What does a financial advisor do?

A financial advisor can be anyone who provides advice or assistance with your money decisions. Investment advisers, lawyers, accountants—and yes, even robots—can be financial advisors. A financial advisor doesn’t have one specific role (the way, say, a tax preparer does).

Learn more

Fun facts about retirement

- Thinking of hiring a robot as your financial advisor? It’s a popular choice, with assets managed by so-called robo-advisors growing to almost $300 billion in recent years.

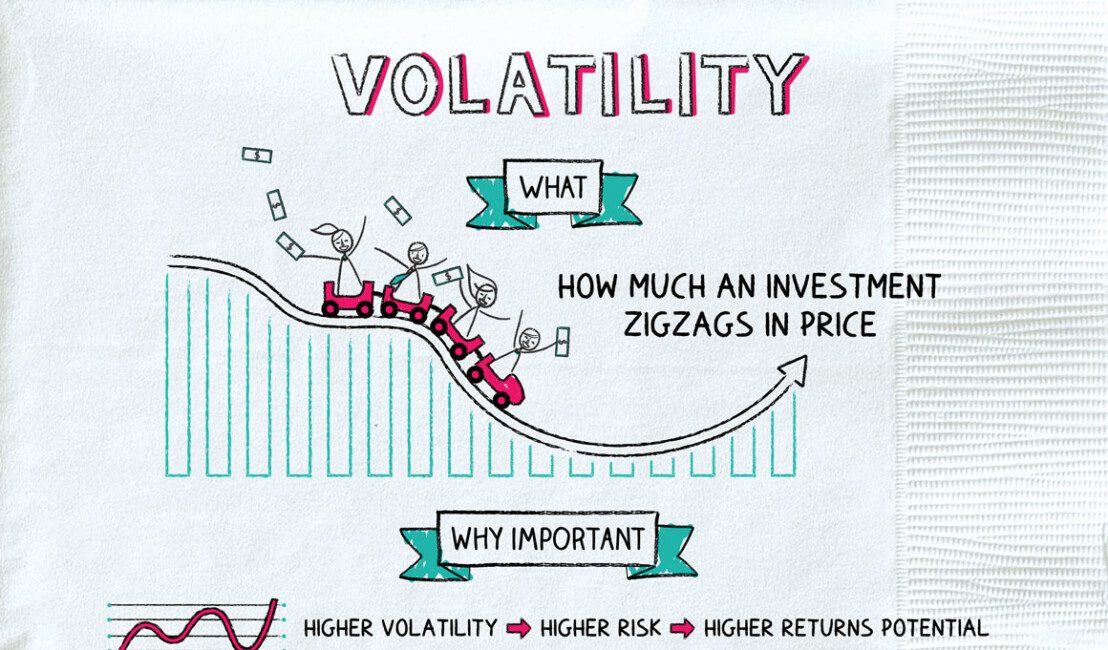

- The biggest drawback of using a robo-advisor has typically been that they can’t offer a shoulder to cry on—like when you’re scared about market volatility or trade wars. But increasingly, robo-advisors are offering phone access to live financial planners alongside their existing tech-based offerings (because sometimes, even millennials want to talk to a real human).

- In decades past, financial advisors (who were usually brokers) mainly focussed on getting their clients in on the hottest investments. These days, more advisors engage in “goals-based” or “holistic” financial planning—which can entail looking at issues like asset allocation, taxes, debt, saving for college, estate planning, and more, in one swoop.

- The largest “Registered Investment Advisor” (or RIA) is a company called CAPTRUST, with almost $300 billion in assets. The largest “broker dealer” (another flavor of advisory firm) is LPL Financial, with about $630 billion in account assets.