Rebalancing

Move Your Assets

Know how self-help gurus are always talking about “finding the balance” in your personal life? That same idea can apply to your money, too. Here’s what rebalancing your portfolio means––and why it matters.

Before diving into portfolio rebalancing, you need to know a few key terms about investing itself:

- Diversification: When your dollars are spread across multiple types of investments––usually a mix of different stocks, bonds, and cash. Diversification is the investing version of not putting all your eggs in one basket.

- Asset allocation: How much of each asset you hold. This depends on your “risk tolerance,” which is based on how much time you have to invest and how much risk you’re willing to take. (More time and risk appetite → higher risk tolerance → more stocks, fewer bonds.)

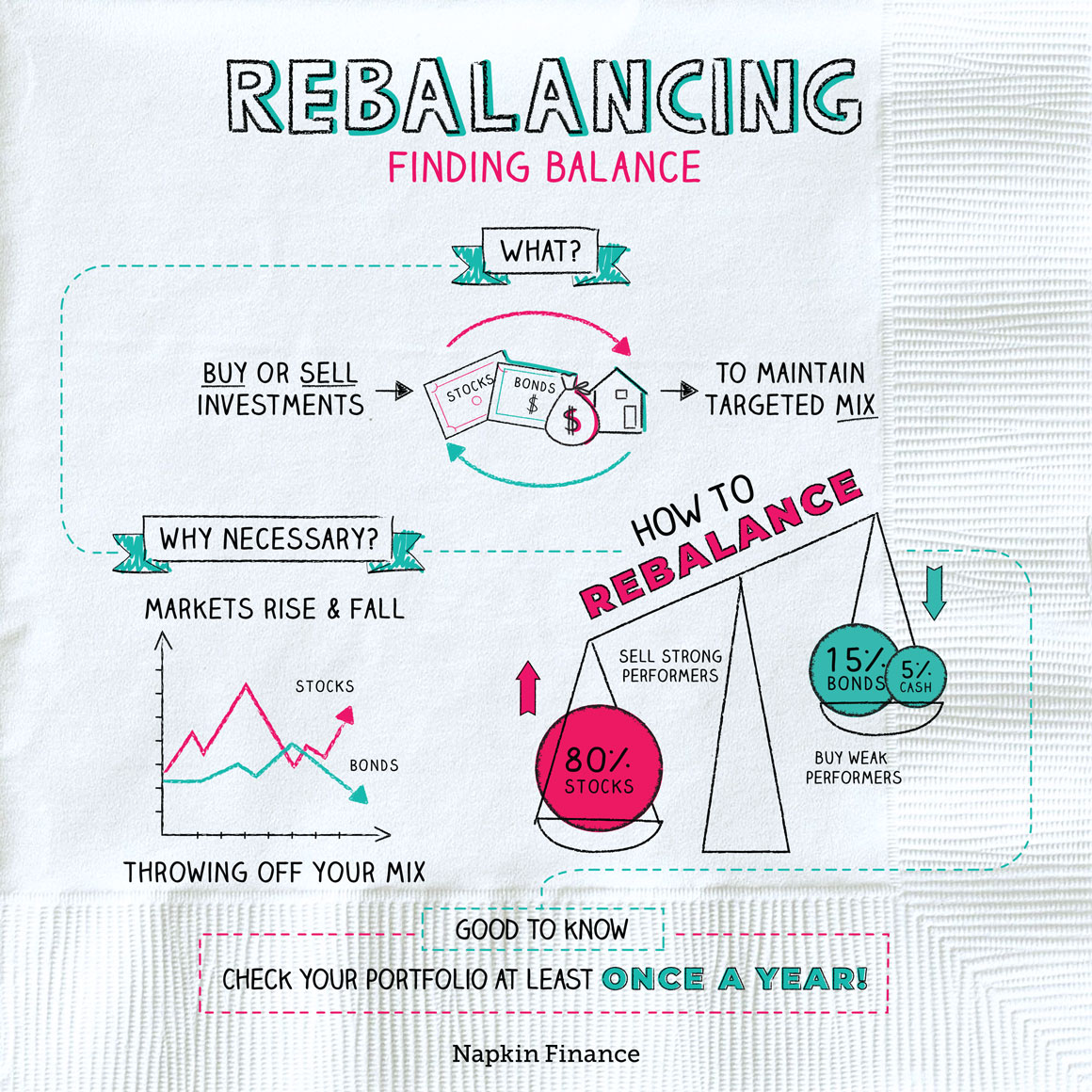

Putting those two concepts together can help you come up with the right mix of investments. But picking the right mix is only part of investing. The market is always changing, and when the market shifts, your portfolio shifts. Rebalancing is what you do to maintain your investment mix.

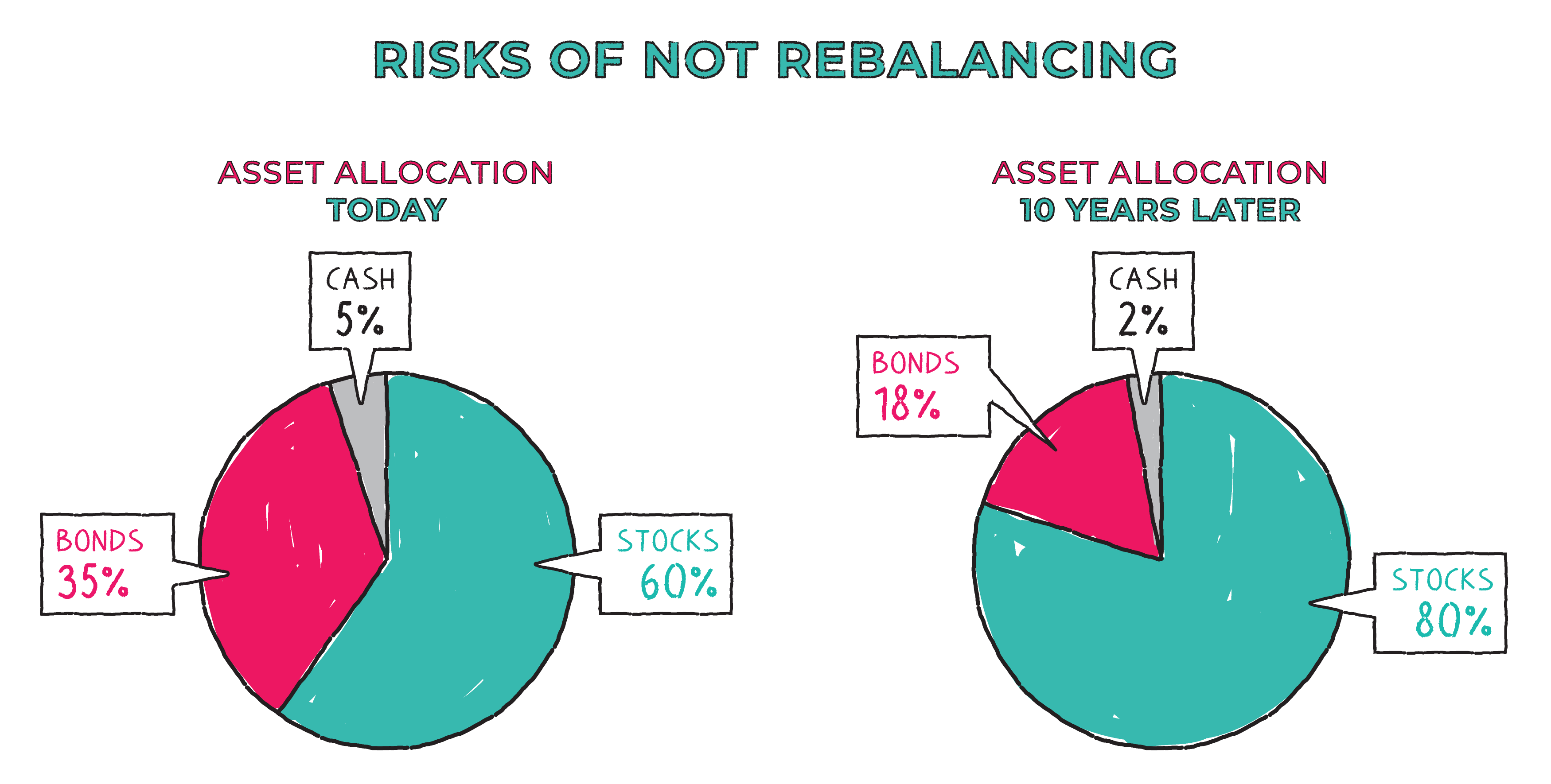

Suppose you’ve decided that the best portfolio for you is made up of 60% stocks, 35% bonds, and 5% cash.

You open a portfolio and invest your money… and then go on living your life, eating tacos, forgetting the account even exists. As the years pass, the value of your stocks gradually increases. In 10 years, your asset allocation is way off target––and you’re exposed to way more risk than you’d initially intended.

You might be saying, “Wait, what’s the problem here? My stocks grew a ton––shouldn’t I be celebrating?” And, yes, while it’s wonderful your investments gained in value, don’t forget that stocks can drop just as quickly as they rise.

So, though it’s tempting to let it ride, keeping 80% of your money in stocks means the overall value of your portfolio could plummet overnight. (In which case, you can say goodbye to Mai Tais on the beach in retirement.)

At a minimum, check your portfolio once a year. If each asset is within five percentage points of its intended allocation, you can let it lie. But if it’s more out of whack, then it’s time to rebalance, by either:

- Selling the high performers and reinvesting that money into lower performers

- Funnelling new money into lower performers

In other words, if your stocks did great and your bonds didn’t, you could sell off some of the stocks and use that money to buy bonds. Or you could keep the stocks, and use extra cash to buy more bonds.

Although rebalancing your portfolio won’t necessarily make you money, it does have several benefits (as well as a few downsides).

| Pros | Cons |

| Keeps your portfolio in line with your risk tolerance | Takes time and work |

| Keeps emotions out of your investment decisions | Can increase the trading fees you pay |

| Can help you buy low and sell high––the Holy Grail of investing |

If all that sounds like a lot of work––which TBH, it kind of is––then you have a few options:

- Hire a good financial advisor. An advisor can help you find the right investment mix, and many will do the work of rebalancing for you (for a fee). Many robo-advisors offer automatic rebalancing services.

- Pick a “target date” mutual fund. These funds are based on the year you want to retire and automatically adjust your asset allocation as you age. They are widely available at brokerage firms and in 401(k)s.

- Don’t rebalance at all. Some experts say it’s unnecessary, particularly if you have a long time horizon before you’ll need to sell your investments.

If you ignore your investments for too long, you may find that your actual investment mix has drifted far from your intended asset allocation. Rebalancing is when you buy or sell investments to bring your asset allocation back in line with your targets. Though not every expert thinks it’s essential, rebalancing helps you avoid taking on too much risk or trading on emotions––which are always good things.

- Rebalancing your portfolio means making sure your portfolio matches your desired asset allocation.

- As the market rises and falls, it can change your asset allocation and expose you to more risk than you’d intended.

- Most financial experts recommend examining your portfolio once a year to see how much your assets have shifted.

- If your assets are more than five percentage points off from your desired allocation, you should funnel money toward weak performers.

- If rebalancing sounds like too much work, you can let a financial advisor, robo-advisor, or target date fund do the work for you.

Rebalancing your portfolio is a way to manage your investment risk. When stocks and bonds shift in value, it can throw off your asset allocation and expose you to more risk than you should be taking on. You can rebalance by examining your portfolio each year and buying or selling investments until you’re back at your targeted mix. If rebalancing your portfolio sounds like too much work, consider hiring a financial advisor or investing in a target date fund.

- If you’d purchased $1,000 of Netflix stock at its IPO in 1992, you’d have more than $256,000 today. If you’d purchased $1,000 of Groupon stock? You’d now have… $231. Whomp, whomp.

- John Bogle, who invented index funds and founded investment firm Vanguard, is famously anti-rebalancing. He doesn’t rebalance his own portfolio and says the extra fees offset the gains for long-term investors.

- On April 19, 2016, Frenchman Nathan Paulin set the world record for slacklining by walking for over one kilometer on a narrow rope nearly 2,000 feet off the ground. Now that’s balance!