Power of Attorney

More Power to You

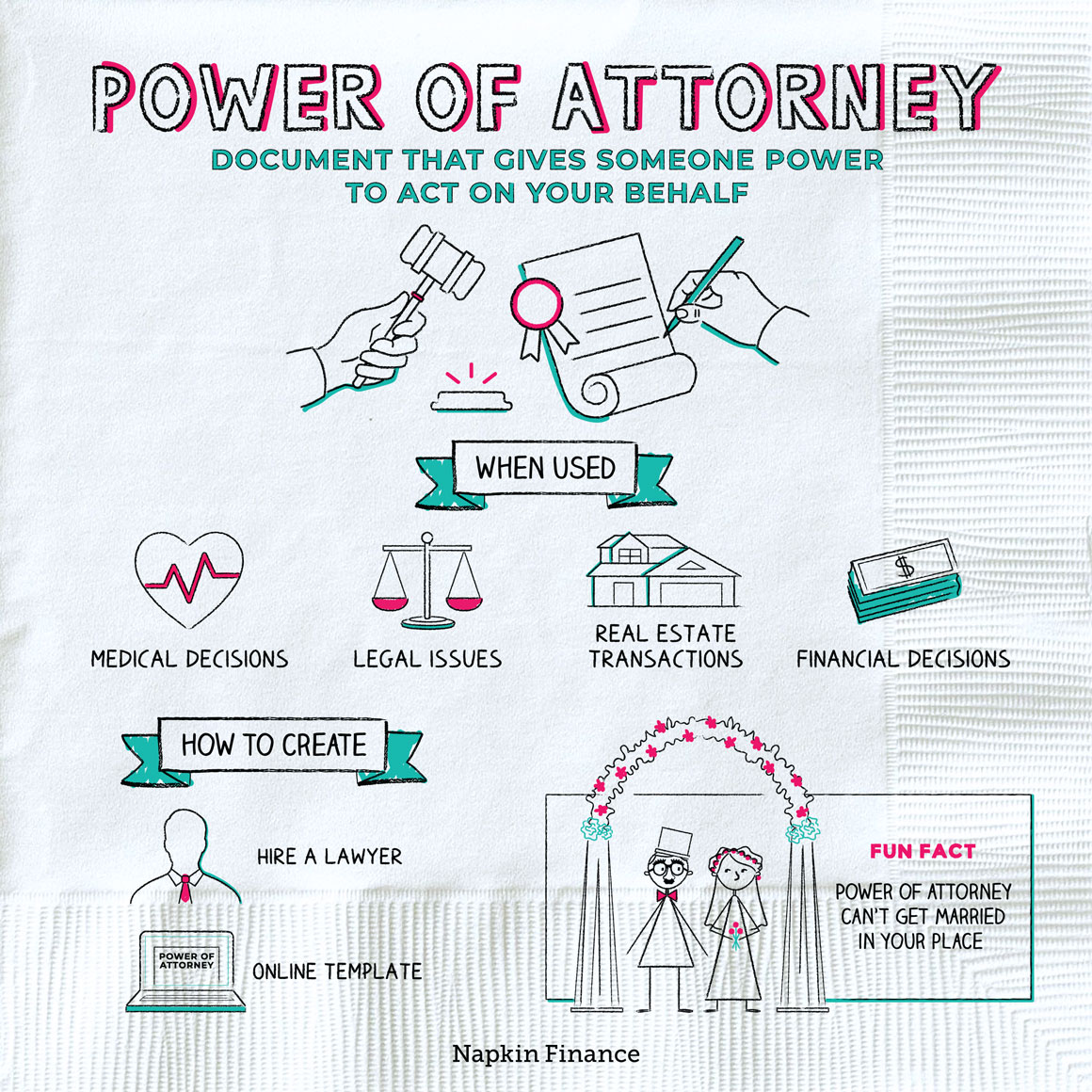

A power of attorney is a document you can create if you want to give someone else the authority to act or make decisions on your behalf.

It’s a tool people can use to make sure that someone they trust will handle their decisions if there’s ever a situation (usually legal or medical) when they can’t or don’t want to make their own.

If you’re the one creating the power of attorney, you’re called the “principal.” The person who you give authority to is called the “agent” or “attorney in fact.”

You can generally decide whether to give authority over lots of types of decisions or only covering a few specific areas, such as:

- Property

- Finances

- Contracts

- Legal actions

- Healthcare

There are various specific types of power of attorney, which can provide different levels of authority. The most common include:

| Type | What it is |

| General |

|

| Special (limited) |

|

| Healthcare |

|

| Durable |

|

| Springing |

|

Agents are legally bound to act and make decisions only in the principal’s best interest, but they still have a lot of freedom. This makes it important that you carefully consider who should act as your agent. Ask yourself:

- Do I trust them?

- Do they understand my wishes?

- Will they do what I ask?

- Do they have the needed knowledge or expertise for any issues that might come up?

- Will they keep in touch with me when necessary?

People often choose a trusted family member or friend for the role. Keep in mind that the agent you choose is legally liable for intentional misconduct but not unknowing mistakes.

Some people create a power of attorney themselves or using online templates, while others may choose to hire a lawyer. A lawyer can also review the document to make sure it’s legally enforceable (i.e., that a judge would think it’s legit) and does what you want it to do.

To make sure your power of attorney will hold up (legally) when you need it, be sure to sign it with witnesses present and have it notarized. Certify all copies made.

You’re free to revoke your power of attorney at any time by destroying the copies or providing written notice to the agent. Your letter should include:

- Your name

- The date of the letter and the date you executed the original power of attorney

- Evidence that you’re of sound state of mind

- A statement that you wish to revoke the power of attorney

- The name of the agent

- Your signature

It’s a good idea to collect any copies of the power of attorney and let your bank and other financial institutions know it’s no longer in force. For extra protection, sign your letter in front of witnesses and have it notarized.

A power of attorney lets you give authority to someone else to act on your behalf. These powers may be specific to a certain event (such as a home purchase) or more general. If you’re creating a power of attorney, think carefully about whom you’re choosing and pick someone you think will act in your best interest and respect your wishes.

- A power of attorney can’t take your place in a marriage ceremony or sign your marriage license on your behalf.

- You can thank (or blame) a power of attorney for Go Set a Watchman. The book was published under the direction of author Harper Lee’s power of attorney (who was also her actual attorney at the time) amid controversy over whether it was truly what Lee wanted.

- Power of attorney battles can get pretty nasty. Apollo 11 astronaut Buzz Aldrin was locked in legal battles with his kids after revoking his son’s power of attorney over his affairs. Aldrin accused his kids of slandering his good name and pilfering his money. His kids claimed that Aldrin was suffering from dementia and being exploited for his money by a set of new friends. (Both sides eventually dropped their cases.)

- A power of attorney is a document giving authority to another person (an agent) to act on your behalf.

- You can choose to give your agent general authority or specific powers.

- Powers of attorney can be used for financial, healthcare, real estate, and other matters.

- The power of attorney is automatically revoked after you die. You can also terminate it at any point (so long as you’re of sound mind).

- It’s important that you choose your agent carefully and pick someone you trust who will act in your best interest.