Reverse Mortgage

Can’t Take it With You

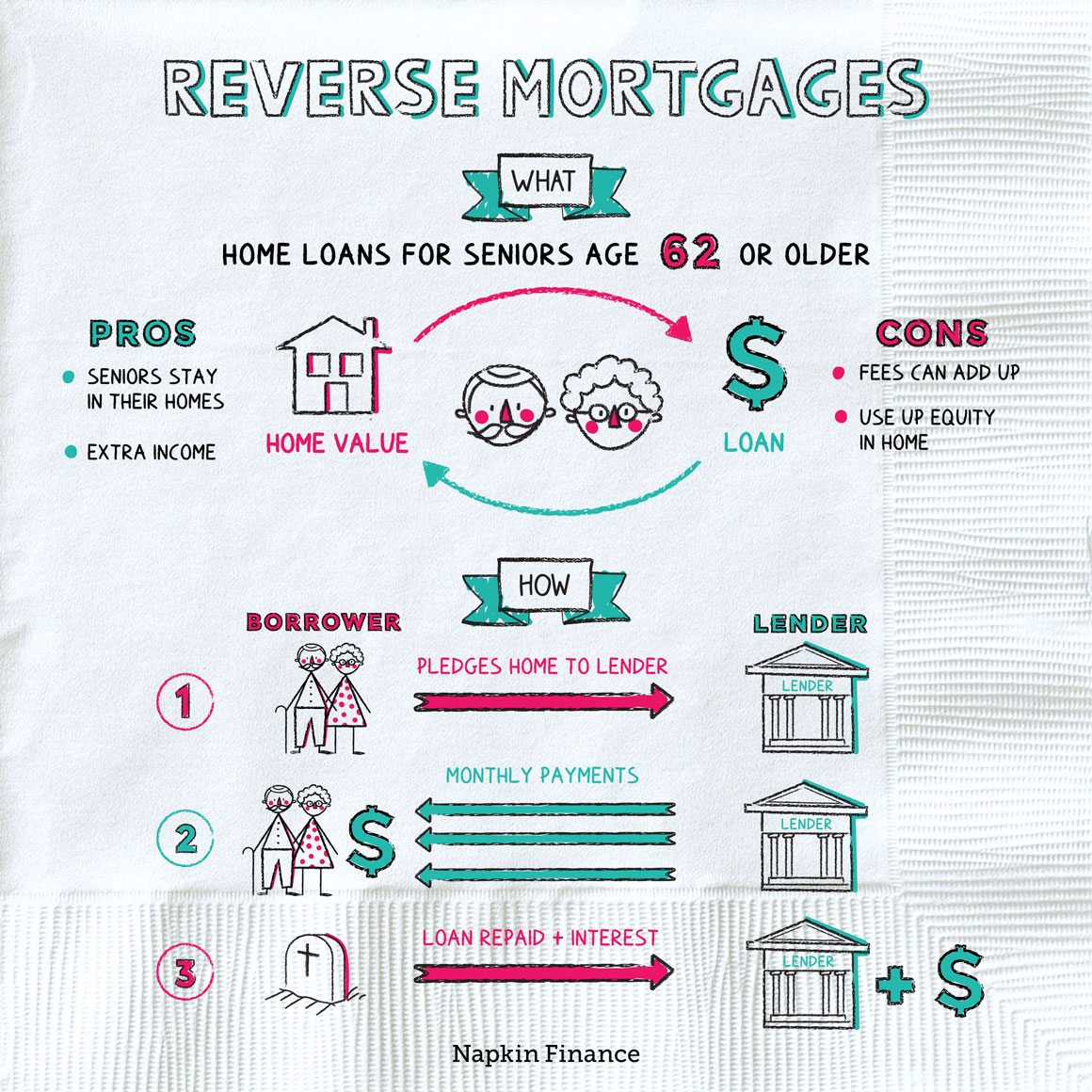

A reverse mortgage is exactly what it sounds like: instead of paying down a mortgage balance every month, a homeowner receives a steady paycheck every month—paid out of the equity they have accumulated in their home.

It can be a way for retirees to receive regular income from real estate that they own.

To take out a reverse mortgage, you must:

- Be 62 or older

- Own and live in your home

- Have enough equity in your home

The lender bases how much you can borrow on a number of factors, including your age, interest rates, and the amount of equity you have.

With a reverse mortgage, instead of paying the bank, the bank pays you.

A reverse mortgage is like steadily withdrawing money against the ATM of your home equity.

Here’s how it works:

You put up your house as security for the loan

↓

The bank offers to pay you a lump sum, monthly payment,

or other structure of payments

↓

The money first pays off any existing mortgage

↓

You can use the remaining money for

living expenses or specific expenses

↓

The loan balance increases over time

(as the principal you owe grows over time)

↓

When you die, the loan is paid pack out of

your estate (or sooner if you sell your house)

Reverse mortgages are mainly used by retirees who need regular income. Instead of making a monthly payment toward a mortgage balance, retirees can use them to receive a monthly paycheck that’s paid from their home equity.

They might use this money to:

- Fund day-to-day expenses

- Pay off their existing mortgage

- Make home improvements

- Cover medical expenses

- Pay off high-interest debt

There are three main types of reverse mortgages:

- Single purpose: Instead of regular income that you can use as you see fit, the lender dictates exactly what you can use the money for (such as home repairs or property taxes).

- Proprietary: These are private loans backed by an issuing company. Typically, the higher your home value and lower your mortgage amount, the more you can get.

- Home equity conversion (HECM): These loans are federally insured, and you can use them for any purpose. There’s usually a cap on how much you can borrow.

Both traditional and reverse mortgages relate to owning a home, and both require a lender, but that’s about where the similarities end.

| Traditional | Reverse | |

| What’s it for? | Used to build ownership in your home | Used to withdraw cash from your ownership in your home |

| Who’s it for? | Anyone | Homeowners aged 62 or over |

| How does repayment work? | Repay the balance over many years with interest | Loan is repaid (with interest) after you sell the house or die |

| Good to know | Build equity as you make your payments | Lose equity as you receive payments |

If you meet the age requirement and need a steady stream of money, then a reverse mortgage might sound like a pretty good deal. But bear in mind that there can be considerable risks:

| Pros | Cons |

| Lets seniors keep and stay in their homes | Fees can be significant—even higher than with a traditional mortgage |

| Can provide extra income to meet expenses | High interest can eat up your equity quickly |

| Could be cheaper than some home equity loans | Depletes your financial security over time |

Here are some other caveats to bear in mind when it comes to reverse mortgages:

- If you don’t pay your property taxes or homeowners insurance, your reverse mortgage lender can foreclose on your house.

- If you and your spouse are co-borrowers on a reverse mortgage and one of you moves to a long-term care facility or passes away, the other spouse might be able to remain in the home.

Ultimately, for most retirees—whether or not to get a reverse mortgage isn’t a home run. The benefits of receiving a steady monthly paycheck can be substantial. But so can the risks of bringing a new lender into your finances and depleting your home equity.

- The first reverse mortgage was written in 1961 to help the widow of a high school football coach stay in her home.

- The first home equity conversion mortgage was issued in 1989. Since then, more than one million Americans have received them.

Reverse mortgages can let retirees receive steady monthly paychecks out of the equity they’ve built in their homes—instead of making a monthly payment toward their outstanding mortgage balances. Although reverse mortgages can be convenient ways for seniors to pad their retirement income, they can also pose substantial risks.

- A reverse mortgage is like a home equity loan and allows older homeowners to borrow against the equity in their houses.

- Borrowers generally pay a reverse mortgage back after the house is sold or when they die.

- A reverse mortgage can provide steady cash flow or a lump sum payment to cover other debts.

- There are three main types of reverse mortgages: single purpose, proprietary, and home equity conversion.

- Although reverse mortgages can be convenient ways for retirees to access extra income, they can come with substantial risks and costs.