Lesson 1: Starting Early

It can be hard to find the motivation to start saving if retirement is still decades away—particularly if you can’t afford to save much. If you’re still earning the salary of a 20-something, it can be tempting to tell yourself that you’ll start aggressively saving as soon as your earnings pick up, and that you’ll make up for lost ground then.

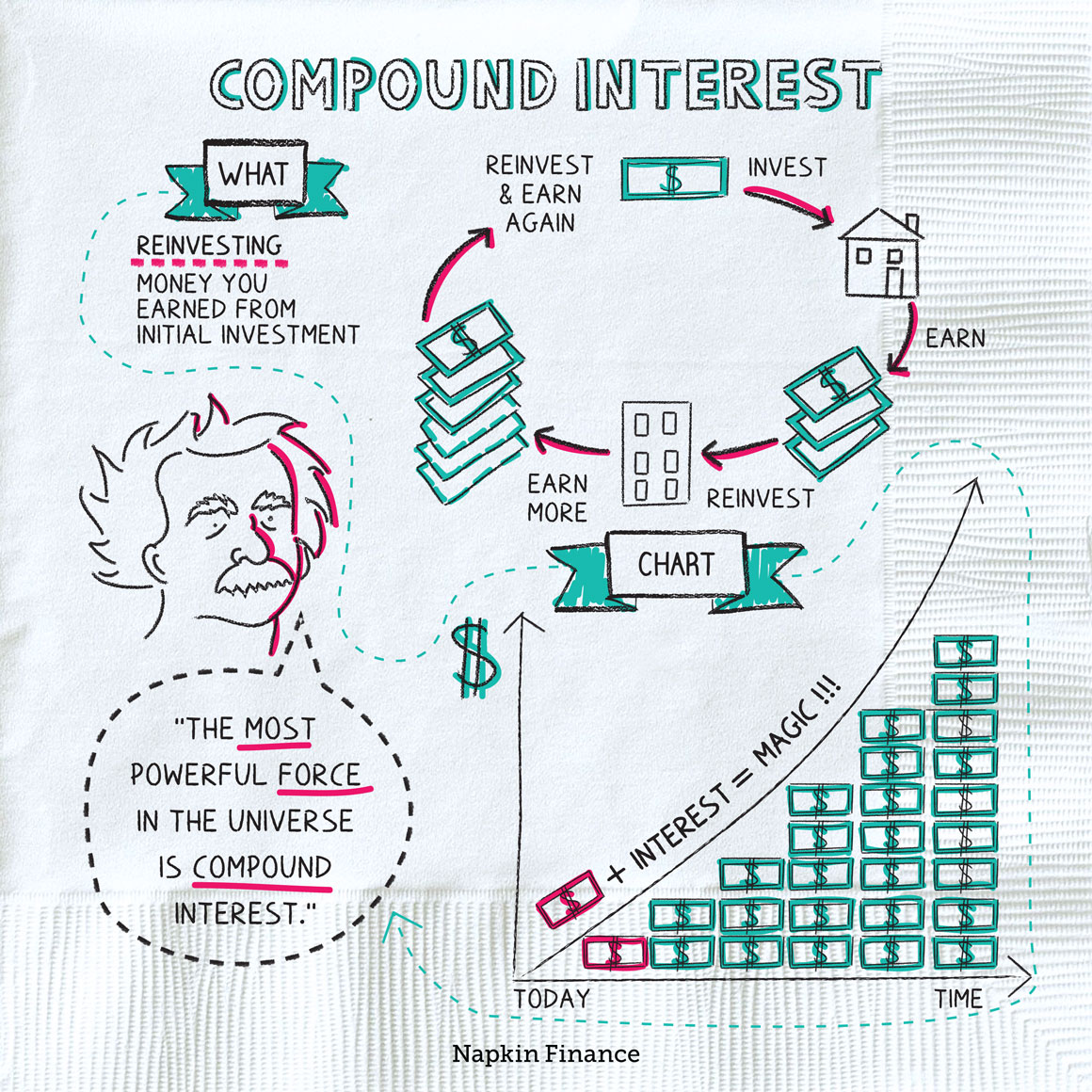

But it’s crucial to start early even if you’re only saving token amounts. That’s because small amounts can grow to large sums over time if you invest them, add to them, and give them time to grow with the power of compound interest. That’s also because being a successful retirement saver is all about making it a habit. Put something away every month, and over time your small efforts will add up.

By the numbers

Suppose you want to retire at age 65 with $2 million saved. (Although this sounds like a lot, it would likely work out to an annual income of around $80,000 in retirement.)

Here’s how much you would have to save each month to meet that goal, assuming your investments earn 7% a year (which is a typical assumption).

| If you start saving at age… | Then you’d need to save… |

| 25 | $762 /month |

| 35 | $1,639 /month |

| 45 | $3,839 /month |

| 55 | $11,555 /month |

| 60 | $27,936 /month |

Rule of thumb

If you start early and keep at it, that big end goal can realistically come into reach.

That said, saving anything might not be realistic if you’re right out of college and working the intern circuit. A solid rule of thumb for most people is to start saving for retirement once you land your first job that offers a retirement savings plan, such as a 401(k) or 403(b).

(However, if you’re working as a contractor and unlikely to have a traditional employment relationship anytime in your early 20s, you may need to get started even without an employer plan. Learn more about retirement savings for contractors.)

How to prioritize

Another challenge is that saving for retirement may be in competition with your other goals, such as:

- Paying off your student loans

- Paying down credit card debt

- Building an emergency fund

- Saving for a down payment

- Building up your kid’s college fund

So where should retirement fit in? Experts often suggest that you should consider paying off any high-rate debt (such as credit card debt) and building up an emergency fund first. That’s because checking off those boxes can give you a more solid financial foundation.

After that, start building up your retirement savings rate. After all, your kids can always take on loans for college—but there are no loans for retirement.

Make it work

If it still feels like a major stretch to put anything into that retirement fund, just do what you can. Even saving $50 a month counts. Set up automatic contributions so that saving happens automatically, and increase your contribution rate gradually over time. Making saving for retirement a habit and a routine is half the battle!