Diversification

Spread Your Bets

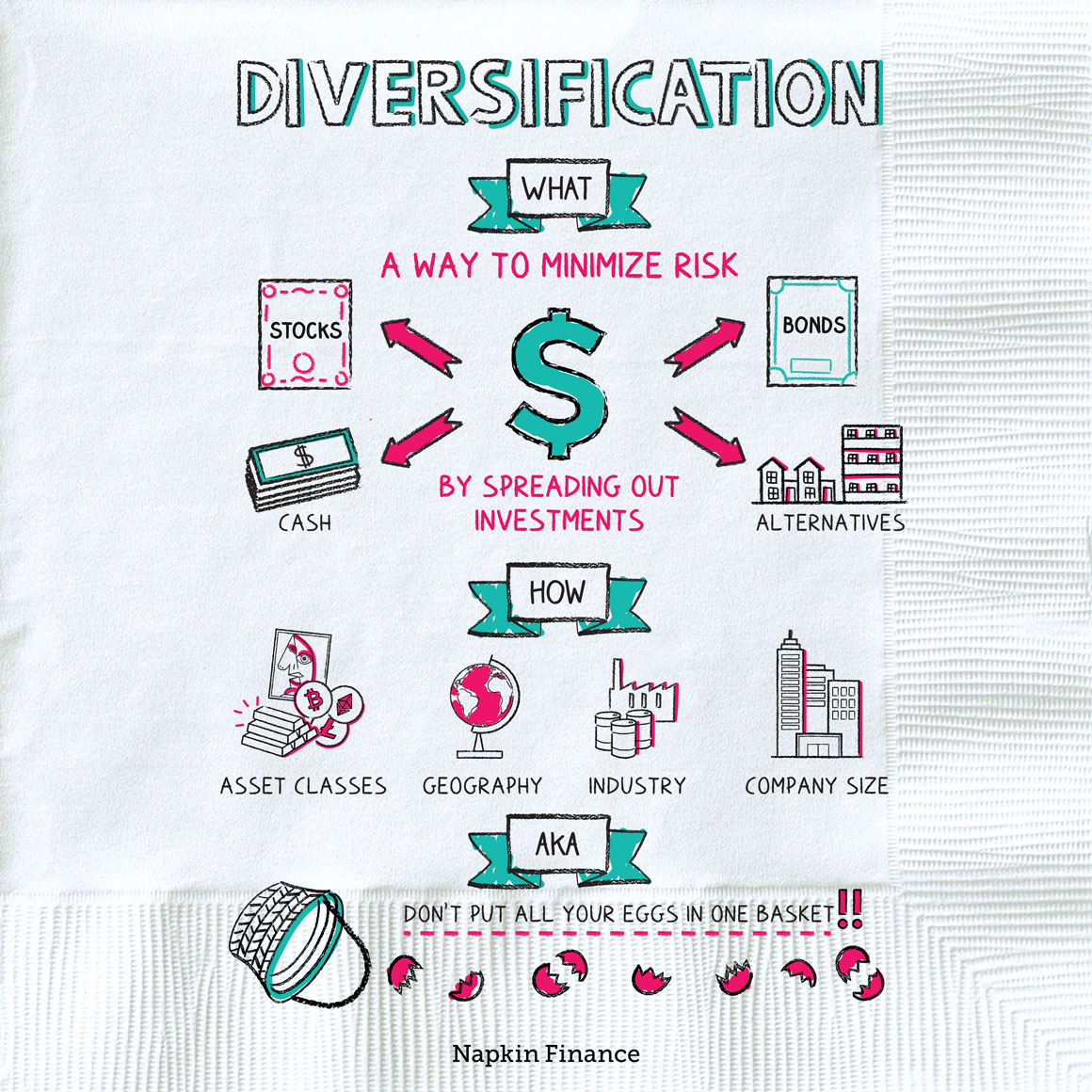

Diversification is the practice of dividing your money among lots of different types of investments. It’s the investing version of spreading your bets.

The stock market is a lot like riding a rollercoaster, with plenty of exhilaration and stomach churning drops. Diversification lets you smooth out the ride.

The basic idea is this: If you have different investments and the value of one falls, your other investments can help stabilize your portfolio’s overall returns.

How exactly does that happen? Investments don’t usually move as a group. If oil is down, tech stocks might be up. Or, if small company stocks are struggling, large companies could be doing well. So, if one of your investments loses value, the others might decrease less, hold their value, or even increase.

You can never completely eliminate investing risk, but diversification can significantly reduce it. The more you spread out your money, the less likely a dip in one part of the market will tank your entire portfolio.

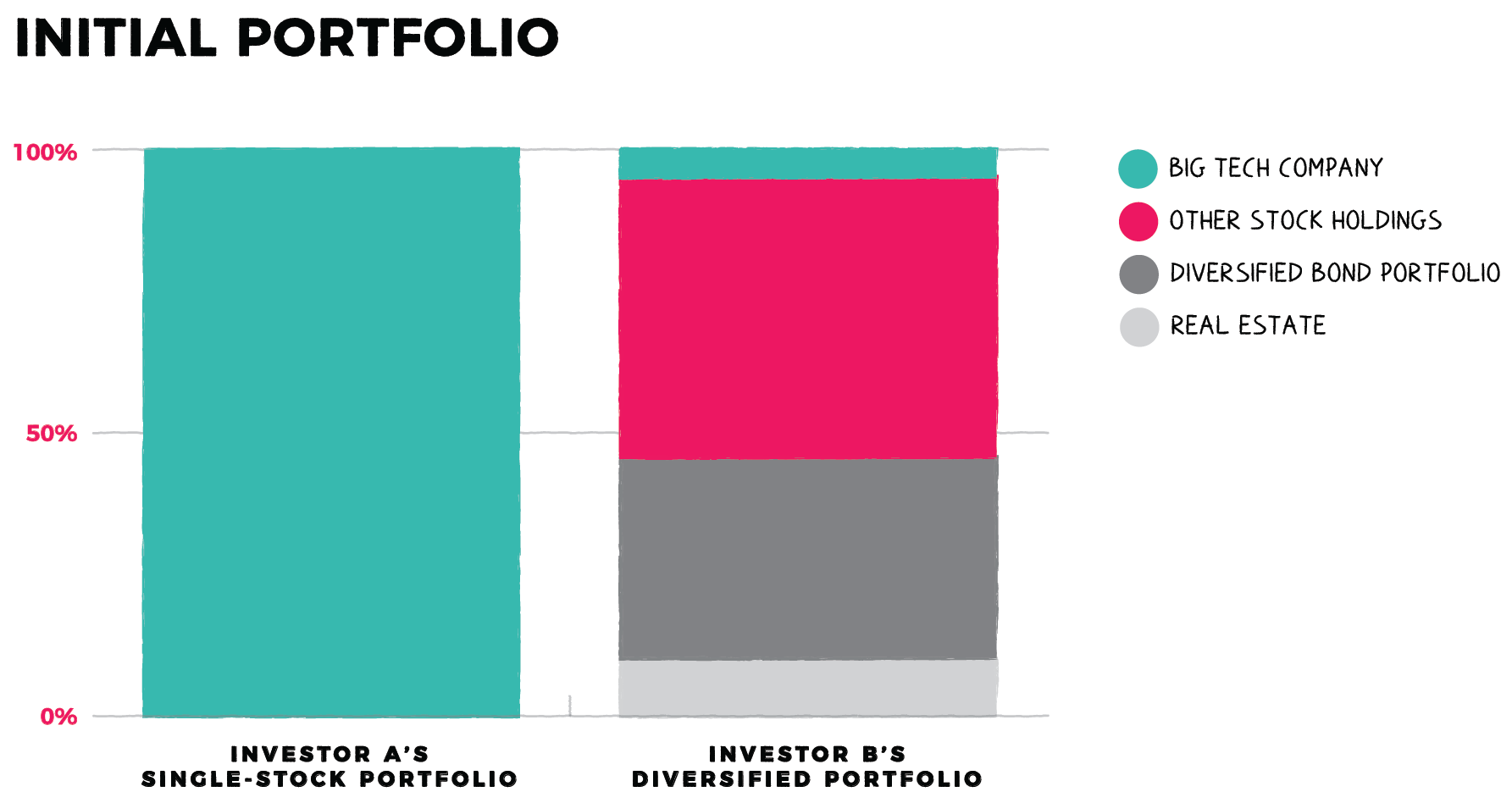

Consider two investors’ portfolios:

- Investor A: 100% invested in Big Tech Company

- Investor B: A mix of stocks, bonds, real estate, and a little of Big Tech Company

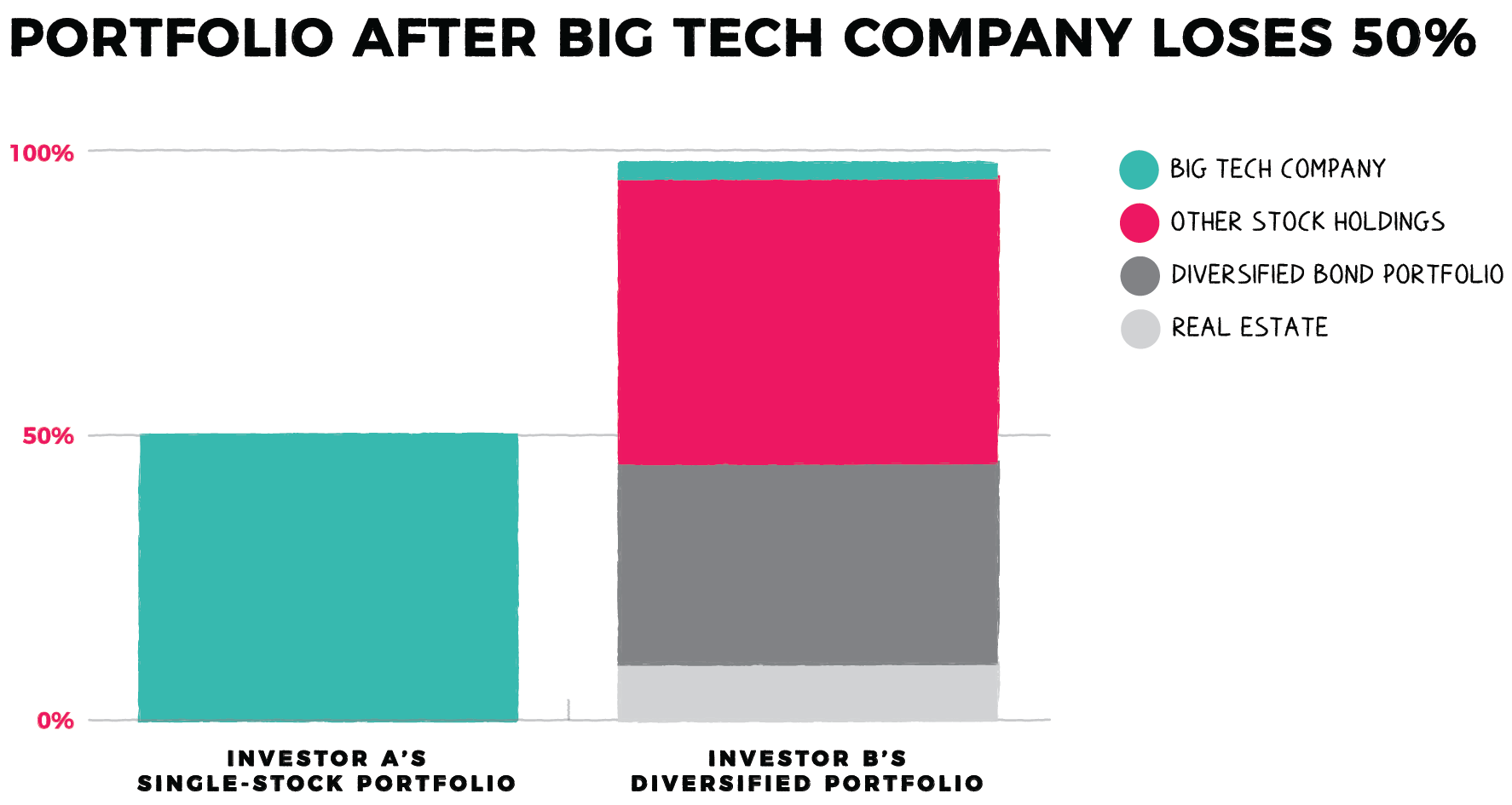

If Big Tech Company suddenly suffers a 50% drop, Investor A’s portfolio will also fall 50%. On the other hand, because Investor B has a diversified portfolio, they’ll only lose a little bit (assuming the portfolio’s other investments hold their value).

If Big Tech Company suddenly suffers a 50% drop, Investor A’s portfolio will also fall 50%. On the other hand, because Investor B has a diversified portfolio, they’ll only lose a little bit (assuming the portfolio’s other investments hold their value).

Investing experts disagree about a lot of things, but they tend to agree that diversifying is a great strategy. Here are some of the advantages:

- Reduced risk. The more you spread your money around, the less you stand to lose if any one or two of your investments tank.

- Smoother returns. Any one investment might rise or fall in price from year to year. But holding a broad range usually reduces the bumps.

- Better chances at finding winners. Every investor wants to get in on the next Google or Amazon. The more investments you own, the better your chances of doing so.

“Don’t look for the needle in the haystack. Just buy the haystack.“

—John Bogle

You can diversify according to:

| Asset classes | Consider holding a mix of stocks, bonds, cash, and alternative investments. |

| Geography | The U.S. can be a great place to invest, but other countries’ investments may offer better returns when the U.S. hits a recession. |

| Industry | In some years, tech companies may be the best-performing investments, while in other years healthcare companies (or another industry) may be. It can make sense to hold a bit of everything. |

| Bond issuer type | For your bond investments, consider holding a mix of corporate, federal government, and state and local government bonds. |

| Company size | Small companies tend to do better during strong economics, while larger companies tend to do better during recessions. Consider investing in both. |

Diversification is a strategy of spreading your money around with many different investments. Because investments don’t usually move as a group, diversification can help insulate you from the ups and downs of any single stock and even out your overall returns. There are many ways to diversify your investments, including by investing in different industries, geographic regions, and asset classes.

- Diversification is often called “the only free lunch” in investing because it can reduce risk without reducing returns.

- The word diversification comes from the Latin words diversus, meaning “turned in different ways,” and faciō, meaning “to make” or “to do.”

- Some investors diversify with precious metals. Gold often performs well during stock market crashes when investors are looking for safe havens.

- Diversifying is the act of spreading your money around with many kinds of investments.

- The benefits of diversification can include reduced risk, better chances at holding winners, and smoother performance.

- You can diversify by investing in different asset classes, countries, and industries, among other ways.