Lesson 4: Choosing Investments

It can be easy to feel overwhelmed by the prospect of choosing investments for your 401(k) or IRA—particularly if you don’t already have experience with investing.

But you don’t need to be some kind of stock-picking whiz in order to make good choices with your retirement investments. Chances are you’ll be just fine with one or two mutual funds that are offered in your plan. Instead of looking for hot, winning investments to give you a lotto ticket toward a lavish retirement, your aim is to build a sensible mix that you can, for the most part, set and forget.

Main decision

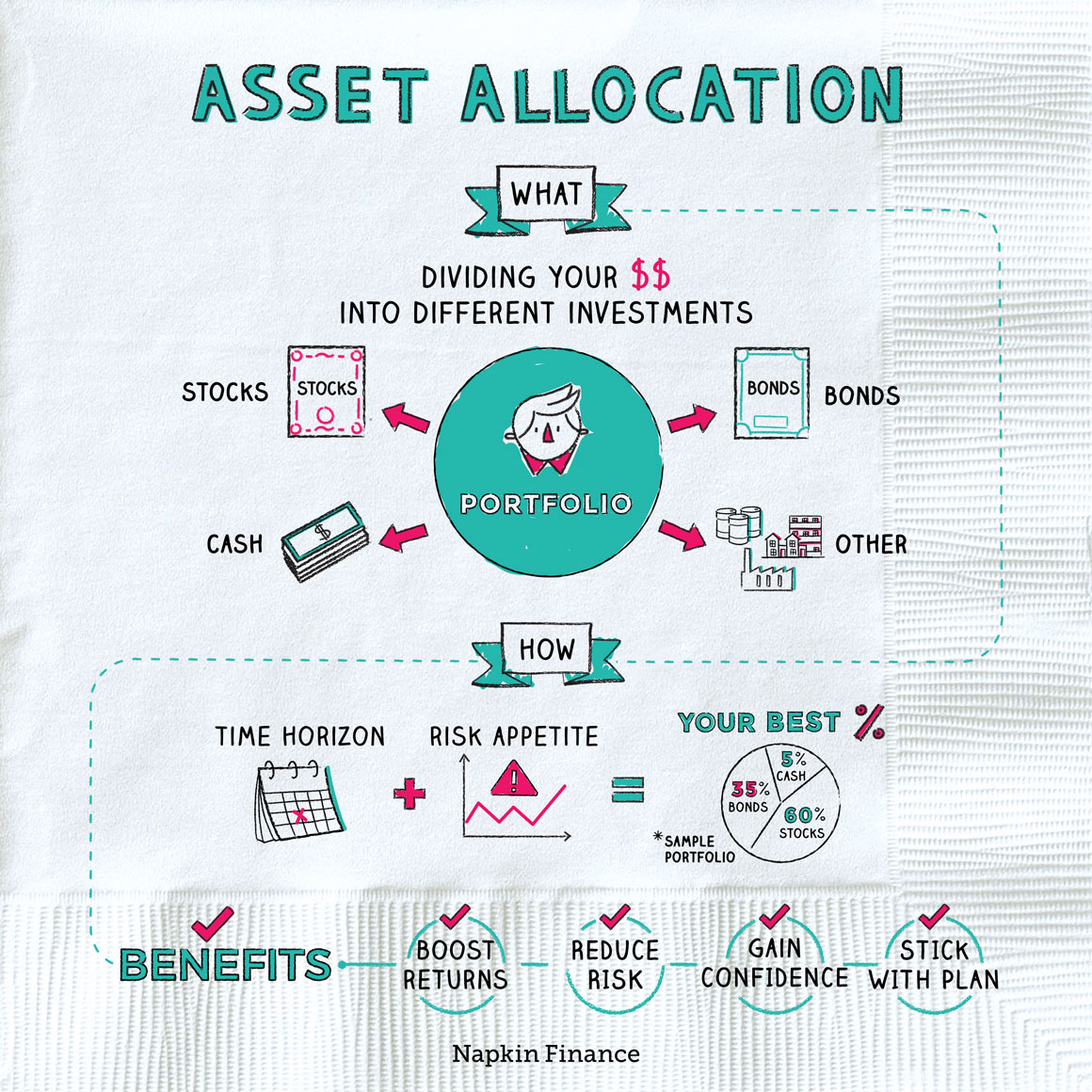

The main issue you need to decide when choosing investments for your retirement accounts is your stock/bond mix. (This is also known as your asset allocation.)

When you’re young, it probably makes sense to mainly hold stocks. That’s because stocks provide pretty reliable long-term growth (even though they can perform erratically in the short run or even lose money in a single year). As you near retirement, you’ll likely want to start shifting your portfolio toward bonds, which don’t usually return as much as stocks but also don’t take such extreme price swings.

Rule of thumb

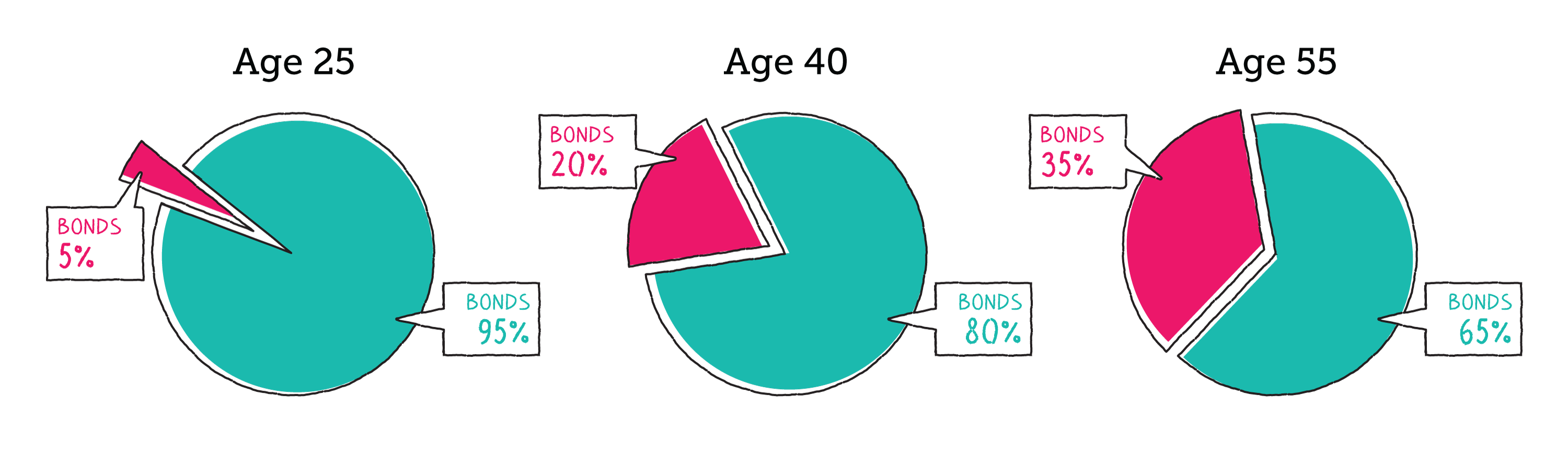

An easy rule of thumb to follow for choosing your mix is called the rule of 120. Just subtract your age from 120, and use that figure as your percentage allocation to stocks. Invest the rest of your money in bonds.

Here’s how your stock/bond mix would look at different ages if you follow the rule of 120:

Target date funds

Target date funds are mutual funds that automatically adjust their asset allocation over time. They’re designed to be one-stop shops for investing for retirement because they hold a diversified mix of investments that shifts over time to reduce risk.

Many investors choose to put their retirement savings into a target date fund because doing so can save you the headache of trying to build a well-rounded mix of individual funds on your own. Investing in a target date fund can be a solid option, but all investments come with trade-offs. Here’s what you need to know about target date funds:

| Pros: | Cons: |

|

|

The funds are designed to line up with investors’ expected retirement year. So if you decide to invest in a target date fund and you expect to retire around 2050, look for a fund that has “2050” in its name.

Fees

Although you might think that being a good investor is all about choosing the right stocks or funds, paying attention to fees can be as (or even more) important. That’s because you can’t control how much a particular stock—or the market itself—will return, but you can control how much you pay in fees.

Keeping fees down is particularly important when you’re investing for retirement because even small fee differences can really add up over the course of decades.

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.“

—Warren Buffett

Consider how different fee levels can eat into your savings over time. (We’re assuming you save $12,000 a year, and that your investments earn 7% per year before fees.)

| 0.2% fees

(low) |

1% fees

(moderate) |

2% fees

(high) |

|

| After 10 years | $164,239 | $158,170 | $150,935 |

| After 20 years | $481,335 | $441,427 | $396,791 |

| After 30 years | $1,093,548 | $948,698 | $797,266 |

So how do you know what counts as high or low fees? Here’s how average fees recently added up for the main types of mutual funds. Higher than these would be higher than average, and lower would be lower than average:

| Type of fund | Average management fees |

| Stocks | 0.55% |

| Bonds | 0.48% |

| Target date | 0.40% |