Risk vs. Reward

Double Down

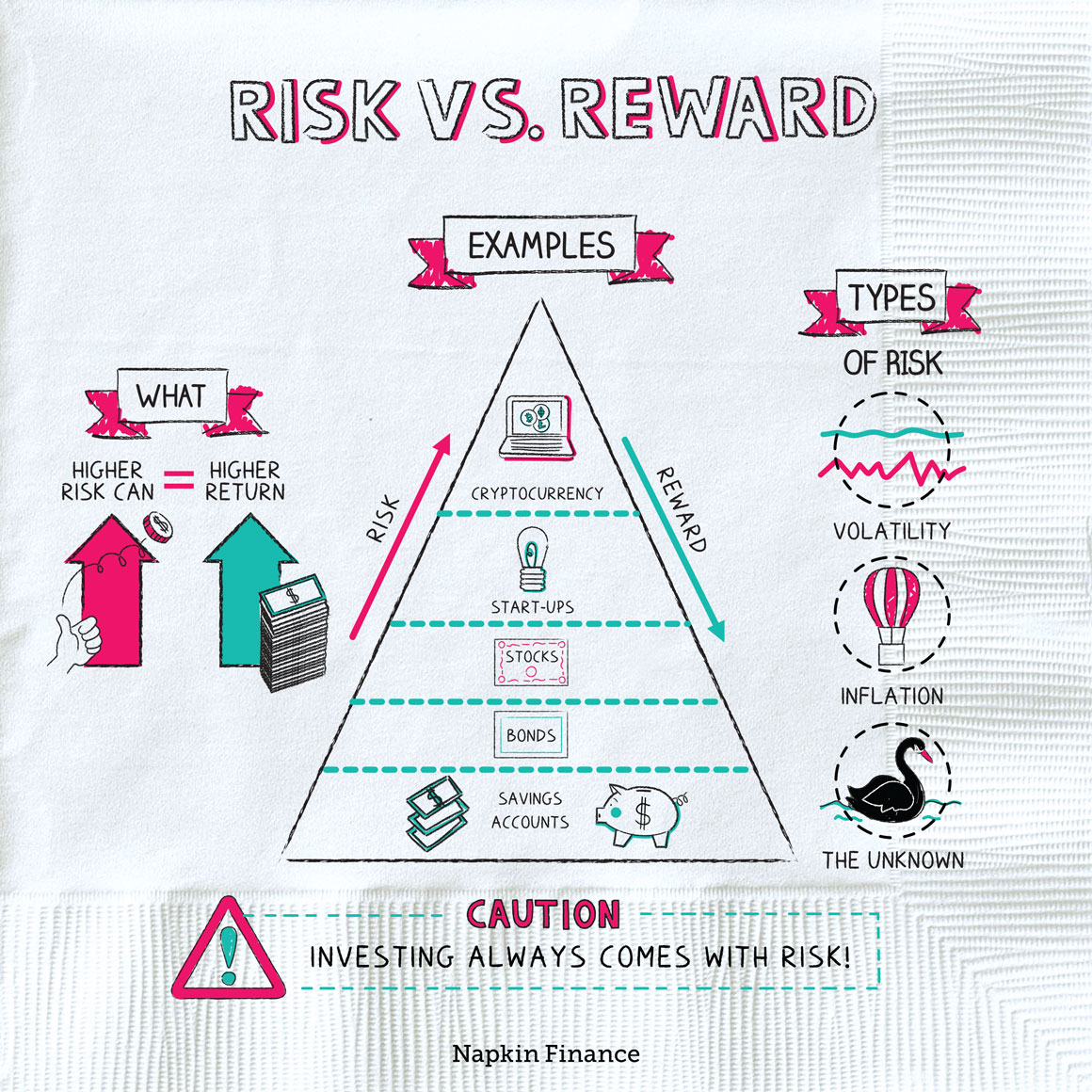

All investments come with risk. With financial investments, risk is usually tied to reward. That means investments with the potential to return the most also usually have the potential to lose the most. And safe investments typically don’t return much.

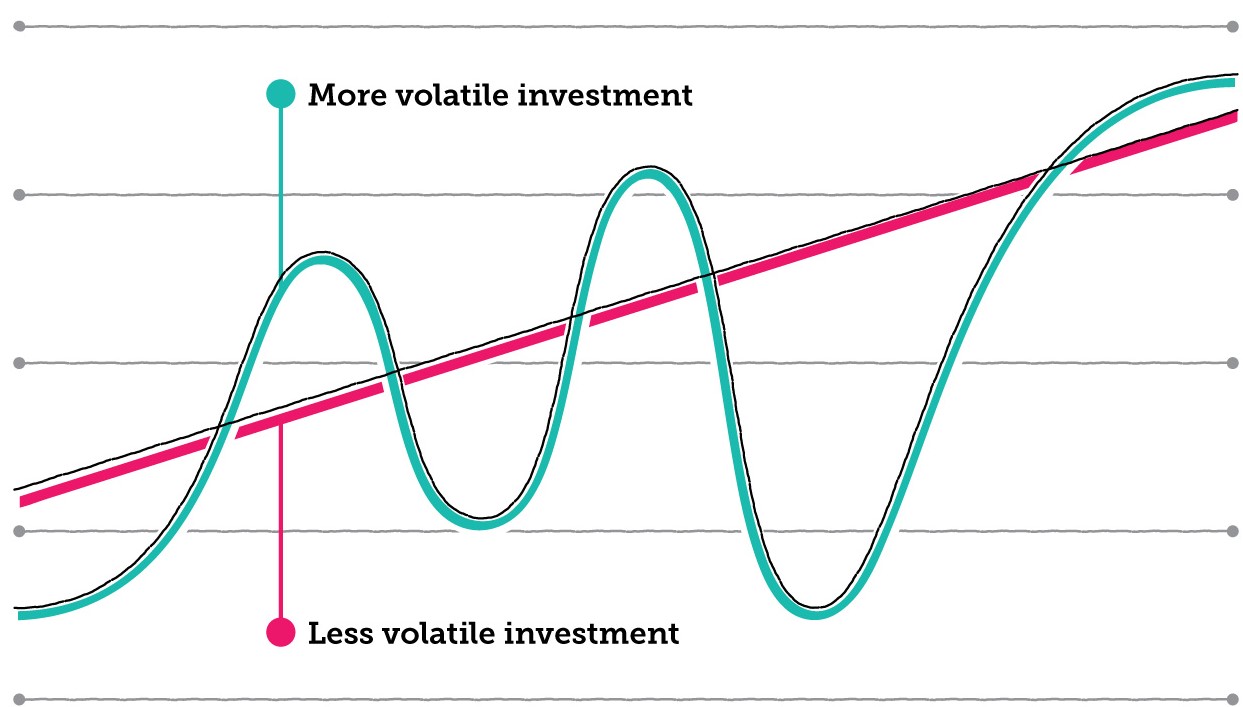

Investors often think of risk as how much an investment bounces around in price, which is called volatility.

Some experts argue that volatility doesn’t capture all types of risk. For one thing, investors’ accounts with Bernie Madoff (who ran one of the largest investment frauds in history) showed pretty smooth returns. And technically, an investment that consistently loses money could be “low risk” under this definition.

But volatility is still the best shortcut for understanding which investments are high risk and which are low risk.

Since risk and reward go hand in hand, you can rank investment types according to their risk and potential return:

| Investment type | Risk level | Why? |

| Cryptocurrency | XXXXX | Some cryptocurrencies end up being worthless. Others could turn you into a millionaire overnight. |

| Startups | XXXX | Some startups will be wildly successful, some will flame out, and others will fall somewhere in the middle. |

| Stocks | XXX | Stocks can ping-pong in price and occasionally take a nosedive, but in the long term they usually deliver solid returns—at about 10% per year on average. |

| Bonds | XX | Bonds can rise and fall in price but usually much less than stocks. Long term they’ve earned about 5% per year on average. |

| Savings accounts | X | Savings accounts are federally insured for up to $250,000, so you have a 0% chance of losing money if you stay within that limit. But you might only earn 0.1% per year. |

Choosing the right balance of risk and return is arguably the most important part of investing. Your risk/reward balance is described by your asset allocation.

You want to invest according to the risk level that’s right for you. This is your “risk tolerance,” and it plays a big role in your asset allocation.

You can determine your risk tolerance by looking at two factors:

- Your investment timeline—the time until you need access to the money you’re investing. The longer that time frame, the more risk you can take on.

- Your risk appetite—how much risk you can stomach. If you’d freak out if your investments tumbled, you probably have a low risk tolerance. But if you can ride the market roller coaster, you may have a higher risk tolerance.

Based on your timeline and risk appetite, you can start figuring out how aggressive or conservative your asset allocation should be.

| Long timeline | Short timeline | |

| High risk appetite | Aggressive | Moderate |

| Low risk appetite | Moderate | Conservative |

“Avoiding danger is no safer in the long run than outright exposure. Life is either a daring adventure or nothing.“

—Helen Keller

Investments usually come with risk, which investors assume in exchange for a reward. Generally, the riskier your investment, the higher your potential reward and vice versa. Investment experts often look at risk from the perspective of volatility, that is, how much an investment bounces around in price.

- Despite the well-established relationship of risk and reward, women tend to invest more conservatively than men but still earn better returns on average—possibly because they trade less.

- Some investing strategies can let you invest in volatility itself—meaning you make money when the market acts bananas and lose money when it’s calm.

- Investing always comes with risk.

- Usually, investments that have the potential to return more are riskier.

- Many investors think of risk as how much an investment swings in price, but there can be other types of risk too.

- Risk tolerance, or how long until you need your money and how much risk you’re comfortable with, can help you decide how to invest your money.