SBA Loans

Helping Hand

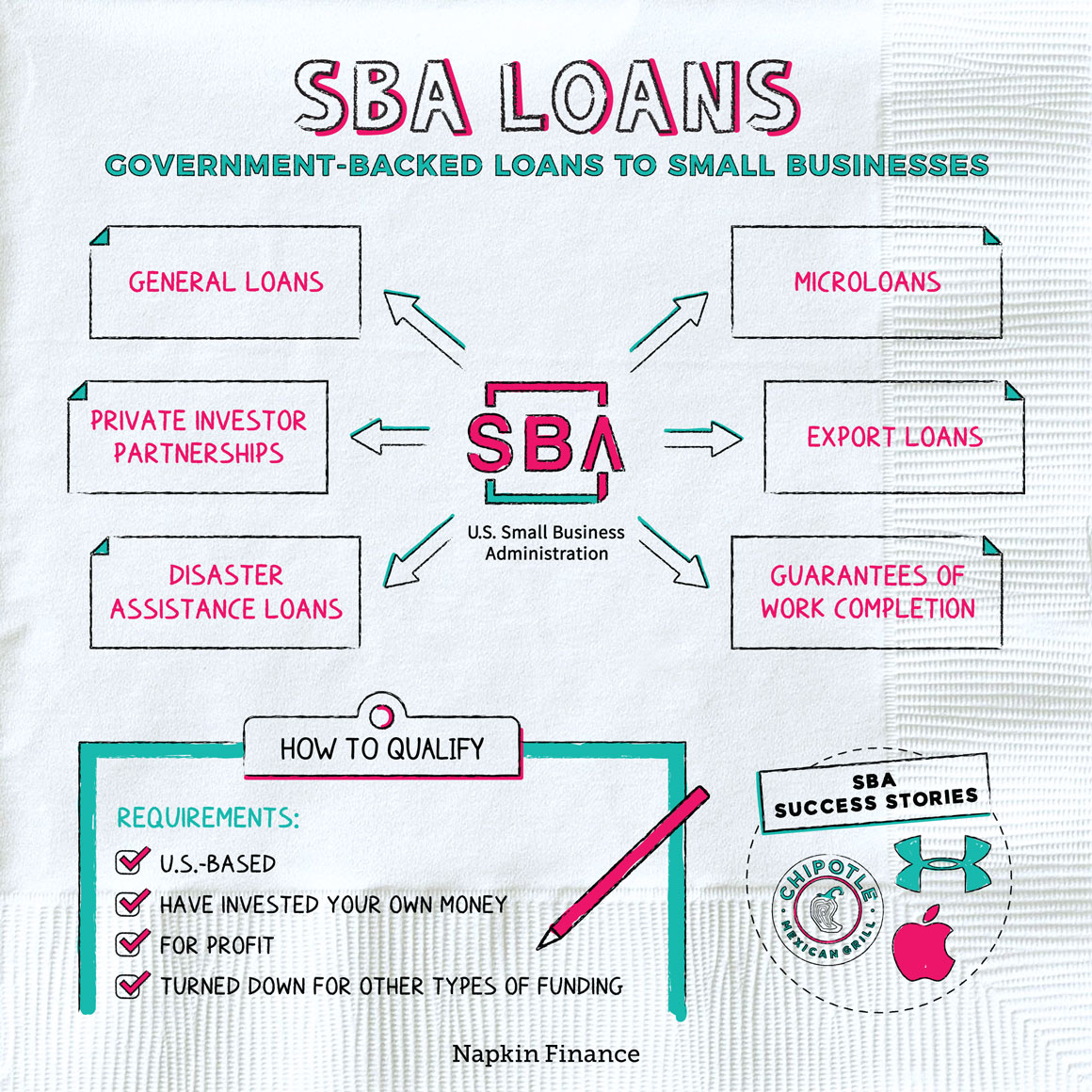

SBA-guaranteed loans (or just “SBA loans”) are business loans backed by the U.S. Small Business Administration (SBA).

The SBA doesn’t lend money itself, but it works with lenders who otherwise might not feel confident giving money to startups and other new businesses that don’t have great credit or growth histories. The SBA also offers mentorship and other resources to support small businesses.

The SBA offers several types of funding assistance, including:

| Name | What it is |

| 7(a) Loans | Part of the SBA’s main loan program, which offers several different options and terms based on your company’s needs. |

| Small Business Investment Company (SBIC) funding | The SBA works with approved private investors that partner with small businesses to provide funding. |

| Disaster assistance loans | Low-interest loans that small-business owners can use for operating expenses or property repairs after a declared emergency, such as a hurricane or flood. |

| Surety bonds | Bonds that guarantee that a small business will complete the work for which it was contracted. This helps small businesses win new clients who might otherwise have gone with a larger or more established company. |

| Export loans | Loans that help young companies set up and grow their exporting business. Exports are considered high risk, so it can be difficult for small businesses to get these loans with conventional lenders. |

| Microloans | The average size of one of these loans is about $13,000, but small businesses can apply for up to $50,000 through this program. |

If you’re looking for funding for your business, the right type may depend on how large your company is, when it was founded, and why you need the money. A business recovering from a natural disaster will be in a different position from one that wants to expand its client base overseas.

Here’s the basic process for obtaining an SBA loan:

Find an SBA-approved lender

↓

Fill out a loan application

↓

Write one-year financial projection and profit and loss statements

↓

Compile all supporting documents

(business history, income taxes, past loan applications, etc.)

↓

Submit your application

The whole process, from when you apply until when you actually receive the funds, can take at least a couple of months.

SBA loan amounts vary from as little as $500 up to $5.5 million. How much you can borrow depends on your creditworthiness (and your company’s), what you need the money for, and a number of other factors determined by your lender.

Lenders evaluate borrowers’ applications on a case-by-case basis, though you typically have to meet some general criteria:

- Your business must be U.S. based

- You must have put your own money (equity) into the business

- The company must be for-profit

- You must have been turned down for other types of business loans

The stronger your credit history and that of your business, the more likely it is that you’ll receive funding.

However, some startups may be eligible for loans even if they have bad credit. Business owners are sometimes able to qualify by using their personal credit score, getting a cosigner, or putting up collateral to secure the loan (i.e., a physical item that the lender could repossess if the borrower can’t make loan payments).

Companies can use the money they receive from an SBA loan in a number of ways, including:

- Buying business assets, such as property, furniture, or manufacturing equipment

- Remodeling a storefront

- Covering seasonal expenses

- Setting up exporting functions

- Refinancing business debt and more

You’ll need to decide how you plan to use the money before you apply because when you sign your application you’re typically committing to only using the funds for the purposes you stated.

SBA loans aren’t the only option for small business financing (and, in fact, you have to prove you can’t get funding elsewhere before you’ll be approved for an SBA loan). Here are some other sources of funds to consider.

| Pros | Cons | |

| SBA loans |

|

|

| Conventional loans (i.e., not backed by the SBA) |

|

|

| Grants |

|

|

| Venture capital |

|

|

How you fund your business will come down to your credit profile, what your needs are, and how lenders and investors perceive the company.

SBA loans can be great funding sources, especially if your business recently opened or you’ve struggled to secure capital from other lenders. But it’s important to consider where your business is in its life cycle and what your goals are with the money. It’s not just about getting access to cash; it’s about getting it from the right place so that you can grow sustainably.

- Apple, Chipotle, Under Armour, and Columbia Sportswear are some of the big-name success stories of the SBA’s lending program.

- It pays to be your own boss. Self-employed Americans with incorporated businesses earn almost $20,000 more a year than the overall nationwide median personal income.

- The U.S. has more than 30 million small businesses, and roughly half of all workers work for small businesses.

- SBA loans are loans to small businesses that are guaranteed by the U.S. Small Business Administration.

- They can make it easier for new businesses to borrow money so that they can grow.

- To get approved for an SBA loan, you must have put your own money into your business and have been rejected for other types of funding.

- SBA loans may be used for many purposes, including buying new equipment, purchasing new store space, and setting up export operations.