Roth IRAs

Road to Retirement

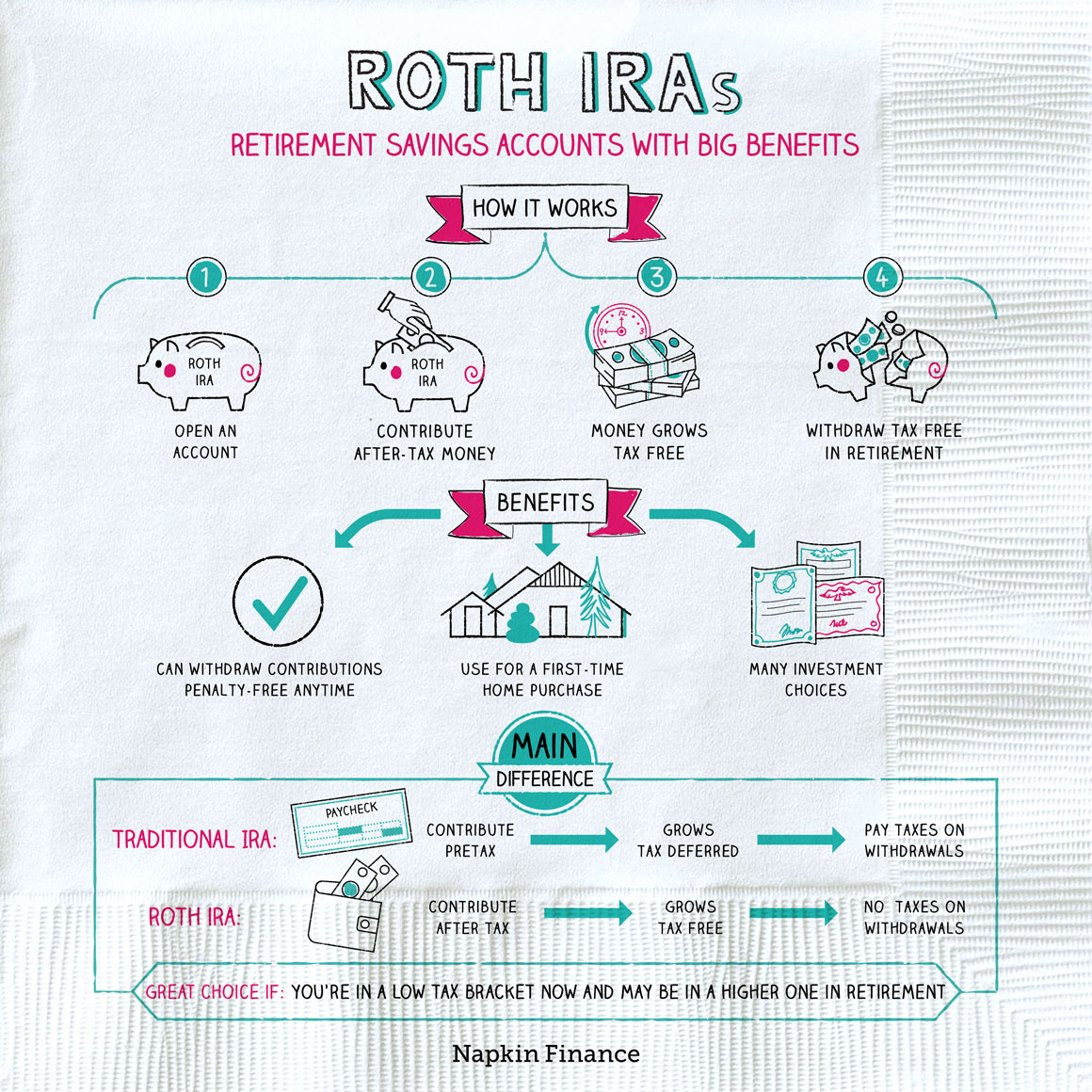

A Roth IRA, or Individual Retirement Account, is one of the most common types of retirement savings accounts out there.

Like traditional IRAs, Roth IRAs can help you save and invest for retirement. But Roth IRAs are especially great for young people because they have major tax perks that can save you serious money over time.

Here’s what you need to know about Roth IRAs:

- You’re in control.

- You can start a Roth IRA on your own anytime by opening an account with a financial institution.

- You can also choose investments on your own. But don’t panic if that doesn’t interest you—you can hire someone to help you on the investment side.

- Your money grows tax free.

- Unlike many other types of retirement accounts, you can withdraw money from your Roth IRA tax free in retirement, and you won’t owe taxes on your investment returns over time.

- You contribute after tax.

- Unlike contributions to traditional IRAs, you can’t deduct your contributions to a Roth.

- By paying taxes on your contributions now, you avoid getting hit with a big income tax bill later. If you expect to be in a higher tax bracket by the time you need your Roth IRA funds, that’s a very good thing.

- How much you can save is limited.

- Like other retirement accounts with tax perks, you can only save a certain maximum amount in an IRA each year. Check the IRS website for the current limits.

Here’s the basic life cycle of a Roth IRA:

Open an account

↓

Choose your investments

↓

Contribute after-tax money to your account

(i.e., from your bank account)

↓

Leave your money alone so that it can grow

↓

Hit retirement

↓

Take withdrawals as needed

(and pay no taxes on your withdrawals)

Like traditional IRAs and 401(k)s, Roth IRAs can be valuable tools to help you save for retirement. But they have some important distinctions:

| Roth IRA | Traditional IRA | Traditional 401(k) | |

| Who sets it up | You | You | Your employer |

| Who funds it | You | You | You and your employer |

| When can you contribute? | Anytime as long as you’re earning income | Anytime as long as you’re earning income | As long as you’re at your job |

| When do you pay taxes? | When you contribute | When you take distributions | When you take distributions |

The biggest distinction among retirement accounts is whether your contributions are made on a pretax or after-tax basis.

Pretax means that you won’t pay any taxes on your contributions until you start taking withdrawals. Pretax contributions are tax deductible (in the case of traditional IRAs) or are made with pretax dollars through payroll (in the case of 401(k)s).

The main takeaway: If you’re in a low tax bracket now (i.e., because you’re early in your career), then it can make sense to save in a Roth IRA so that you can get those taxes out of the way. But if you’re in a higher tax bracket now (i.e., because you’re a high earner) and you may be in a lower tax bracket in retirement, it can make sense to use a traditional IRA and kick those taxes down the road.

Roth IRAs come with some other unique benefits that make them a great option for young savers:

- You can withdraw contributions (but not earnings) anytime without paying a penalty.

- You may use $10,000 penalty free to buy a house if you’re a first-time homebuyer.

- If you have or adopt a baby, you can take out $5,000 penalty free within a year of your child’s birth or adoption.

- Your children or other beneficiaries can inherit your Roth IRA tax free.

You can’t contribute to a Roth IRA if you earn more than a certain amount, and the income cutoffs vary based on whether you file as single, married, or married filing separately (the cutoffs may also change from year to year). Check the IRS website to see if you qualify and for the current income cutoffs.

Here are some issues to consider before you open an account:

- Think about where you want to open it.

- You can open an account with a bank, an online brokerage firm, or a digital robo-advisor.

- Consider whether you want to be hands on or hands off.

- If you sign up with an online brokerage, you’ll typically be choosing your own investments. To some people, that sounds perfect, but others find the responsibility overwhelming. The latter may want to go with a robo-advisor or a traditional human financial advisor.

- Evaluate your budget.

- Consider how much you can afford to contribute each year, and make a plan for whether you’re going to contribute that amount all at once in a lump sum or in a steady trickle of monthly contributions.

A Roth IRA is an easy, accessible option to help you start saving for retirement. Even if you have a 401(k) through your employer, consider boosting your retirement savings by opening a Roth IRA and contributing what you can each year.

- You can make Roth IRAs a family affair. Even if your spouse doesn’t work, you can make contributions on his or her behalf.

- Roth IRAs are named for William V. Roth Jr., the Delaware senator who sponsored the legislation that authorized the accounts. Roth once decorated a Christmas tree with wrenches, nuts, and bolts to illustrate unnecessary defense spending, saying the government was spending too much on overpriced hardware.

- One in four millennials has a Roth IRA, though 401(k)s remain more common.

- A Roth IRA is a retirement savings account that you can open on your own with a financial institution of your choosing.

- Unlike a traditional IRA, with a Roth IRA, you contribute after-tax dollars now, but your money grows tax free and can be withdrawn in retirement tax free.

- You can have a Roth IRA in addition to your 401(k), and both can be important tools for retirement savings.