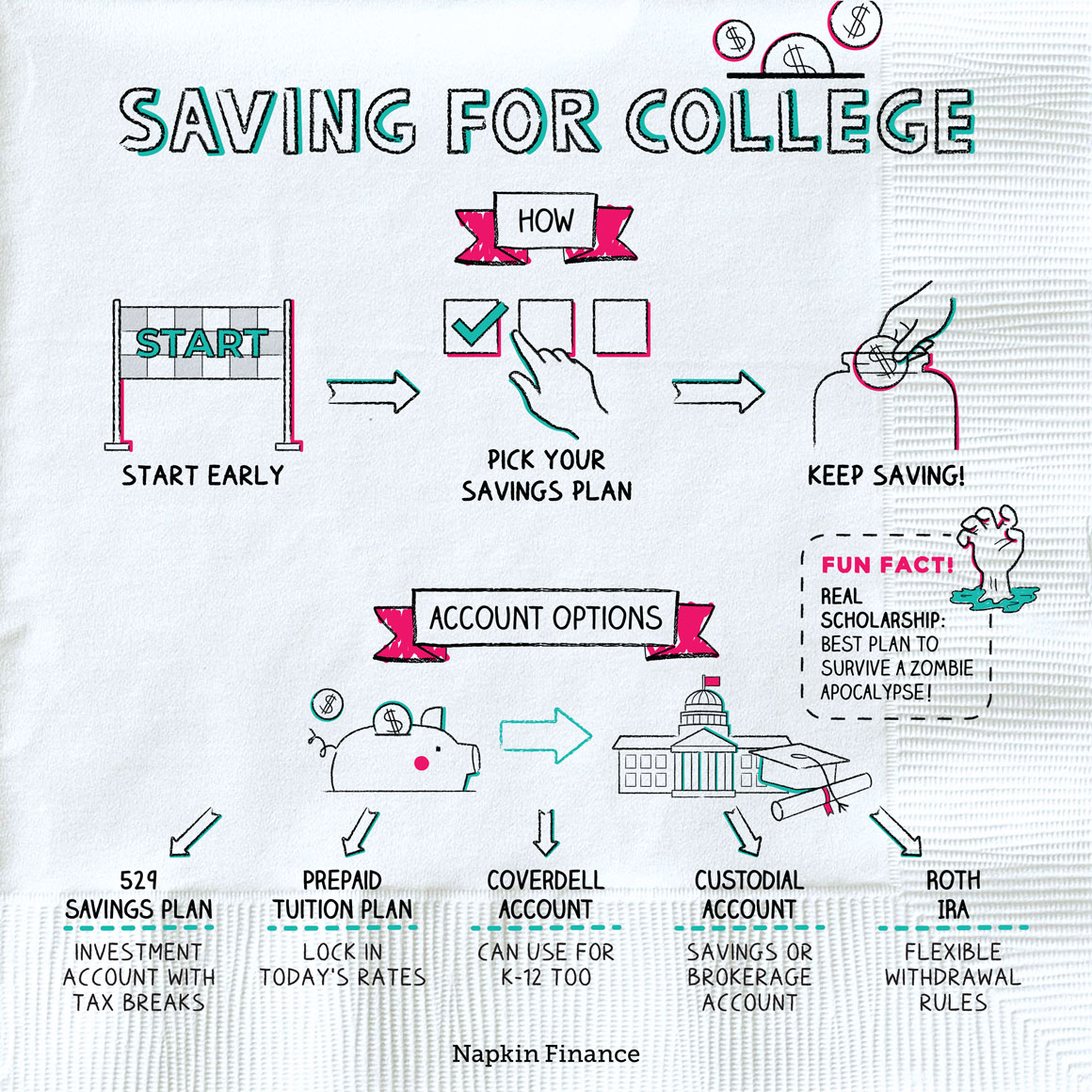

Chances are you don’t just want somewhere to save. You also want an account where your money can grow (and ideally benefit from some tax perks). Some options include:

- 529 savings plan: State-run account that lets you withdraw money for education expenses

- Prepaid 529 plan: Buy blocks of tuition (or full tuition) at a state university, locking in today’s rates

- Coverdell education savings account (ESA): An investment account for education expenses you can open at any financial institution

- Roth IRA: A type of retirement account you may also be able to use for education expenses

- Custodial accounts (UGMA or UTMA): Account that’s controlled by a custodian until a child reaches legal age

Not every college savings plan makes sense for every family. They all give you a leg up when the first bill comes in the mail, but there are important trade-offs to consider.

| Account type | Advantages | Disadvantages |

| 529 savings plan |

|

|

| Prepaid 529 plan |

|

|

| Coverdell education savings account (ESA) |

|

|

| Roth IRA |

|

|

| Custodial account (UGMA, UTMA) |

|

|

Going to college is a big investment, and saving for college is a big commitment. Here are some tips to help make your savings plan a success:

- Start early—So your money has plenty of time to grow thanks to the power of compound interest.

- Shop around—You don’t necessarily have to choose your state’s 529 plan; in fact, some states have lower fees than others.

- Invest wisely—Consider your risk tolerance and timeline when you’re picking investment options. Don’t assume the default investment option is the right one for you.

- Plan to pay—Don’t assume scholarships, grants, or financial aid will cover all college costs or that you’ll owe nothing out of pocket.

- Automate—Consider setting up recurring withdrawals from your bank account to the savings plan so that you can save automatically.

- Let others help—Invite friends and family to contribute to your college savings instead of giving birthday or holiday gifts.

Ultimately, remember that every little bit helps. Even if you can’t save for the full cost (really, who can?), that shouldn’t deter you from putting something aside.

Saving money for college means a commitment to your or a loved one’s pursuit of higher education. Having money set aside can help you expand your school options, benefit from tax perks, and avoid a crushing debt load. There are various savings account options to consider—including 529 plans, Coverdell accounts, and Roth IRAs—each with its own pros and cons.

- Real-life scholarships exist for marbles tournament winners, for those who can win a “cutest couples” contest, and for those who can submit the most convincing plan for surviving a zombie apocalypse.

- Waitressing isn’t the only option if you’re looking to pay your way through. Some students have paid their way by choosing a school with a medical center and then signing up for paid clinical trials.

- Saving for future college expenses can help you avoid loan debt while offering tax advantages and expanding your school options.

- Investment accounts, such as 529 plans, Roth IRAs, custodial accounts, and Coverdells, let you save and invest your money so that it grows before you need to use it.

- Each type of savings account has its own pros and cons, so be sure you understand what you’re signing up for.

- Starting early, choosing your account type carefully, and automating your savings can help you make faster progress toward your college savings goal.