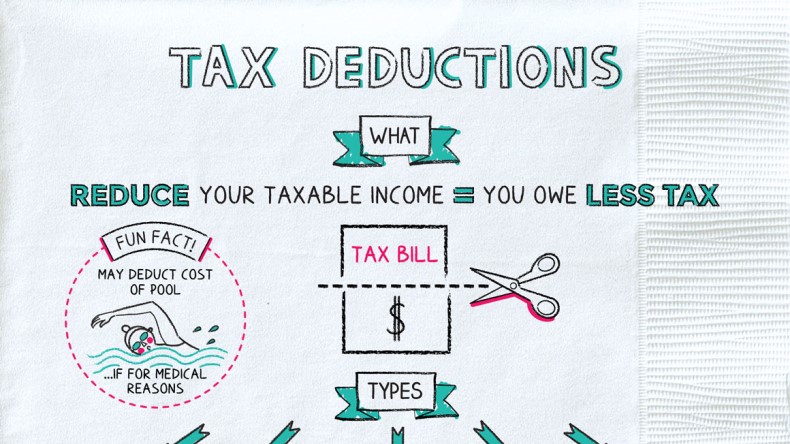

Tax Deductions

Cut Rate

Tax deductions, such as for donations to charity or interest on student loans, are amounts that you subtract from your income when calculating how much you owe in taxes. Claiming tax deductions helps you pay less tax.

If you earned $50,000 for the year but took $10,000 in deductions, the amount of tax you pay would be based on $40,000 of income.

Some of the main deductions include:

- Interest on student loans

- Contributions to traditional Individual Retirement Accounts (IRAs)

- State and local taxes

- Interest on your home mortgage

- Donations to charity

- Medical expenses (if your expenses for the year reached a certain percentage of your income)

- Business expenses (if you run your own business)

“Few of us ever test our powers of deduction, except when filling out an income tax form.“

—Laurence J. Peter

Both credits and deductions reduce what you owe in taxes. But tax credits give you more bang for your buck because they reduce your taxes dollar for dollar (while deductions reduce the amount of income you owe tax on).

Suppose you earned $50,000 and your tax rate is 25% (real-life rates are more complicated than this). Here’s how a deduction of $10,000 would work out compared with a credit of $10,000:

| $10,000 deduction | $10,000 credit | |

| Your taxable income is: | $50,000 – $10,000 = $40,000 | $50,000 |

| At 25%, your taxes are: | $40,000 x 0.25 = $10,000 | $50,000 x 0.25 = $12,500 |

| Minus credits: | -$0 | -$10,000 |

| Total tax you pay: | $10,000 | $2,500 |

Everyone has to choose between taking the standard deduction or itemizing. The standard deduction is simpler—there’s a set dollar amount that you deduct from your income, and you don’t need to do a lot of math or recordkeeping.

Itemizing is more complicated but results in bigger savings for some people—you figure out all the specific deductions you’re eligible for and add them up.

Some specific deductions you can still take even if you don’t itemize (such as the student loan interest deduction). But many you can’t take unless you itemize (such as the deductions for mortgage interest and charity donations).

“There may be liberty and justice for all, but there are tax breaks only for some.“

—Martin A. Sullivan

Here are a few pointers if you’re trying to make the most of your deductions:

- There are a ton of often overlooked tax deductions, including those for gambling losses, sales taxes, home office expenses, teacher supplies, health insurance premiums, and babysitters. But not everyone qualifies, so be sure you know the rules.

- Even if a deduction isn’t allowed on your federal taxes, you might still be able to claim it on your state taxes.

- If the year is over but you’re still looking for ways to reduce your tax bill, see if you could make a deductible IRA contribution. You can typically make them up until April 15 but still claim them as deductions for the previous calendar year’s taxes.

And of course, be sure to keep records documenting your deductions—like receipts for charitable contributions or medical expenses. If you’re audited, you might have to show them to the IRS.

Tax deductions are amounts you can subtract from your income when figuring out how much you owe in taxes. There are deductions for student loan interest, charitable donations, medical expenses, IRA contributions, and more. Deductions are different from tax credits, which reduce how much you owe dollar for dollar.

- Work expenses are often tax deductible. A stripper was reportedly able to deduct the cost of breast augmentation surgery after a judge ruled her implants were stage props.

- You may be able to deduct the cost of a swimming pool or home renovations if you need the pool or the renovations for medical reasons.

- Tax deductions reduce what you pay in taxes by lowering the amount of income your taxes are calculated on.

- Common tax deductions include breaks for student loan interest, mortgage interest, and some retirement plan contributions.

- When you do your taxes, you’ll need to choose between taking the standard deduction—which is a set dollar amount—or itemizing your deductions—which means adding up the value of all the individual deductions you’re eligible for.

- Tax deductions are great, but credits can be even better because they reduce the tax you owe dollar for dollar.

- Be sure to keep receipts or other records for any deductions you take in case the IRS ever comes knocking.