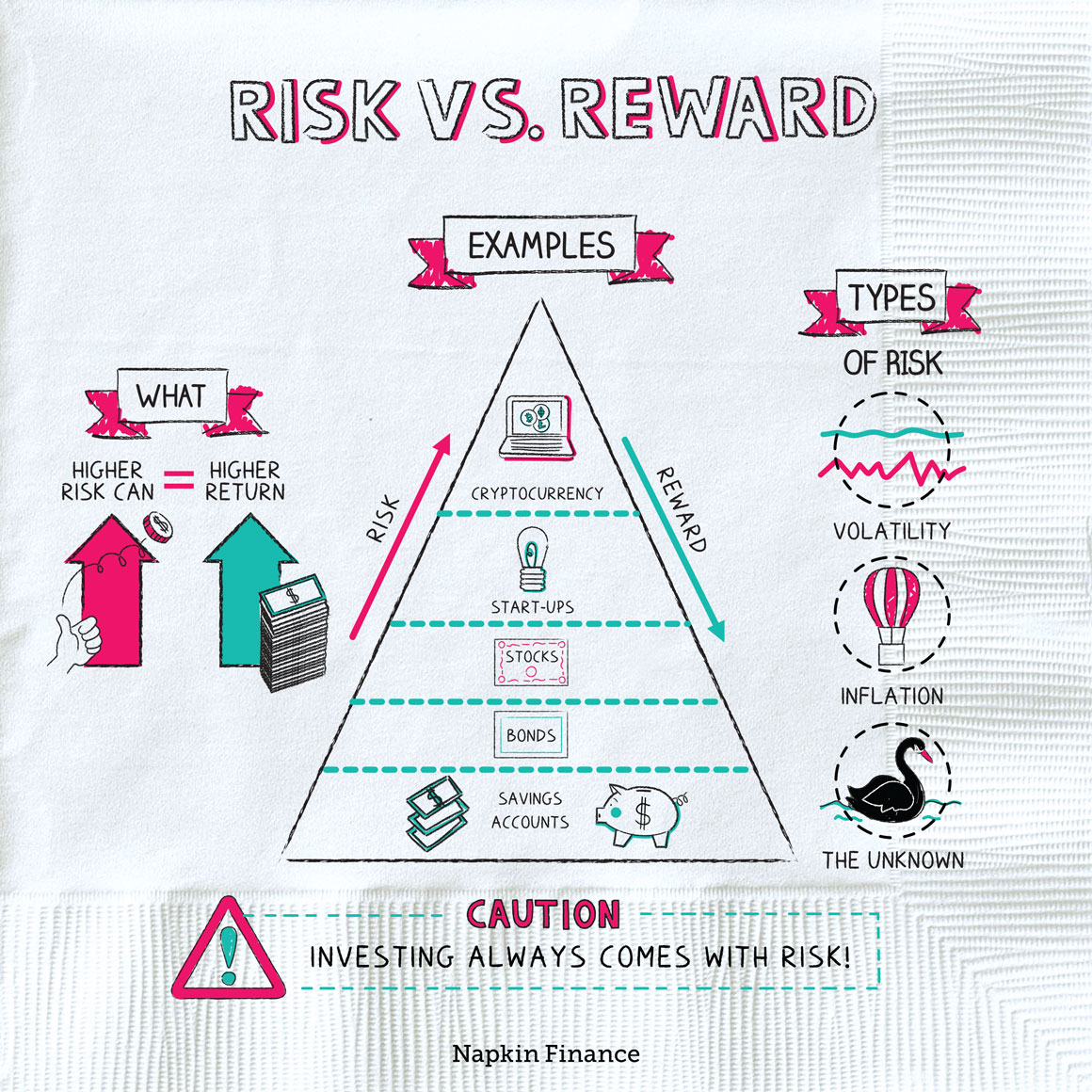

Lesson 2: Risk vs. Reward

In investing, risk and reward go hand in hand. That’s because investments that have the potential to return a lot are generally riskier, and safer investments typically don’t return much.

| Cryptocurrencies | Rating: Extreme risk Investors could make gobs of money or lose it all. |

| Start-ups | Rating: High risk Many startups fail, but some will succeed spectacularly. |

| Stocks | Rating: Moderate risk Stock prices can zigzag in the short term but have always marched up in the long run. |

| Corporate bonds | Rating: Low risk Big, well-known companies almost always repay their debts. |

| U.S. government bonds | Rating: Safe U.S. government bonds are considered to be the safest investments in the world. |

Finding the right balance

The takeaway isn’t that you should avoid risk. As we explained in the previous lesson, keeping your money in the bank or somewhere else super safe probably won’t get you where you need to go.

Instead, you want to invest according to the level of risk that’s right for you. That’s called your “risk tolerance” and is based on the following:

- Investment timeline: The longer you have before you need to access your money, the more risk you can take on.

- Risk appetite: How comfortable are you with risk? If your investments tumbled, would you panic and sell, or would you be able to hold on?

Based on those two factors, here’s a rough approximation of your risk tolerance:

| Timeline: Long | Timeline: Short | |

| Risk appetite: High | Aggressive | Moderate |

| Risk appetite: Low | Moderate | Conservative |

Now you can figure out which types of investments fit you. Though we’ll dive into that more in the next lesson, here’s a preview: