5th Period: Making Money Work For You

Making your money work for you is about controlling your finances. At its most basic, this happens in a three-step process:

Earn it (whether through work, investing, or another source)

↓

Limit how much goes out

↓

Protect and grow what you have

Let’s explore each step a little more.

Step one: Earn it

To make money work for you, you first have to earn it. As we covered in the earlier periods, you might earn money from a job, getting an allowance from your parents, turning your big idea into a company, or buying high-performing investments.

Pro tip: Getting an advanced degree or working hard to bring a business idea to life can help increase your earning potential.

Step two: Limit how much goes out

No matter what happens in your financial life, you don’t want to spend more money than you’re taking in. Creating a budget—which tracks how much money is coming in and how much you are spending rather than saving—can help keep you on track.

A good way to start is by figuring out how much money you receive in a month and then calculating how much you spend on necessary expenses (like food or gas). You can set aside anything left over after expenses for savings or to spend however you choose.

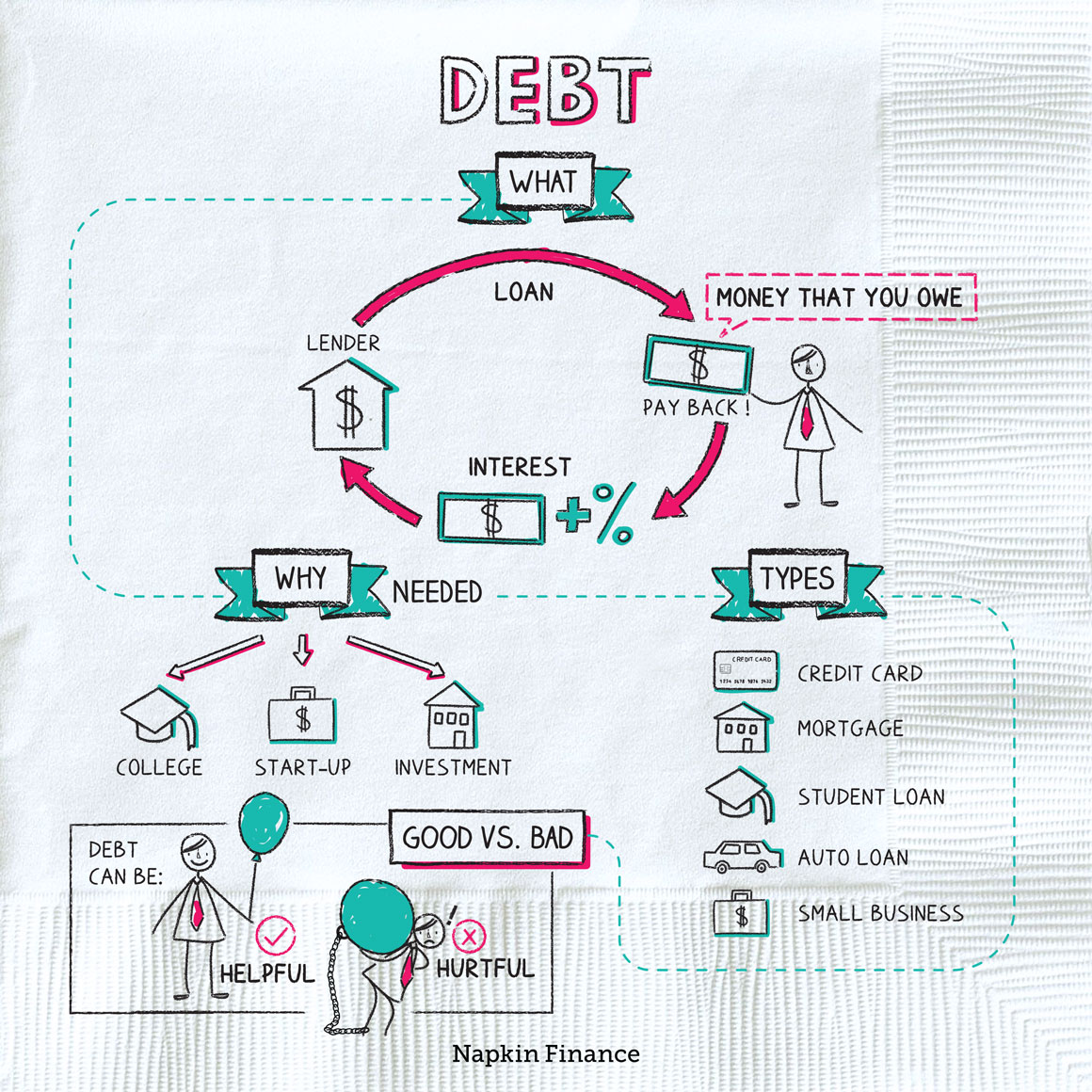

A word about debt

As you get older, you may need to borrow money at times. You might one day get a loan to pay for college, buy a car, or buy a home. You might even already have access to a credit card for emergencies.

Debt isn’t always terrible, but it is something to always take seriously. Debts have to be repaid, usually by a certain date and often with interest (that’s the fee you pay for borrowing money). How you use debt also affects your credit score, which can have a big influence on your financial success later in life.

The takeaway? It’s important to carefully balance whether you really need something before borrowing (college: probably yes; the latest sneakers when you already have a perfectly good pair: probably no).

Pro tip: Keep any upcoming debt payments in mind when putting together a budget. If you miss a payment, the lender will charge additional fees, and a negative mark will show up on your credit report—limiting your financial options in the future.

“I’m gonna be on a budget until the day I die.“

—Cardi B.

Step three: Protect and grow what you have

Once you have some money, you can use it to make more money by opening up a savings account (the bank will pay you a little “thank you” for keeping your money with them) or invest it (and you’ll earn money when your investments are doing well).

As you get older and start making more financial transactions, you’ll also have to worry about keeping it safe online. That might mean:

- Using two-step authentication with your bank and credit card company

- Using strong passwords

- Being cautious with unsecured Wi-Fi networks

- Watching out for phishing scams

Pro tip: Protecting your money extends to keeping it physically safe (because you can’t spend or save money that someone has stolen). A bank account is definitely safer than a jar under your bed.

Talk it through

- What are the main things you spend money on right now?

- If you were able to spend less and save more, what would you do with your savings?