Rent vs. Buy

Where the Heart Is

The choice between renting or buying a home may be one of the biggest decisions you make in your life.

Each option comes with financial trade-offs—plus nonfinancial, personal considerations, which can be equally important.

When you rent, you’re paying a landlord the right to occupy a space. You are not responsible for maintenance or property taxes.

When you buy, you own the space and are responsible for upkeep and taxes. But as the value of the home appreciates over time, you can build wealth.

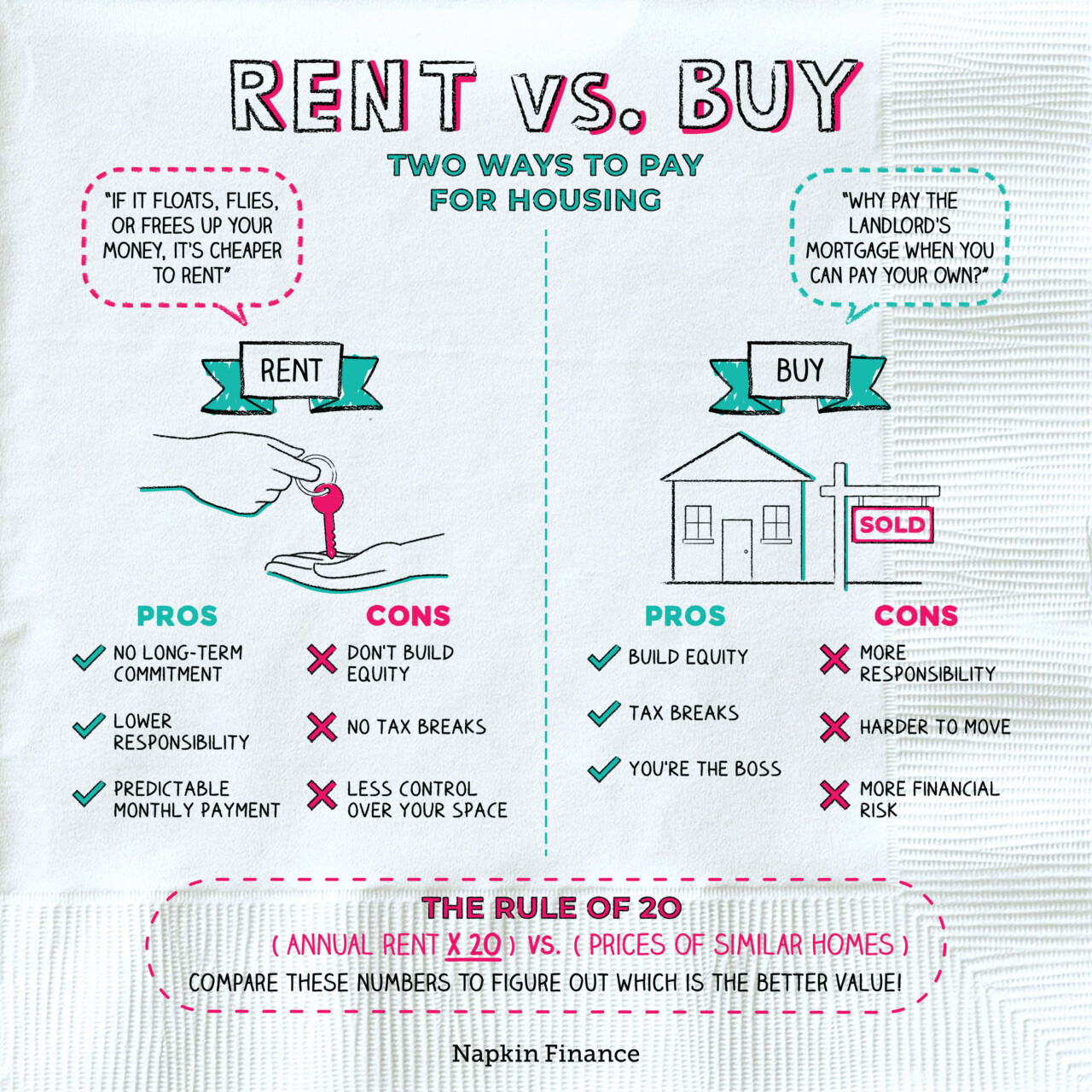

There are advantages and disadvantages to both renting and buying.

| Pros | Cons | |

| Renting |

|

|

| Buying |

|

|

How much you’ll pay is another big part of the rent vs. buy equation.

- Renting usually requires:

- Security deposit

- Rent

- Utilities

- Renter’s insurance

- Buying, on the other hand, usually means:

- Mortgage payments

- Homeowners insurance

- Property taxes

- Homeowners association (HOA) dues (if you live in a community with one)

- All upgrades, utilities, and maintenance

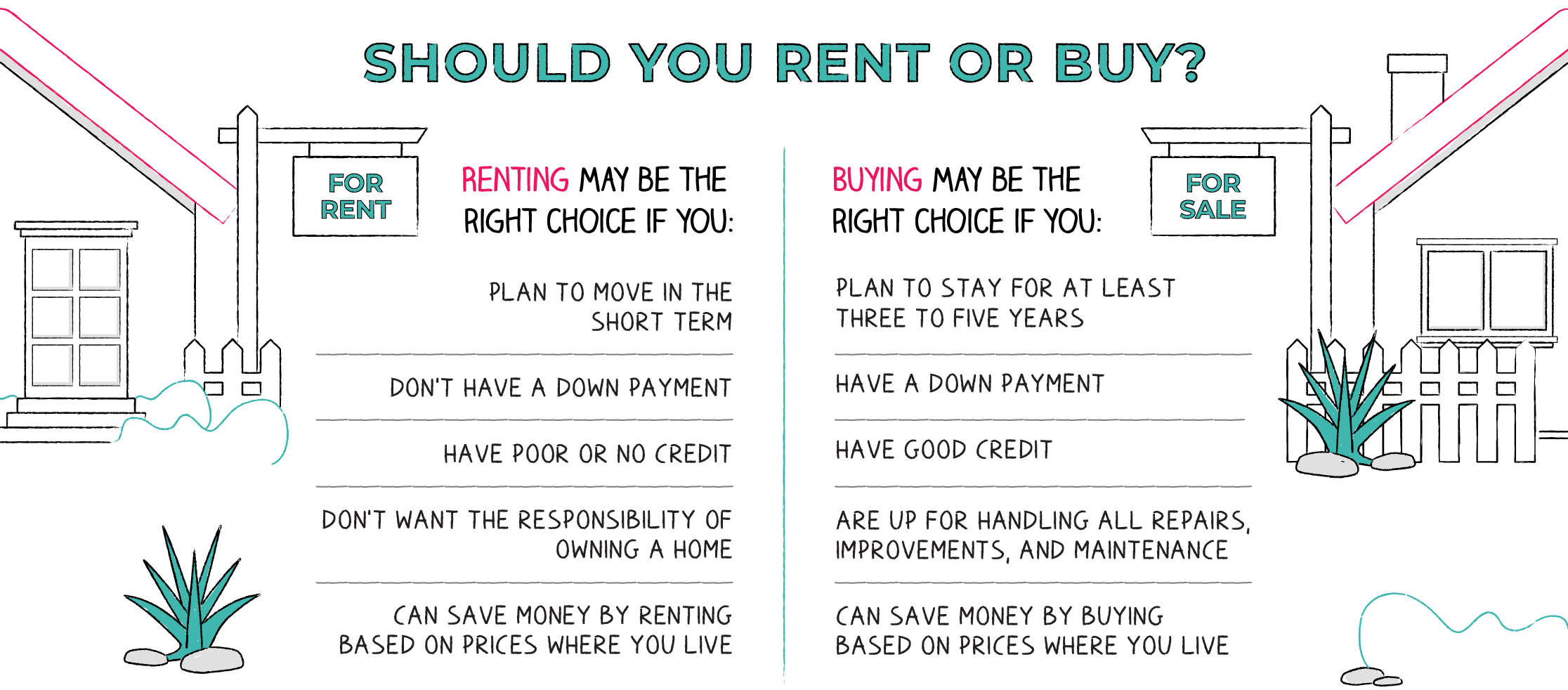

As you weigh the pros and cons of renting and buying, ask yourself:

- Will this house fit my family in size and location for at least the next several years?

- Experts recommend staying in a house for at least three to five years in order to recoup closing costs.

- Can I get approved for a loan?

- Qualifying usually depends on your credit score, income, down payment, and other debts.

- Am I ready to make a big commitment?

- A home means more than just a financial commitment. It means you’re the one on the line if a pipe freezes in the dead of winter or the basement floods while you’re on vacation.

If you answered no to any of the above, then it could be that renting is still right for you (for now).

If you’re truly undecided or you’re trying to make a cool-headed decision based on the numbers, consider the rule of 20.

According to the rule, multiply your annual rent (i.e., monthly rent times 12) by 20. Compare that figure to the value of homes in your area. If the purchase prices are lower, it may be more cost-effective to buy. However, if the multiplied rental value is higher, it may make more sense to keep renting.

“Why pay the landlord’s mortgage when you can pay your own?“

—Unknown

Whether to rent or buy is one of the biggest financial decisions you may make. To figure out what’s right for you, you need to balance the costs that go into renting versus the commitment that goes into buying. Although the financial pros and cons of each option are important, ultimately renting or buying is a personal decision.

- The U.S. homeownership rate hovers around 65%, but in pricey places, like Los Angeles, less than 50% of people own homes. In fact, Californians spend 25% of their income on housing, on average—more than anywhere else in the country.

- Arkansas, Alabama, Ohio, Michigan, and Wisconsin are among the cheapest places in the country to buy a house, with some areas going for less than $100 per square foot.

- Deciding to rent or buy is a major financial, lifestyle, and personal decision.

- The advantages of renting include being able to move easily, not having to worry about taxes or maintenance, and having a fixed monthly financial commitment.

- The benefits of owning include building equity over time, tax breaks, and the independence of being your own boss of your own home.

- Depending on where you live, it could be more expensive to buy a house than rent or vice versa.