Trustee

Handle With Care

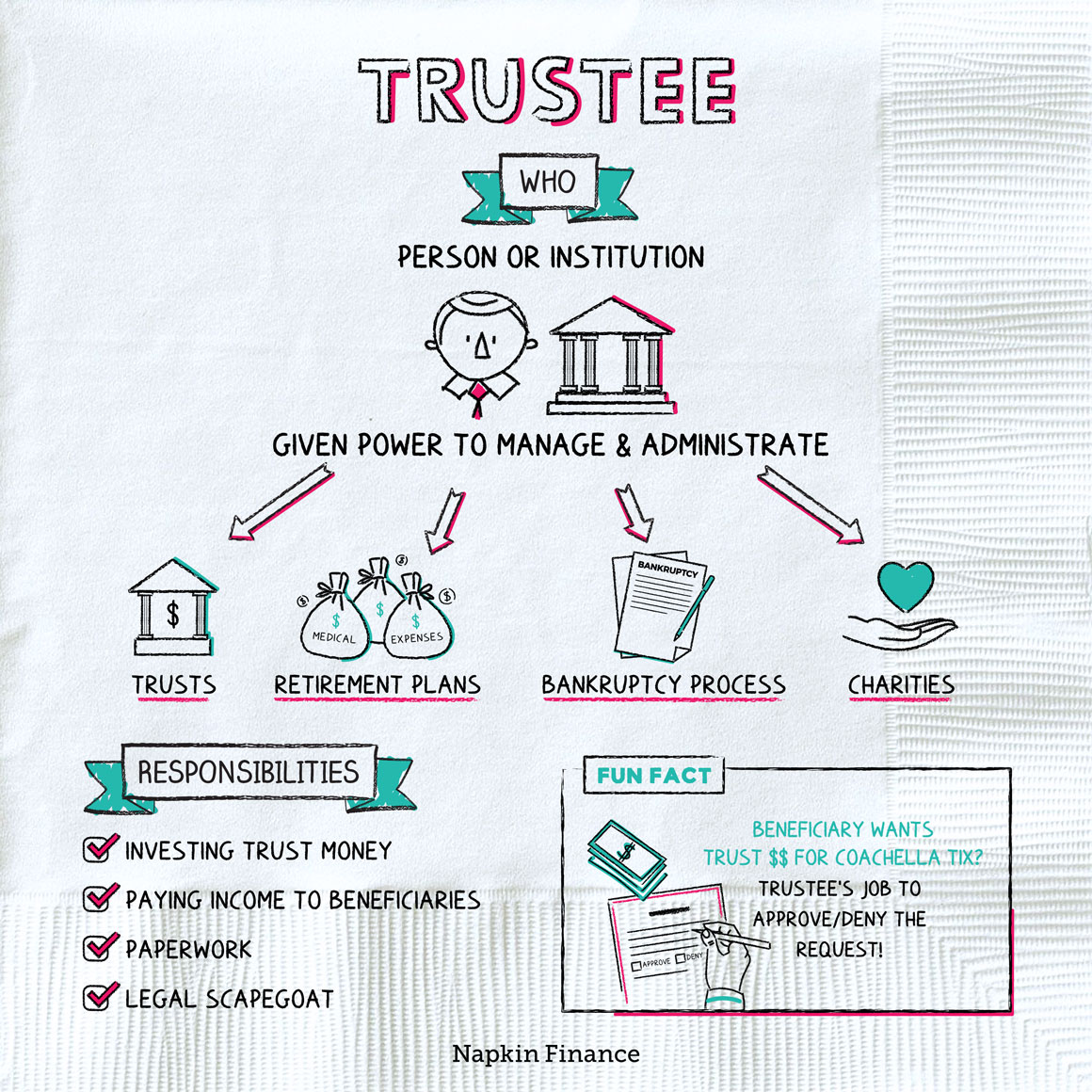

A trustee can be an institution or an individual that is given the power to manage and administer someone’s financial affairs or a pool of assets. This can include managing property, overseeing financial accounts, or other types of financial decision-making.

Trustees most commonly administer trusts, but they can also:

- Manage the assets of a charity.

- Oversee the investment of certain types of retirement plans or pension funds.

- Help manage the finances of a person who has filed for bankruptcy to ensure the person meets his or her obligations to creditors as dictated by the court.

A trust is a legal relationship that allows a third party (the trustee) to hold assets on behalf of someone else. Here are the basics:

Step 1 → The “settlor” (or “grantor”) sets up the trust. Typically, the settlor is also the person who deposits assets into the trust (such as a wealthy parent setting up a trust on behalf of her kids).

Step 2 → The settlor decides the terms of the trust, including naming beneficiaries (which could be people or organizations), describing how trust assets can be invested, and specifying when the beneficiaries are allowed to receive income or assets from the trust. The settlor also names the trustee.

Step 3 → The trustee is the person or company that technically owns the trust assets and manages the trust on behalf of the beneficiary or beneficiaries. Trustees are bound by a fiduciary duty to make decisions that are in the best interest of the trust and its beneficiaries.

The trustee’s job is to administer the trust according to the guidelines set out in the trust documents.

A trustee’s responsibilities include:

- Investing and managing trust assets

- Distributing trust income or assets to beneficiaries according to the terms set out

- Approving or denying beneficiaries’ requests for money

- For example, if a young beneficiary wants to withdraw $20,000 from his or her trust to go to Coachella, the trustee has to decide whether or not to approve the withdrawal.

- Paperwork—such as keeping track of records and making sure tax returns get filed

- Being the legal scapegoat—if something goes wrong with the trust, the trustee could be on the hook

A trustee is a person or firm that manages assets on behalf of a third party. A trustee’s responsibilities can include managing trust assets, distributing payments to beneficiaries, and maintaining the trust’s records.

Trustees can fill different roles, but all trustees are bound by a fiduciary duty to make decisions in the best interest of the trust and the beneficiary.

- The Paradise Papers, released in 2017, revealed that hedge fund founder James H. Simons maintained one of the largest private trusts ever disclosed—worth more than $8 billion.

- Some very affluent families set up so-called “dynasty trusts”—vehicles that are designed to pass wealth on (and avoid estate taxes) for multiple generations.

- A trustee is the person or institution that manages assets or financial affairs on behalf of another person or organization.

- Trustees may be needed in many different situations, such as to oversee the assets of a charity or certain types of retirement funds.

- Trustees most commonly oversee trusts, in which case they’re in charge of managing trust assets, making distributions to beneficiaries, and handling paperwork.

- Trustees are bound by a fiduciary duty to put the interests of the trust or beneficiaries ahead of their own.