Lesson 3: How Much to Save?

Unless you’re lucky enough to be a very high earner, chances are the challenge you’re facing is managing to save enough for retirement (rather than the possibility of saving too much). If that’s the case, you should generally aim to save as much as you reasonably can and boost your savings whenever you can (such as whenever you get a raise).

Rules of thumb

Over time as you’re able to gradually increase your savings rate, try to hit these savings milestones:

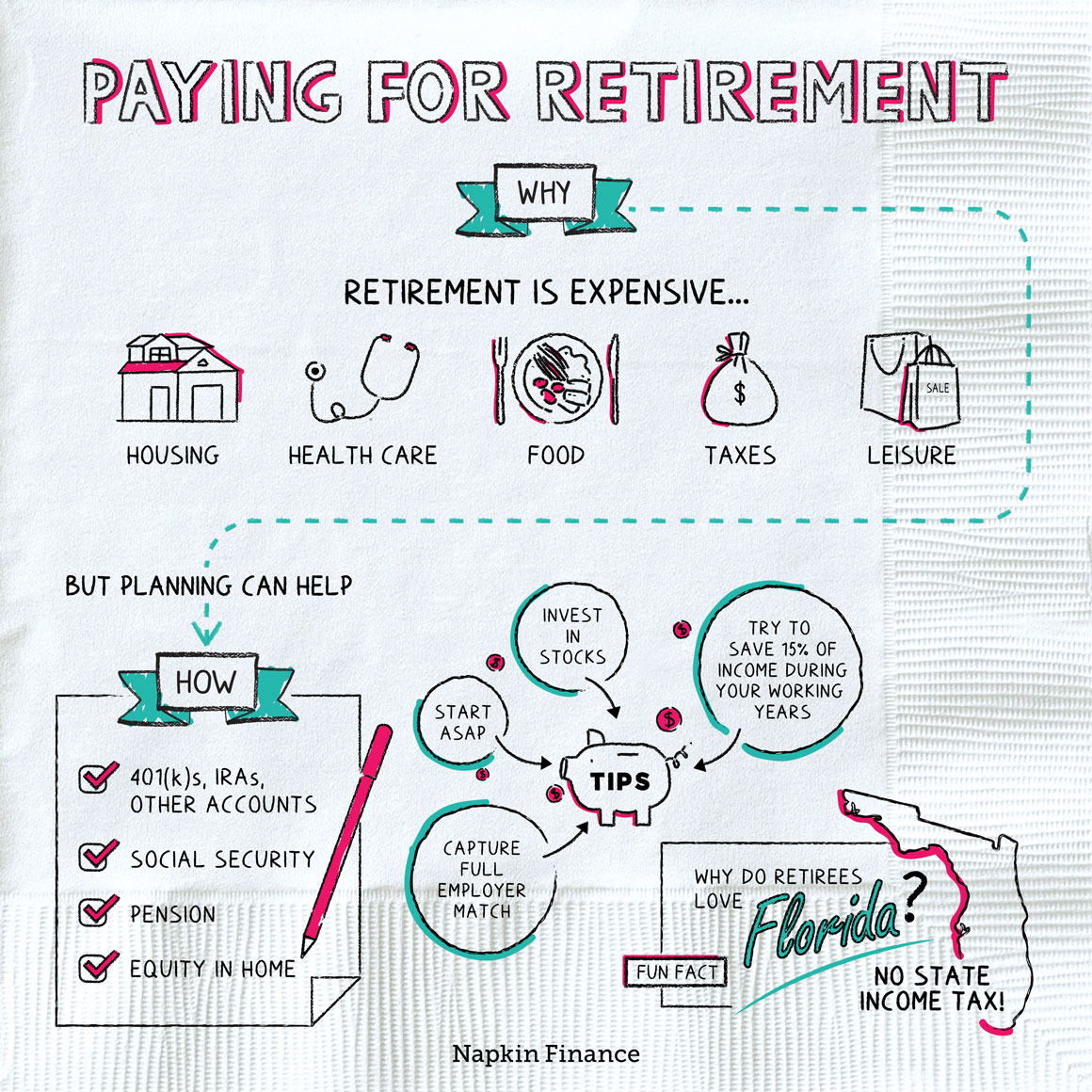

- Milestone #1: Capture the full employer match.

- Many employers will match (or partly match) what you save in their plan, such as matching every dollar you contribute up to 6% of your salary. That’s free money, so try to reach this milestone as soon as you can.

- Milestone #2: Saving 15% of your pretax salary.

- Lots of experts say this is a solid long-term savings rate to aim for. Even better, you get to count your employer’s contributions toward this goal. So if you earn $100,000 and your employer matches the first 6% you contribute, you can hit the 15% (i.e., $15,000) mark by contributing $9,000.

- Milestone #3: Max out your annual 401(k) contributions.

- Now you’re really socking it away! The IRS limits how much you can save each year in a 401(k) or other employer-sponsored plan (and this limit typically increases every year or two). As your salary increases over your career, try to get to the point that you can contribute the maximum every year.

- Milestone #4: Max out and still save more.

- As your income increases over time, you may be able to max out your employer’s plan but still save more (in fact, you may need to in order to keep up that 15% savings rate). Depending on your situation, you may be able to save more in another retirement plan, such as a Roth IRA, or you may need to stash extra savings in an ordinary brokerage account.

Check your progress

Even if you’re doing everything you can to save as you go, you may still want to check your overall progress from time to time to see if you’re on track. Two main ways you can do so are by:

- Comparing your total savings with your salary.

- This is a quick and easy method that compares your total balance in your retirement accounts with your current salary. According to experts at Fidelity Investments, you want to aim to have saved:

- 1x your salary by age 30

- 3x your salary by age 40

- 6x your salary by age 50

- 8x your salary by age 60

- This is a quick and easy method that compares your total balance in your retirement accounts with your current salary. According to experts at Fidelity Investments, you want to aim to have saved:

- Using a retirement calculator.

- If you’re looking for a deep-dive analysis, there are retirement calculators that let you factor in Social Security, your tax rate in retirement, and more.

- Others are simpler and can give you a projection of how much you’ll have by retirement or a quick-take on whether you’re on track.