Lesson 5: Investing During Retirement

Once you get to retirement, your entire approach to investing may need to shift. That’s because in retirement you’ll need to start withdrawing money from your accounts—i.e., turn those stocks, bonds, and other investments into cash.

Generating retirement income can create tough decisions—like how to restructure your portfolio, which investments to sell and when, and how much to withdraw. One added source of uncertainty is that no one knows how long they’ll spend in retirement—whether three years or 30—so you have to juggle the priorities of giving yourself enough to live on while leaving enough in your accounts so that you won’t run out of money if you end up living longer than expected.

The basics

There are four main strategies for investing in retirement:

- Income investing

- Total return investing

- Bucket investing

- Investing in annuities

Next, we turn to a deeper dive on each of those strategies.

Income investing

With income investing, you focus on holding investments that pay a steady or high stream of income—through coupon payments from bonds and dividend payments from stocks. The main types of income investments are:

- Dividend-paying stocks

- Bonds

- Real estate investment trusts (REITs)

Retirees who use income investing often aim only to withdraw the income their portfolio generates. So, for example, if a retiree has a portfolio of $1,000,000 in income investments and those investments generate about $10,000 in interest and dividend payments each quarter, the retiree would only withdraw and spend that $10,000 per quarter (or $40,000 per year) and leave the rest of the money untouched.

The main advantage of this approach is that it allows you (hopefully) never to run out of money—because you never withdraw your investing principal. The main drawbacks are that it limits your universe of investments and leaves you little flexibility in how much money you withdraw each period.

Total return investing

Unlike income investing—which limits your universe of investments—with total return investing, you can potentially own anything. The aim—as it was with investing during your working years—is to hold a diversified mix of investments that takes on the right amount of risk for you.

What’s different about total return investing in retirement is that every year (or every month or quarter—or however often you need to take money out of your portfolio), you need to sell some investments in order to take withdrawals.

The pros of a total return approach are:

- No limits on what you can invest in

- Based on solid theory (academics tend to like this approach)

- Lots of flexibility

The cons of a total return approach are:

- More complicated to use

- More decisions to make, such as:

- Which investments to sell when you take withdrawals

- How much to withdraw each period

- Fewer rules can = easier to make a mistake

Bucket strategy

With a bucket strategy, you divide your money into different buckets—each of which has a different investing time horizon. There’s no one right way to do it, but a common approach is:

| Short-term bucket | Medium-term bucket | Long-term bucket | |

| Purpose | Fund your living expenses for the next 2 years | Fund your expenses for years 3 through 10 | What you’ll live on after 10 years |

| Percent of portfolio | 8% | 32% | 60% |

| Investments it holds | Cash (or cash equivalents, like CDs) | Bonds | Stocks and other high-growth investments |

The big advantage of a bucket strategy is that you always know where your near-term living expenses will come from. That can give you peace of mind if the stock market crashes because you know you’ll have 10 years for your stock holdings to recover before you actually need that money to live on.

The downside is that it still requires lots of maintenance. You’ll periodically need to “refill” your near-term and medium-term buckets—and that means choosing some investments from your long-term bucket to sell.

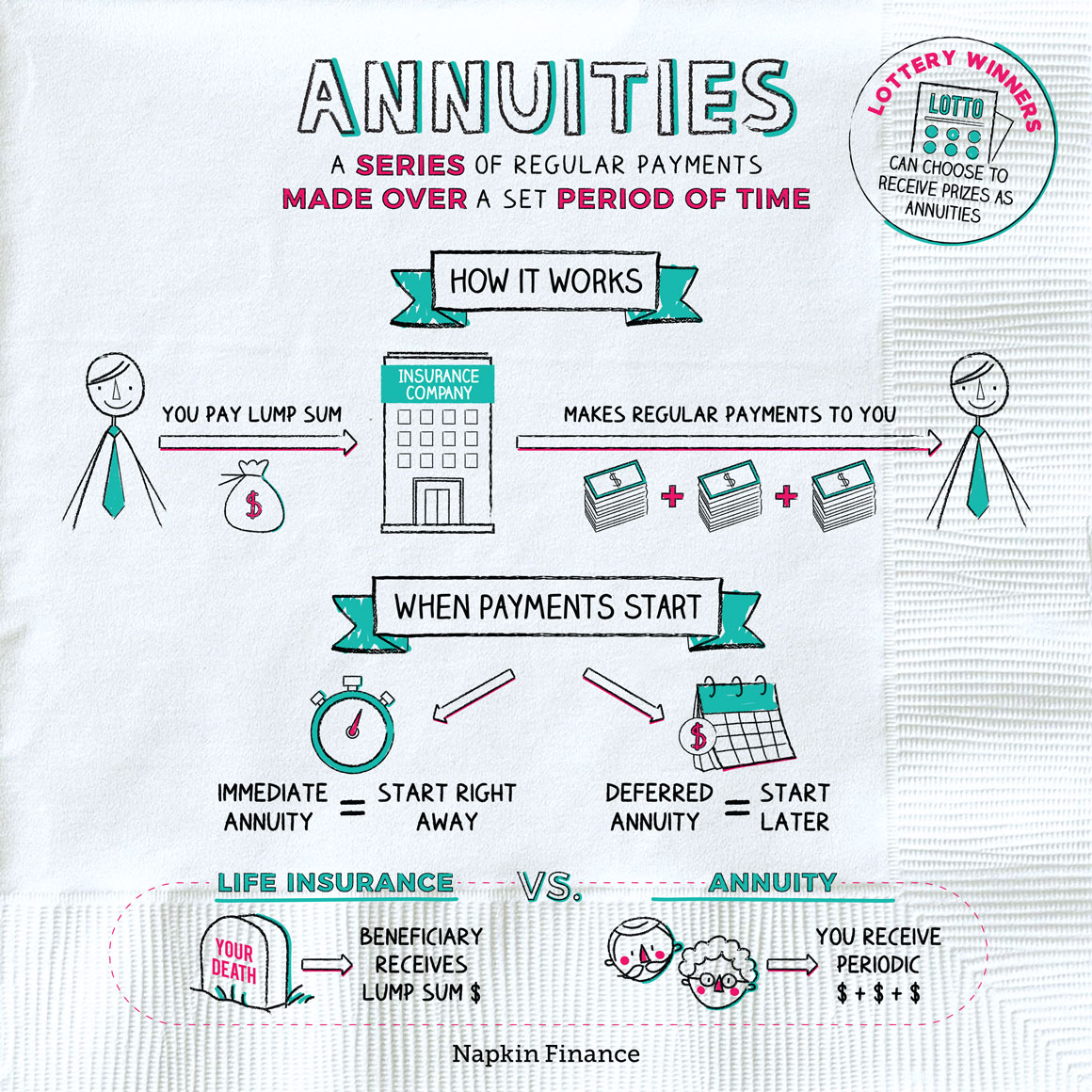

Annuities

With an annuity, you pay a big sum of money to an insurance company now, and in exchange the insurance company pays you a steady stream of income for the rest of your life. That’s the most basic form of an annuity—although they can also come with a variety of features and terms.

Buying annuities isn’t a comprehensive investing strategy. But they can be a useful addition to a retirement income strategy because of the benefits they offer, including:

- Reliable income

- With an annuity, you have certainty as to how much money you’ll receive and when.

- Lifelong payments

- For many retiree investors, a big worry is the possibility that they’ll outlive their money. With an annuity, you can count on that income for as long as you live.

- Guaranteed

- Although annuities aren’t backed by FDIC insurance, they are guaranteed by the insurance company and usually considered very safe.

Here are a few of the ways you can use an annuity in a retirement income strategy:

| Strategy | Pros | Cons |

| Put all your money in one or more annuities | No headaches in managing investments; reliable stream of income | No chance at growth; income you receive may lose value to inflation over time |

| Buy an annuity only to cover basic living expenses | You’ll never be completely broke; your other money can still be invested for growth | Other money could run out; income from an annuity may lose value to inflation over time |

| Buy an annuity that won’t start payments until you’re much older (such as in your 80s or 90s) | Peace of mind that you won’t outlive money; highly cost-effective if you buy one of these annuities when you’re younger | You could die before the annuity kicks in = that money is lost |